Norfolk Southern Corporation (NYSE: NSC) reported record first quarter diluted earnings per share (EPS) for 1Q 2019. The company’s diluted EPS came in at $2.51, a 30 percent increase year-over-year, outpacing analyst estimates of $2.18.

NSC has beaten EPS estimates every quarter for the past two years.

The company posted an operating ratio (OR) of 66 percent, improving on its fourth quarter 2018 OR of 67.8 percent and setting a first quarter record.

Deutsche Bank criticized the company’s high OR in comparison to its competitors after its earnings call last quarter.

“The company’s fourth quarter underlying OR of 67.8 percent is 600 bps worse than the company’s direct competitor (CSX) on an apples-to-apples basis,” the report from the team led by Amit Mehrotra said.

First quarter results still show a wide gap in operating ratio between NSC and CSX, with CSX reporting an OR of 59.5 percent. The operating ratio measures the efficiency of a company’s management by comparing the company’s total operating expenses to net sales. Operating ratio is often used in capital-intensive industries and industries that require a large percentage of revenues to maintain operations, such as railroads.

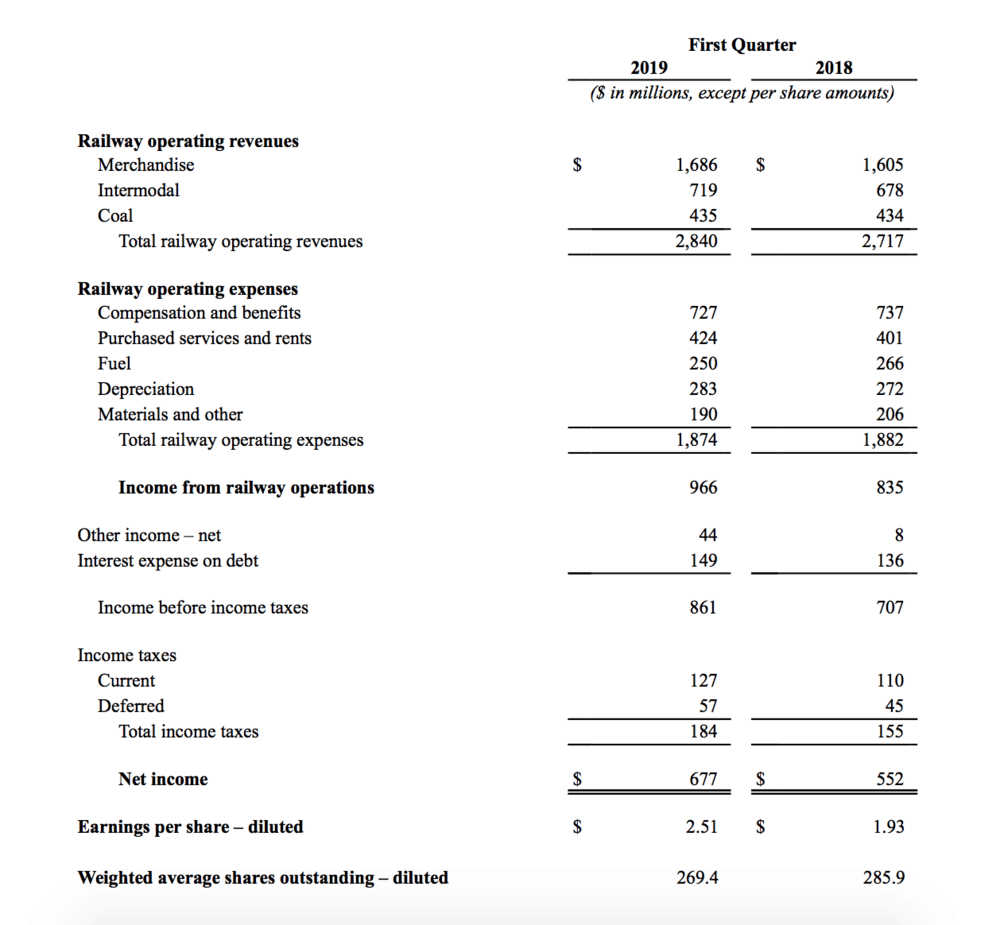

The company’s first-quarter net income rose 23 percent year-over-year, coming in at $677 million. This was due to a 16 percent increase in income from railway operations, as well as an increase in other income, according to NSC’s earnings release.

“Our first-quarter results reflect the initial steps in the implementation of our new strategic plan that are transforming our company,” said James Squires, Norfolk Southern chairman, president and CEO. “We set company records for many financial measures in the first quarter, while improving our service product for our customers. We are intensely focused on the execution of the initiatives in our strategic plan that will drive shareholder value.”

The company’s railway operating revenue also broke a first quarter record, increasing 5 percent year-over-year to $2.8 billion. NSC attributed the climb to an increase in revenue per unit, resulting from increased rates and higher fuel surcharge revenue. Revenue was in-line with analyst estimates of $2.82 billion.

Railway operating expenses for the first quarter of 2019 were $1.9 billion, an $8 million decrease from the same quarter last year. The company said fuel price declines and lower compensation and benefits expenses were offset by increased purchased services and rents.

Income from railway operations set another first-quarter record, climbing 16 percent year-over-year to $966 million.

The company’s stock was up $0.14, or about 0.07 percent, in pre-market trading Wednesday, April 24.

Norfolk Southern Corporation’s Norfolk Southern Railway Company subsidiary operates approximately 19,500 route miles in 22 states and the District of Columbia. It serves every major container port in the eastern United States and provides efficient connections to other rail carriers. Norfolk Southern is a major transporter of industrial products, including chemicals, agriculture, and metals and construction materials. In addition, the railroad operates the most extensive intermodal network in the East and is a principal carrier of coal, automobiles and automotive parts.