During yesterday’s fourth quarter earnings call, transportation equities analysts asked Echo Global Logistics (NASDAQ: ECHO) management to look into their crystal balls and predict everything from freight volumes and contract pricing in 2019 to the macroeconomic outlook. CEO Doug Waggoner, CFO Kyle Sauers, and COO Dave Menzel pointed to tough comps against last year’s inflationary freight markets and gave realistic, clear-eyed guidance on revenues.

“I think that we are not going to get into the specifics on kind of volume and rates inherent in all the guidance numbers, but I do think that you’ll see volume gains throughout the year. But it will be a little tougher certainly in this quarter and I think also in the second quarter, given market conditions,” said Menzel said in response to an analyst question during the Q&A.

This morning the stock market reacted negatively and ECHO shares traded as low as $22.11 – down 8.79 percent from Wednesday’s close – before rallying to $23.15 by 2:00 p.m. EST, just 4.5 percent off the previous day’s close. That price movement prompted analysts to characterize shares of the freight brokerage as a buying opportunity.

Stifel’s Bruce Chan reiterated his ‘Buy’ rating; Chan’s $34 price target for ECHO represents a 47 percent upside from where the stock is currently trading.

“The market still doesn’t like what’s happening with spot pricing, and flat revenue guidance seems to be spooking the multiple, in our view,” Chan wrote in a February 7 mid-morning note. “On a multi-year stack, Echo is still significantly outpacing its long-term 10 percent average annual top-line growth target, and doing so on flat-to-declining costs.”

Susquehanna’s Bascome Majors wrote that after Thursday’s selloff, Echo was “too cheap to ignore.”

“While ECHO’s top-line outlook for 1Q and 2019 came in below the Street, revenues were within our reduced range that we established in early January,” Majors wrote in a Thursday midday note, “and the expense components management shared came in-line-to-better than our forecasts such that we’ve actually raised, not lowered, our estimates exiting 4Q (+$0.05 in 2019E, +$0.10 in 2020E).”

Echo has begun pivoting away from its heavy exposure to the truckload spot market (in the fourth quarter of 2018 its freight mix was 52 percent spot compared to 59 percent in the same quarter of 2017) in favor of growing its contracted and managed transportation business. If this trend continues, spot rates’ effect on top line revenue will become more diluted as spot rates shift from being a price for Echo’s services to more of a pure expense for Echo. Still, as long as tender rejection rates remain near historic lows, freight will stay out of the spot market, presenting a spot volume – not price – challenge to Echo. That’s the theme Morningstar’s Matthew Young picked up on.

“Narrow-moat highway broker Echo Global Logistics’ fourth-quarter gross revenue increased a modest 6 percent (up 26 percent for full-year 2018), slightly below our expected run rate due to softer than anticipated spot-volume on truckload business,” Young wrote in a February 6 note after the earnings call. “Of note, the capacity crunch seen throughout much of 2018 eased during the quarter, and year-over-year comparisons became quite challenging. Thus, pricing and load-volume trends moderated significantly – in fact, truckload shipment volume was flat.”

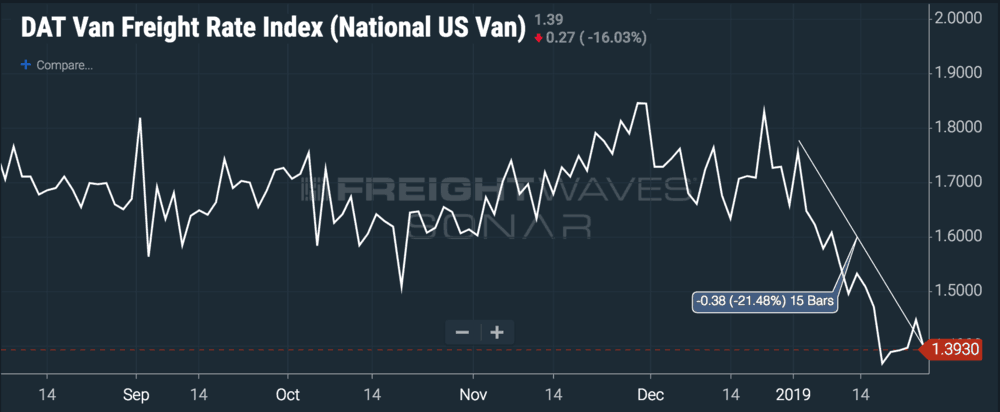

Echo has already seen positive impacts to its net revenue margins from selling capacity at contract rates and buying it at spot rates. Management shared that margins are tracking at 18 percent quarter-to-date during a period when national average spot rates (DATVF.VNU) plummeted 21.48 percent.

Echo has a long-term compound annual growth rate (CAGR) target of 10 percent, and management expects that even flat year-over-year growth in 2019 should not hinder those plans. All told, Echo’s 2018 revenues grew 25.6 percent over the prior year, so flattish to slight growth in 2019 still leaves the company ahead of target for 2018-9.

“The market outlook for Echo remains strong,” Chan concluded, “and, even in the face of difficult top-line growth comps, the company has plenty of opportunity to drive incremental earnings growth. Longer term, we see Echo as a market share gainer in a consolidating industry.”