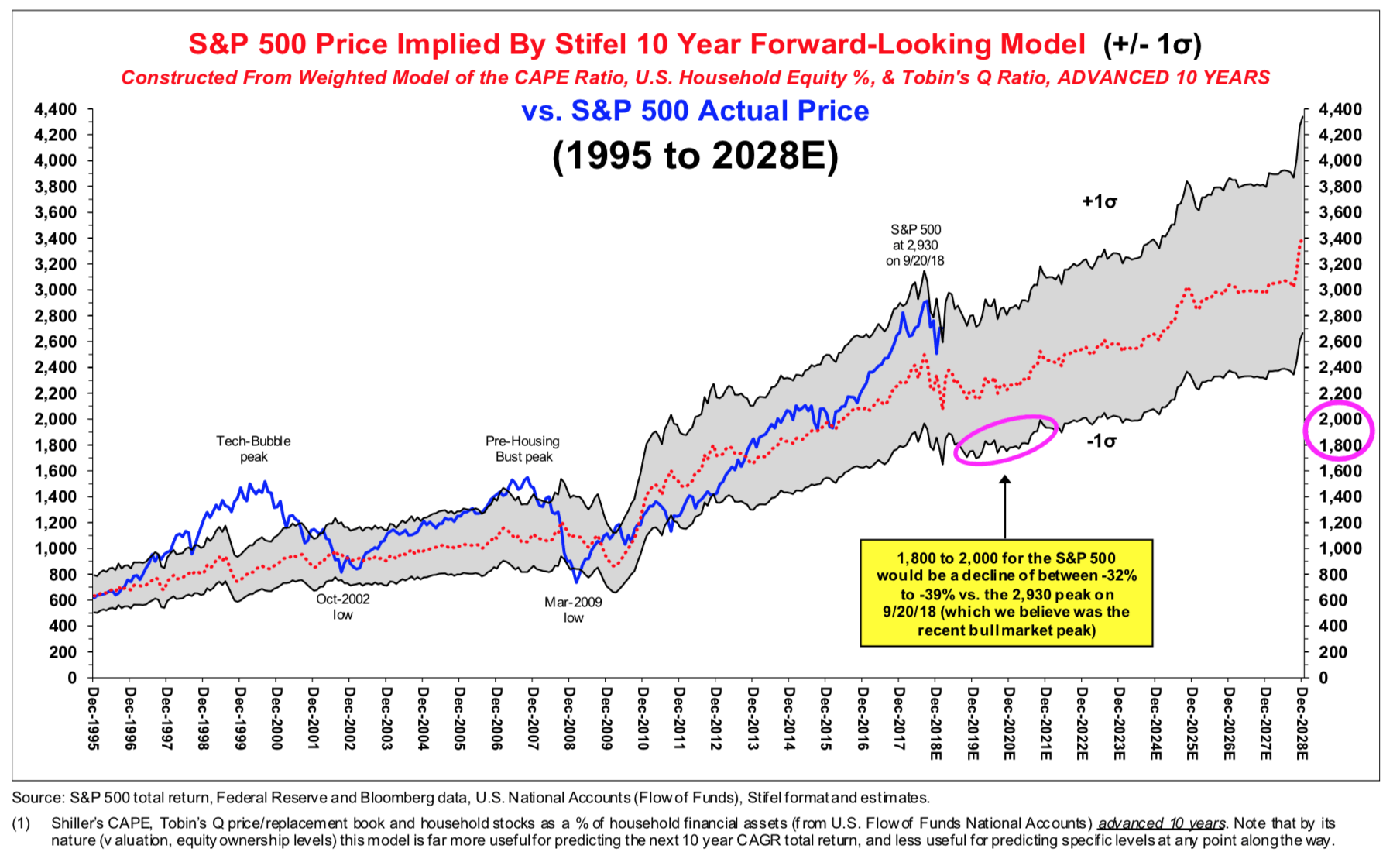

S&P 500 likely weak for the next decade

China, U.S. devaluing currencies in tandem would export deflation to Europe., putting stress on E.U.

FreightWaves is attending Stifel’s Transportation and Logistics conference in at the Fontainebleau in Miami Beach, an annual event that brings together publicly traded transportation companies and institutional investors, as well as thought leaders from privately held companies.

