Europe’s shift from coal to natural gas for power generation is poised to accelerate – a negative for coal producers and transporters – according to a special report issued by investment bank Morgan Stanley on July 22.

Morgan Stanley said that lower than expected natural gas prices will compel the switch from coal faster than previously thought – not just in Europe but in Asia as well – heralding a “new age of disruption.”

“Shale gas disrupted the U.S. energy industry. Now, cheap LNG [liquefied natural gas] is set to do the same globally,” affirmed Morgan Stanley in the 111-page ‘Blue Paper’ entitled ‘Natural Gas: Fueling Global Disruption,’ authored by a team of analysts led by commodities strategist Devin McDermott. The bank issues a so-called Blue Paper report when it perceives a “critical investment theme.”

Coal exports already sliding in 2019

Coal is divided into two primarily categories – metallurgical coal, also known as ‘met’ or ‘coking’ coal, which is used for the production of steel, and thermal or ‘steam’ coal, which is used for power generation.

U.S. export volume was just 8.1 percent of total production in 2016, but exports jumped to 15.3 percent of production in 2018, according to data from the U.S. Energy Information Administration (EIA). The percentage gain was driven by a near-doubling of U.S. exports between 2016 and 2018.

Export volumes in January-May 2019 were 14.2 percent of production. The percentage is down this year because exports are falling faster than production.

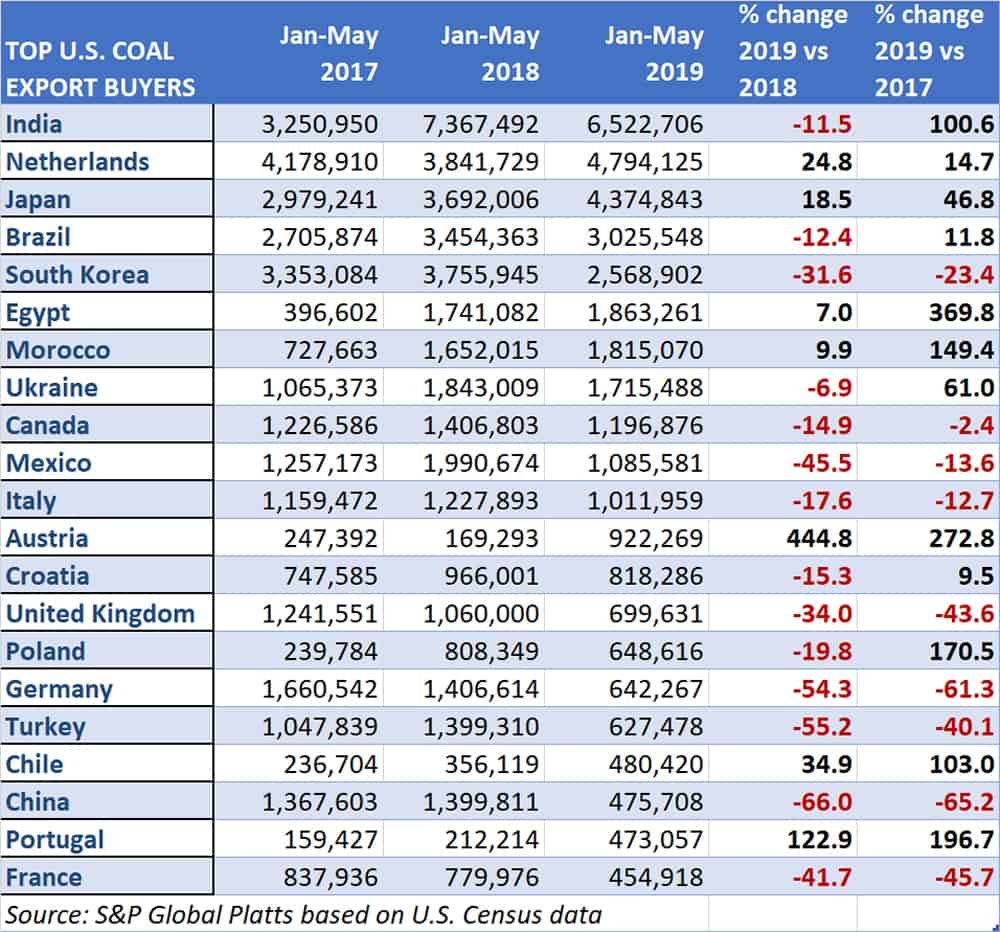

Production is estimated at 270.5 million metric tons for the first five months, down 2.8 percent year-on-year. Exports were 38.47 million metric tons, down 11.3 percent, according to U.S. Census data compiled by S&P Global Platts.

The export decline is impacting rail volumes. According to the latest data from the Association of American Railroads, 2,386,814 carloads of coal were loaded between January 1 and July 13, down 5.1 percent year-on-year.

The Morgan Stanley report implies that the U.S. coal export drop seen this year could be only the beginning.

