ODFL continues driving operational efficiency

CEO Gantt guides 2019 capex down by $10 million to $480 million

Old Dominion Freight Lines (NASDAQ: ODFL) reported its financial results for the first quarter of 2019 before the markets opened on April 25. The less-than-truckload carrier continued improving efficiency and investing its cash in technology, real estate, and trailers.

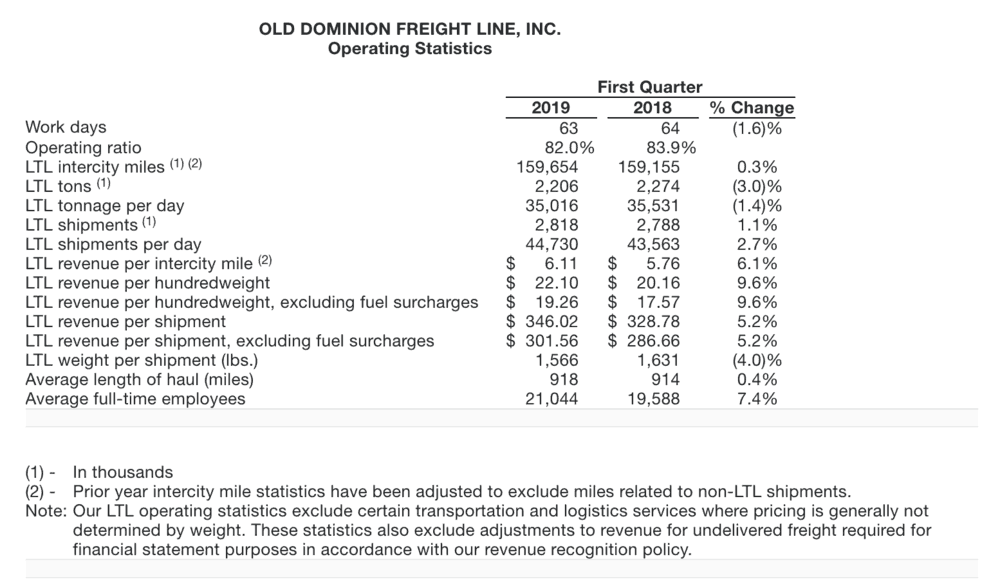

ODFL grew top line revenue by 7.1 percent year-over-year to $990.7 million and improved its operating ratio by 190 basis points to 82 percent.

“Old Dominion began 2019 with strong financial results for the first quarter, which included growth in our pre-tax income that exceeded 20.0% for the eighth straight quarter,” said Greg C. Gantt, president and chief executive officer of Old Dominion, in a statement.

ODFL beat the Wall Street consensus estimate on earnings per share — $1.58 according to Barchart — by reporting earnings of $1.64/share, 23.3 percent higher than earnings in the first quarter of 2018.

The less-than-truckload (LTL) carrier benefited from a stronger rate environment that drove a 9.6 percent improvement in revenue per hundredweight which was only partially offset by a 3 percent decline in overall LTL tonnage for the quarter.

“We have been encouraged by the continued strength in our yield trends, and we intend to maintain our disciplined approach to pricing to support our long-term strategic plan and improve profitability,” Gantt said.

Old Dominion invested $70.7 million in capital expenditure during the first quarter but expects the pace of capex to accelerate. Gantt said that investors should expect about $480 million in capex for 2019, which includes $220 million for real estate and service center expansion projects, $165 million for tractors and trailers, and $95 million for technology.

At ODFL’s February investor presentation at Stifel’s conference in Miami Beach, chief financial officer Adam Satterfield explained the carrier’s aggressive capex strategy which calls for ODFL to invest roughly twice the LTL industry average as a percentage of revenue. In 2018, notably, ODFL committed $590 million in capex. This year’s lower, more conservative number —just lowered from $490 million to $4890 million — likely reflects revenue headwinds, but the pre-trading release did not offer new guidance on revenue. We expect analysts to take up the topic in the conference call.

“Pricing discipline and a consistent philosophy with respect to yield allowed us to strengthen financial position and allowed us to further invest and drive operating efficiencies,” Satterfield said at the February presentation.

ODFL builds service centers before they’re actually needed, anticipating future growth, preferring to maintain 20 to 25 percent excess capacity so that the size of the network never constrains volumes. More trailers improves the velocity of Old Dominion’s network by letting shippers pre-load trailers and allowing ODFL’s tractors to quickly move in and out of shipper facilities.

The LTL carrier’s service, often called ‘best-in-class’ by Wall Street analysts, remains excellent. On-time delivery rates have been at 99 percent since 2012, and ODFL’s cargo claims ratio has been falling for fifteen years, from 1.5 percent in 2002 to 0.3 percent in 2018. Damage metrics are particularly important for less-than-truckload carriers because palletized LTL freight is typically handled more times than truckload freight. We expect more color on those KPIs during the conference call.

The chart below compares the relative performance of various LTL stocks over the past year. Old Dominion is red, YRC is orange, ArcBest is green, and XPO is purple.

Updates from ODFL’s analyst conference call

Equities analysts on Old Dominion’s conference call fixated on a line from CEO Greg Gantt’s prepared remarks.

“We’re encouraged by the general stability of the pricing environment, but have seen evidence that competitors are losing their discipline,” Gantt said.

Analyst after analyst wanted to know if the pricing competition was broad-based or restricted to a few players, whether 3PLs were leading the charge on aggressively bidding down freight, and how bad it could get.

Gantt and chief financial officer Adam Satterfield spent the majority of the call reassuring Wall Street that ODFL was not losing accounts, but just some freight in certain lanes where their competitors are being more aggressive than they have been in years past. Gantt reminded his interlocutors that the LTL is very consolidated, with 80 percent of capacity held by about ten carriers, and said that in the past, trading price for volumes has not worked well.

“We’re seeing our customers shop because they think the environment is favorable for getting lower rates,” Gantt said. “Some of the business that crept away from us is competitors taking the decrease that we weren’t willing to take. It’s early in the game and we’ll see where that goes.”

Ravi Shanker from Morgan Stanley pressed ODFL management on the notion of a pricing war.

“Is this [price competition] how it starts before it snowballs?” Shanker asked. Satterfield downplayed the idea of a long-term decline in price.

“We are not expecting broad-based or deep discounting to play out,” Satterfield insisted.