In the last week before Christmas, carriers make plans to get their drivers home for the holiday. It’s one of the only days of the year that most carriers guarantee their drivers hometime, and they generally make every effort to keep their promises. This nationwide repositioning has a significant effect on available capacity, and shippers who don’t plan for it often see their freight stranded.

Freight brokers told FreightWaves that at this time during the year, driver preferences on origin/destination firm up, because they become less willing to drive into a backhaul market and wait to find a load out. Lanes that take a truck further than one day out from the driver’s domicile become very much less attractive, and it takes carrier-centric brokers with an intimate knowledge of their fleets and driver pools to coordinate the movement of assets.

“Anything over a day trip, really, is subject to a red flag,” said Asa Shirley, SVP of Sales at Arrive Logistics. “You’re going to have to pay round trip [into a backhaul market],” he said.

Savvy shippers are setting up loads that have to move during the holiday itself this week or even the prior week, but problems always occur for those who wait until this point in the holiday season.

Carriers are becoming reluctant to move certain loads because they’re concerned about keeping their valuable pool of drivers happy and know they can’t force them to drive across the country right before Christmas. When contracted carriers kick a load back to the shipper, the shipper will turn to a brokerage to find capacity, and costs soar.

That’s how Arrive ended up with a load that had to move 1,500 miles before delivering the morning after Christmas Day, Shirley said.

“That’s where we have a conversation with the customer — is it more important to get it off the dock or is it important that it’s delivered? That’s where we can be smart about it and offer a real solution,” Shirley said, noting that if the freight simply needs to exit the warehouse, sometimes it can be staged at a yard halfway to its destination and then delivered later.

Carriers know there’s money to be made around the holidays, and savvy shippers know that capacity will come at a premium. For high-priced holiday loads tendered early enough, Shirley said that he likes to pass such “Christmas goodies” to his best, most reliable carriers as a kind of ‘thank you.’

“But when a load goes into the spot market, it’s who flinches first — that’s the headache and stress of logistics during the holidays,” Shirley said.

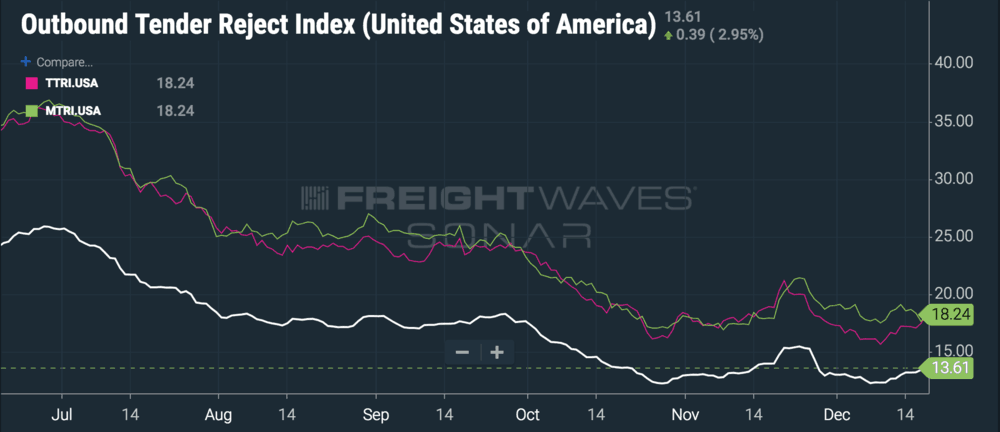

FreightWaves SONAR data shows that tender rejections on a national basis (OTRI.USA) have started ticking upward as capacity tightens before the holiday. The lengths of haul pulling the average upward are medium hauls (MTRI.USA) and tweener hauls (TTRI.USA), defined as 250-450 miles and 450-800 miles respectively.

Keith Gray, VP of Operations at LYNC Logistics, said that anything over 500 miles has started to get tricky to pull off, but that his shop’s regional freight is dedicated and hasn’t been an issue.

“Volume has been very heavy for us this week,” Gray said. “Shippers are getting it off the docks so they aren’t dealing with it next week. It was a heavy day [Tuesday], not outrageous, but heavier than what we expected.”

Gray said that he plays holiday spot freight conservatively and tends to work backwards, getting a truck in hand before he quotes a rate to a shipper.

“You always have emergency loads that pop up, and you can always find someone to pull the load. But truckers aren’t stupid—they know they’re going to make money over the holidays,” Gray said. “We’ll service our customers when we get those loads just because we know it means something to them; they have to have it moved. But looking at spot that’s going to hold over Christmas, I’d rather go truck in hand. If it’s something the shipper brings to us on the twenty-fourth and we have to go out to market, we’ll say ‘let us source that first and we’ll get back to you with a rate.’”

The brokers we spoke to anticipated that Christmas on a Tuesday meant an extended holiday, and that “New Years will turn into another four day holiday,” Gray said.

“What causes a load to be a must-go into the spot market the last week of 2018?” Shirley wondered. “You investigate and discover… you don’t want to overpromise and underdeliver. We have to be really careful until we get back to January 7, the first full week of Q1.”