Global LNG prices to converge

Historically, there have been wide spreads between the U.S. natural gas benchmark (Henry Hub), the European benchmarks (TTF in the Netherlands and NBP in the U.K.) and the Asia benchmark (JKM). Traditional ocean shipping contracts for LNG were focused on very long-term supply deals with little flexibility to shift volumes and close those spreads.

In contrast, ocean shipping networks for crude oil became highly developed during recent decades. The availability and flexibility of tanker shipping options helped close spreads between various regional oil markets.

LNG shipping is now becoming much more like oil shipping, due to much more LNG supply hitting the water, more available shipping capacity, more spot cargo trading, more supply contracts with flexible destinations, and more cargo supply contracts priced against Henry Hub.

Consequently, natural gas is transitioning from a regionally to a globally priced commodity. That’s a big problem for coal if the new global price of natural gas is lower than the old regional prices that coal could undercut.

According to Morgan Stanley, “The globalization of natural gas is set to usher in a new energy transition. A wave of investment in LNG, which can be easily transported, is unleashing this cheap energy resource and creating a new global commodity market.”

The report continued, “The drivers of natural gas prices should structurally change, collapsing regional pricing differences. Global gas prices over the next decade should fall by 40 percent versus the past 10 years.”

Beyond the wave of new U.S. LNG projects already under construction, Morgan Stanley expects projects with capacity to generate an additional 100 to 155 million tons of LNG per year to get the green light by 2022, “driving 50 percent growth in the global market size by 2025.”

The reduction in spreads between the regional natural gas benchmarks is already happening. According to Morgan Stanley, “So far in 2019, the spreads between gas prices in Europe, Asia and the U.S. have collapsed.

“While short-term factors drove this, including a surge in new LNG capacity and a mild winter, we believe it is the beginning of a long-term structural shift in global commodity markets – not just a short-term cyclical disconnect. LNG will continue to become more liquid, with growing global trade eliminating the regional arbs [arbitrages] that have existed historically.”

Morgan Stanley’s report also stated, “With a large availability of cheap gas, we expect the U.S. to act as a swing producer – unleashing low-cost shale gas into global gas markets. Long-term LNG prices will hover between marginal costs to produce and ship U.S. LNG during periods of oversupply and the break-even price of new projects during periods of supply tightness.”

The report continued, “Our forecast implies around a 20 to 33 percent downside to 2020-21 forward European TTF benchmark and Asian JKM benchmark gas prices.” Morgan Stanley confirmed that it has cut its own European mid-term gas price forecast by around 20 to 40 percent as a result of its conclusions.

In the next stage of the global energy evolution, in 2022-2024, Morgan Stanley expects gas pricing to steal more market share from coal. Natural gas prices will be set at levels “needed to incentivize new demand via displacing other fuels. Most of this fuel switching is likely to occur in Europe, but we see some fuel-switching potential in South Korea and Japan as well.”

Starting in 2025, it foresees the next wave of natural gas supply hitting the market, taking yet more market share away from coal.

Implications for coal and coal transport

If natural gas prices remain very low for an indefinite period, it would accelerate the decline in demand for thermal coal in export markets important to U.S. sellers. Morgan Stanley believes the effect on European demand will be seismic.

It said, “Europe’s call on thermal coal is already in decline. This trend will accelerate when gas prices are low enough. We forecast that in 2020-21, coal-to-gas switching could reduce the consumption of thermal coal in Germany, Spain, Italy and the U.K. by up to 41-43 million tons per year.

“This is equivalent to around 70 percent of European thermal coal imports and 5 percent of the global seaborne thermal coal market,” it continued, noting that this could lead to a 1 to 2 percent reduction in demand for dry bulk shipping.

Whether or not the collapse in thermal coal demand plays out as quickly Morgan Stanley predicts, the general thesis of secular decline is widely acknowledged.

On the Union Pacific earnings call with analysts on July 18, executives were asked about deteriorating conditions for U.S. coal producers and the recent string of bankruptcies, and how they believe it will affect rail. (Wyoming-based Cloud Peak Energy filed for Chapter 11 bankruptcy protection on May 10, West Virginia’s Blackjewel Coal filed on July 1 and Kentucky-headquartered Blackhawk Mining filed on July 19.)

Union Pacific executive vice president Kenny Rocker responded, “We’ve been living in this environment [with coal] for a long time. It doesn’t change our approach.” He also noted, “When you hear about some of these bankruptcies or closures, it doesn’t take away from the fact that another producer or shipper in that area might be able to move that volume.”

Union Pacific chief executive officer Lance Fritz responded, “Thinking about this market long-term, coal has been challenged in a kind of secular decline. You see that in coal unit closures. You see it in investment in alternative sources of energy.

“We’ve got a game plan for that in the long-term. We also care deeply about making sure there are good, healthy, capitalized coal producers to serve the market. They exist today, and I know they’re working hard to make sure their future is solid, and we’ll support them as they do that.”