Ryder System, Inc. (NYSE: R) beat Wall Street’s expectations by posting an adjusted earnings per share of $1.11, compared to consensus estimates of $0.99 per share, representing 16 percent earnings growth year-over-year. Ryder is a Fortune 500 commercial fleet management, dedicated transportation and supply chain solutions company.

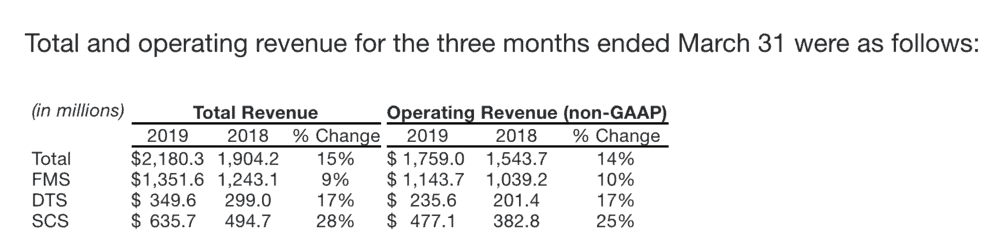

The first quarter of 2019 also brought Ryder record gross revenues of $2.2 billion, up 15 percent year-over-year, and adjusted operating revenues grew 14 percent to a record $1.8 billion.

“We are pleased to report double-digit operating revenue and earnings growth, driven by strong performance in our contractual businesses,” said Ryder chairman and CEO Robert Sanchez. “This growth reflects continued outsourcing trends and the impact of our sales and marketing initiatives. We out-performed our forecast, primarily due to better than anticipated impact of the new lease accounting standard and to a lesser extent stronger performance in ChoiceLease and Dedicated.”

Ryder divides its business into three segments: Fleet Management Solutions (FMS), which leases trucks and performs maintenance services; Dedicated Transportation Solutions (DTS), a fleet that moves freight for dedicated customers; and Supply Chain Solutions (SCS), Ryder’s third-party logistics provider.

The ChoiceLease fleet under Fleet Management Solutions grew organically by 4,200 trucks, and Ryder said that 40 percent of that growth came from customers who were outsourcing for the first time. Overall FMS revenue grew 9 percent year-over-year to $1.35 billion.

Dedicated Transportation Solutions outperformed the larger company, growing revenue 17 percent to $350 million; operating revenue was also up 17 percent, to $236 million for the quarter.

“DTS total and operating revenue growth reflects new business, customer expansions and increased volumes,” Ryder wrote.

Ryder’s logistics business, Supply Chain Solutions, posted gross revenue growth of 28 percent to $636 million and operating revenue growth of 25 percent to $477 million. Notably, this is the last quarter where the year-over-year comparison will not include Ryder’s acquisition of MXD Group, now rebranded as Ryder Last Mile. That $120 million purchase was announced in April 2018, and added 109 e-commerce fulfillment centers, filling out a two-day delivery network across North America. SCS revenue and operating revenue growth should moderate going forward as MXD revenues will be incorporated into year-over-year comparisons.

Sanchez gave positive guidance for the rest of 2019, saying that Ryder was on track to hit all its revenue and operating revenue targets.

“We are on pace to meet or beat our 2019 revenue growth targets in all business segments,” Sanchez said. “In rental, our strategy to leverage e-commerce growth by expanding our medium-duty truck fleet is proceeding well. In used vehicles sales, we are expanding our retail sales capacity to handle additional volume and we continue to expect pricing to be slightly down, particularly in the second half of the year. In addition, we anticipate executing well on our recently announced maintenance cost initiative for the full year.”

Supply Chain Solutions revenue growth will turn negative for the rest of 2019, Sanchez warned, due to previously announced lost business. In March, Ryder announced layoffs of 249 employees in Lockbourne/Franklin, Ohio.

Still, Ryder expects continued improvements in Dedicated’s operating performance to drive further earnings growth.

“In view of these factors, Ryder is revising its full-year 2019 GAAP EPS forecast to a range of $5.28 to $5.58, as compared to the prior forecast of $5.18 to $5.48,” Ryder wrote.