Indonesian coal suppliers have increased their domestic coal production target by 4.5 percent from a previous 485 million tonnes to a massive 507 million tonnes in the current year. All the additional tonnage will be exported. This is in direct response to China’s loosening coal policy for the 2018/2019 winter season.

China’s Ministry of Ecology and Environment last week trimmed its pollution reduction target to 3% from 5% for the period October 2018 through to March 2019, opening the door to a substantial increase in the use of coal for power production in the country’s northern provinces who may now be allowed to set their own winter output curbs for heavy industry.

This comes as the Chinese government agency National Development & Reform Commission, adjusts its green energy targets so that renewables must account 35 per cent of electricity consumption by 2030, up from 20 per cent previously and 15 percent by 2020.

Increasing coal consumption through the winter season, should translate into further growth in imports, currently accounting for 7.7 percent of China’s coal demand. 2017 saw 271 million tonnes shipped in mainly from Indonesia and Australia. The additional 22 million tonnes of coal on the market this winter look likely to head towards China.

Some doubt whether the additional tonnes will enter the market. Scottish consulting firm Wood Mackenzie said in a recent research note that they expect weaker demand from China would hinder Indonesia’s hopes of exporting the additional supply. ‘The government’s attempt to boost exports is unlikely to meet its desired goals,’ the note said.

The same firm noted that IMO2020, which introduces restrictions on sulphur content in bunker fuel could see freight rates on seaborne coal routes rise by as much as 40% by 2020. Coupled with potentially increased demand as coal policy is loosened in the north of China as a stimulus tool to counter weakness in the domestic markets, freight rates from Indonesia to China could reach levels not seen since the 2010 recovery, post Lehman.

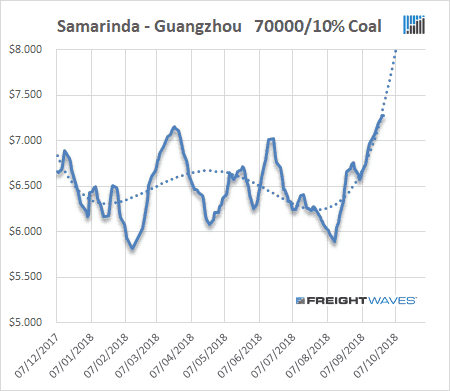

70,000 tonne cargoes from Samarinda to China are now moving at $7.30 per tonne, the highest this year. With anticipation of stronger demand and the impact of IMO2020 as outlined by Wood Mackenzie’s report, Kamsarmax and Panamax freight rates could top $10 per tonne as early as next year.

Evidence of continued expansion of coal fired electricity production has recently emerged, with one report cited by the Guardian stating China is on track to boost existing coal capacity by 25 per cent.

This again points to further upside potential to freight rates in South East Asia going into next year.