SecurSpace develops Airbnb-like model for container storage as intermodal hubs getting tighter on space.

The U.S. import binge of 2018 is creating a hangover for shippers – where to store containers and trailers. North Carolina-based start-up SecurSpace offers a solution by marketing parking and yard slots at third-party terminals to space-constrained shippers.

Last year saw record volumes of containers being brought into the U.S. amid fears of higher tariffs on Chinese goods. But the amount of available U.S. warehousing and logistics space sits at a multi-year low, according to real estate researcher CBRE Group (NYSE: CBRE).

Warehouse and distribution center vacancy across the U.S. is 4.3 percent, according to CBRE’s head of industrial research David Egan, and “the lowest since we started tracking this in 2002.”

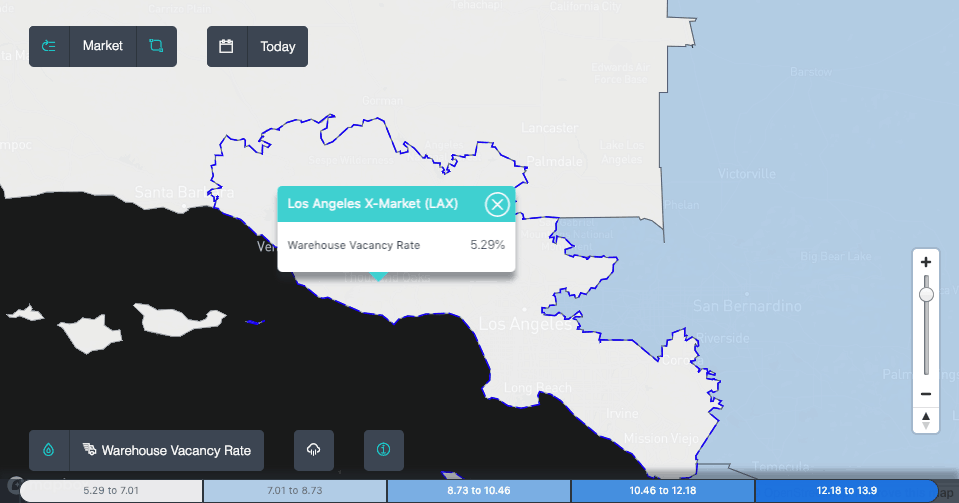

Los Angeles has been ground zero for the U.S. import surge with record volumes coming through the ports of Los Angeles and Long Beach. SONAR data shows the Los Angeles warehouse vacancy rate of 5.3 percent as of mid-2018 among the lowest in the nation.

Rod Stewart, a California-based manager for intermodal terminal owner and operator ITS ConGlobal, says the import surge and low vacancy at warehouses has left shippers scrambling for temporary storage.

“It’s been quite busy in the Los Angeles market,” Stewart said. “The terminals are congested. There are more containers in the market. It’s created a shortage of places to store them until the shipper can receive the cargo.”

ITS ConGlobal mainly provides grounded container storage for shipping lines and railroads. But it used SecurSpace to market 450 available slots at a Los Angeles depot and 100 slots in Chicago for wheeled container storage.

“The goal was to create a market for companies to park their empty or loaded containers and create a new revenue stream,” Stewart said.

For Next Trucking, the problem was finding space for wheeled storage amid the crush of containers coming off shops. The drayage and OTR carrier used SecurSpace to 600 spots across three yards in Southern California.

Sam Symonds, operations manager for Next Trucking, says the company would have previously entered long-term lease agreements at $18 to $20 per day for wheeled storage. But the company now pays around $15 per day with flexible terms.

“Yard space is the key to this game,” Symonds said “The way the ports are right now and the trade war stuff that’s going on, there’s so much volume coming in and there’s not enough space right now.”

SecurSpace founder and chief executive Lance Theobald says many terminals and depot owners are sitting on empty or underused space that could be rented for temporary storage, especially near major logistics hubs. In some cases, trucking companies are simply cold-calling different terminals hoping to find space.

“When a buyer utilizes our platform, we match them with supplier locations that meet their specifications,” Theobald said. “Airbnb, against all odds, convinced people to stay in strangers’ houses and convinced people to open their houses to strangers.”

SecurSpace markets slots at about 320 locations across the U.S, Theobald says. The platform has been live for about a year, but it really started gaining traction in July, he added.

During 2018, the company booked about 400,000 parking days. Theobald says slots marketed on the platform have been almost fully booked.

SecurSpace’s website displays the location and space availability at each terminal. It also handles the billing and gating procedures for customers. SecurSpace charges a 10 percent to 20 percent commission on each rental.

Just as Airbnb hosts can set terms for guests, terminal owners can specify what types of containers, trailers or cargo they will accept and for how long. SecurSpace’s standardized contract covers nearly all the terms between terminal owners and cargo interests.

Damage and liability coverage are largely spelled out in the standard contract. But Theobald says the company is looking to offer customers additional coverage for high-value cargo through a third-party insurer should a customer request it.

In the case of ITS ConGlobal, Stewart says it was more interested in monthly customers since it did not want its security guards to deal with daily in-gating and out-gating. Its Los Angeles slots are occupied by five shippers paying about $300 per month. But other SecurSpace customers are looking for one- and two-day storage, which can run about $20 to $30 per day.

Stewart says the demand for wheeled container storage has been strong enough that ITS ConGlobal is looking at opening additional acreage for SecurSpace.

SecurSpace “takes all the billing responsibility from us so there’s no collection or bad debt to deal with,” Stewart said. “They have the direct marketing expertise to trucking companies that we lack. They are a partner of ours.”

SecurSpace’s gross revenue closed 2018 at $10 million on an annualized basis. Theobald says the company also hit profitability in December. “It was the best Christmas present I could hope for,” he said.