National freight volumes are down about 4 percent year-over-year while capacity is as loose as ever, further depressing truckload spot prices in nearly every market in the country. The extent to which volumes have been impacted by the hangover from freight pulled forward to avoid tariffs versus the slowing overall macroeconomic backdrop is difficult to determine, but publicly traded carriers have started revising down their 2019 guidance.

Last week Covenant Transport (NASDAQ: CVTI) said the company would earn much less – as much as 50 percent less – in the first quarter than previously predicted. Where Wall Street had expected CVTI to post earnings of 36 cents per share, Covenant CEO David Parker said the company would probably earn in the 18 to 26 cents per share range, but attributed first quarter weakness to tariff distortions, the shutdown of the federal government and severe winter weather.

Carrier sentiment is deteriorating across the truckload space. According to DAT’s RateView tool, the spread between average contract and average spot prices for dry vans increased to 41 cents per mile, with the broker-to-carrier spot rate falling to $1.55 excluding fuel and the shipper-to-carrier contract rate falling slightly to $1.96 excluding fuel.

“In our latest survey, respondents expect 2019 [truckload] rates (excluding fuel) to increase ~0.83 percent y/y on average vs. 1.12 percent in our previous update,” wrote Morgan Stanley equities analyst Ravi Shanker in a client note Wednesday morning. “However, among the respondents expecting 2019 rates to increase at least +4 percent y/y (~9 percent of respondents in our current survey versus previous 11 percent) the average anticipated rate increase was ~6.66 percent (vs. ~6.85 percent in our previous survey).”

North American ports and railroads are also reporting weak volume data. Total February container volumes for West Coast ports, including Los Angeles, Long Beach, Oakland, Seattle, Vancouver and Prince Rupert, were down 9.6 percent year-over-year, while over the past four weeks overall rail volumes were down 4.7 percent, according to research by Susquehanna Financial Group.

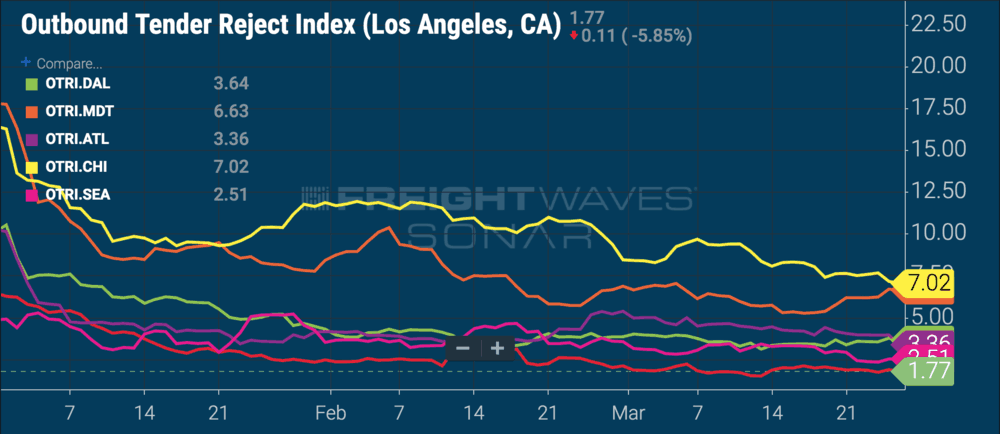

Today freight brokers confirmed the general view of soft demand, and said that truckload capacity was continuing to drive both spot and contract pricing down. The chart below displays outbound tender rejection rates for major freight markets in the United States, including Los Angeles, Dallas, Chicago, Harrisburg, Seattle and Atlanta. FreightWaves uses tender rejections as a proxy for capacity availability – carriers reject tendered loads from shippers when they do not have trucks in the area or are pursuing more lucrative opportunities in the spot market. High tender rejection rates indicate volatility and tight capacity, while very low tender rejection rates tend to signify stability, routing guide compliance and loose capacity.

The chart’s parallel lines suggest that the major freight markets in the United States have largely stabilized.

“The market hasn’t changed a whole lot since January. Frankly, everywhere is soft right now; there is not a tight market in the country,” said Matthew Vogrich, President at MoLo Solutions, a Chicago-based freight brokerage.

Vogrich said that MoLo has experienced week-over-week growth in volumes every week so far in 2019, but that was more a function of newly awarded contracts going live than freight market fundamentals. Vogrich said that MoLo’s willingness to work hard to service its clients’ freight in 2018 was now paying dividends in higher volumes this year. Brokers are bidding aggressively to win those volumes, Vogrich added.

“On a more volatile lane where we saw a ton of fluctuation; to be competitive the price is going to be cheaper than the 2018 rates,” Vogrich said. “Three months into 2019, the market is definitely cheaper, anywhere from 5 to 20 percent cheaper depending on the lane. Will that hold up for the rest of 2019? I can’t tell you that because nobody knows.”

“The market has remained friendly through March so far, but if you loosen the grip on the market trends you’ll miss the leading indicators of capacity shifting. There were a few times in Arizona and Texas you could sense tightening, but it didn’t last long,” wrote Bert Brunsting, associate of business development at Nolan Transportation Group (NTG), an Atlanta-based freight brokerage, in an email.

“In a market like we have with prices lower year over year, you not only notice more participation in the RFP process from asset carriers alongside the 3PLs, but you also notice the aggressive nature/rates,” Brunsting wrote. “3PLs are right there as well, pricing as aggressively if not more aggressively to win as spot volume decreases. It’s very important to remain honest and transparent with customers during the bid seasons because although the market is loose right now, you want to be confident in servicing year round. There is, and always will be, a delicate balance of service and rates.”

“I was expecting more demand toward the end of the quarter and spot rates to elevate, but so far we haven’t seen it,” said Rush Feldhacker, vice president of sales at Trident Transport. “The only tightness we see is in the flatbed markets off the East Coast, in Virginia and North Carolina.”

Feldhacker said that he has noticed more shippers putting freight onto load boards at rates lower than contracted rates, and that Trident has had to lower some prices to its customers to stay competitive.

“We have a kind of ‘wait and see’ approach, while being quick to react when we get a good bead on the market,” Feldhacker said.

Franky

What volume I never seen broker load increase I felt pressure from the broker load going down faster than increase only the big player benefit on it

Mary

Market price of freight went down to transport it. People are cutting each others throats prices of freight drops down when someone underbids another who already bid a price, but fuel prices are going up, a game to kill some smaller companies right out of business.. it’s always a fine game of chess, noone can say where anything is going or which its heading, fuel prices keeps rising fewer owner ops or smaller businesses, will b out

majid ahmed

North American ports and railroads are also reporting weak volume data

https://corporate.nvisionglobal.com/transportation-management/procurement/