One of the nation’s largest transportation and logistics companies, Werner Enterprises, Inc. (NASDAQ: WERN), reported non-GAAP adjusted earnings per share (EPS) of $0.52, besting the consensus estimate of $0.49 per share.

WERN reported revenue of $596.1 million, up 6 percent year-over-year as trucking revenue net of fuel surcharge increased 9 percent to $397.7 million and logistics revenue was flat in the period at $117.4 million.

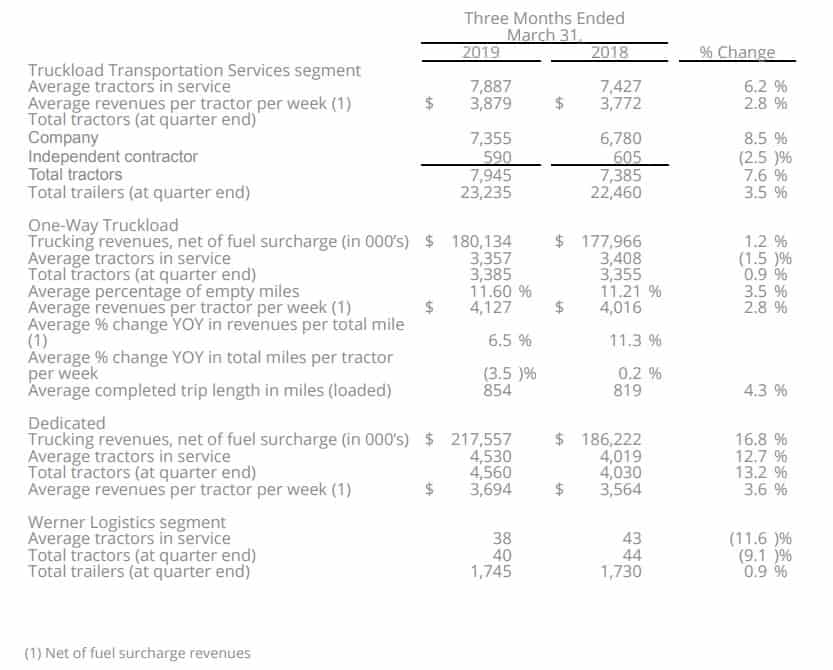

The company’s one-way truckload division saw a 1.5 percent decline in average tractors and a 2.8 percent increase in revenue per tractor in the quarter with the dedicated division seeing a 12.7 percent increase in average tractors and a 3.6 percent increase in revenue per tractor. Revenue per total mile increased 6.5 percent in the one-way truckload division. The company’s trucking operating ratio (net of fuel) improved 190 basis points to 89.1 percent.

From the earnings press release, “Revenues increased 7 percent due to a 6.2 percent increase in average trucks in service and a 2.8 percent growth in average revenues per truck. The average revenues per truck increase was due primarily to an increase in average revenues per total mile, partially offset by a decrease in average miles per truck. The increase in average revenues per total mile was due primarily to higher contractual rates, dedicated fleet expansion and lane mix changes.”

Logistics revenue was flat year-over-year. Logistics gross margin increased 270 bps to 17.3 percent due to contractual pricing and better capacity procurement. Operating margin for the division was 170 bps better at 4 percent given the gross margin improvement and improved cost management.

WERN’s total adjusted operating income increased 40 percent year-over-year to $49.2 million. The company’s consolidated adjusted operating margin improved 200 bps to 8.2 percent.

WERN maintained its 2019 full-year guidance for 3 to 5 percent truck growth, the majority of which will occur in the dedicated division. Also, the company expects one-way revenue per total mile increases to occur at the low end of the prior 4 to 8 percent range, gradually moderating throughout the year as the year-over-year comparisons are tougher.

WERN will host a conference call at 5:00 p.m. EDT to discuss these results.