Tuesday’s lunch keynote speaker was Barry Bannister, Stifel’s Head of Institutional Equity Strategy. Bannister delivered a virtuosic presentation on the outlook for the S&P 500 next year, and the year after that, and in fact all the way to 2028. Riffing on the history of the Fed’s fiscal policy since the 1930s and how it affected stock valuations, Bannister predicted an imminent recession and weak stock market performance for years to come but kept the mood light with ironic asides, quirky analogies, and a good deal of gallows humor.

The key takeaways: weak earnings-per-share growth and flat price-to-earnings ratio that establishes a top for the S&P 500 near 2,750 in the first half of 2019; markets already bought the news of the Fed tightening and will go down unless the Fed issues cuts; the yield curve will likely invert and cause a surge in ‘defensive’ stocks; investors can expect the S&P 500 to deliver volatile 4-5% compound annual total return, i.e., with dividends reinvested, for the next decade; and Value stocks will beat Growth stocks over the next five years.

Bannister likened the recent relationship between the Federal Reserve and the stock market to a high school track coach with a very portly team. Over the past ten years, with rates close to zero from November 2008 through 2016 and rates below 2% until last fall, the portly track team faced hurdles that were at ground level—but now they’re being raised.

“If you lower the hurdle for the track team to ground level, everyone on the track team has a gold star,” Bannister said. “When you raise it to one foot, you’d be surprised at how many face plants you get from your overconfident, portly track team.”

“We spent ten years with rates below neutral, which drove all kinds of stupid investment and leverage schemes,” Bannister explained.

There’s another problem, Bannister believes: hasty investors already “bought the news” of Chairman Powell’s pause—-he said at the Fed’s January 30 meeting that “the case for raising rates has weakened somewhat—without waiting for any kind of improvement in economic fundamentals. Bannister explained that equity recovery after the ‘nominal recession’ in 2015-6 only began after both the “Yellen pause” and economic recovery began.

“Our concern is that investors are buying what they believe is a preemptive ‘Powell Pause’ without waiting for the 2019 slowdown that past tightening already locked in,” Bannister said.

According to Bannister, for value names to outperform growth for a long period of time, a weak dollar will cause prices for commodities like hydrocarbons and gold to soar, and the returns from the S&P 500 will be fairly weak.

One of the most interesting segments in Bannister’s presentation was his analysis of the causes, likely outcomes, and global effects of the trade war between the United States and China. In Bannister’s view, the “U.S./China trade conflict is the natural result of diminishing U.S. returns from incremental debt.” What does that mean?

Despite marginal Federal personal tax rates anywhere from 28% to 90% since 1948, government revenues, including federal, state and local, have never exceeded 30% of nominal GDP. Unfortunately, costs, especially government-paid medical expenses, keep rising as the population ages. The United States has made up the difference with debt, but we’re getting less and less bang for our buck: even as our debt-to-GDP ratio grows, we get a smaller boost in nominal GDP from each dollar of additional debt. In 1962, the U.S. GDP grew by 80 cents for every dollar of debt, but by the year 2000 that number had fallen to about 45 cents. By the end of 2019, if the decades-long linear trend holds, each dollar of debt will generate only about 30 cents of GDP. Unless the United States turns the trend around, the federal government will default on its debt around 2040.

“The U.S. has historically imported foreign savings surpluses and run up domestic debt via ‘twin’ fiscal and trade deficits, but diminishing GDP derived from total debt implies the U.S. can no longer rely on debt while under-investing domestically to the detriment of U.S. productivity and real wages,” Bannister wrote in a slide.

The trade war is really about U.S. companies’ access to Chinese markets and rebalancing the trade relationship, not just tariffs, which are only being used as a tool to force China to the negotiating table, Bannister said. As both economies slow down, China and the United States will devalue their currencies in tandem, keeping the dollar-yuan exchange rate flat, and exporting destructive deflation to the rest of the world. Devaluing the dollar drives commodity prices up (if dollars are worth less, a barrel of oil costs more dollars) and could suppress global demand for oil.

If, for example, the yen and the euro deflate (rising in value), which Bannister says is likely to happen, then the cost that European governments pay to service their debt will soar. Italy could be pushed into another crisis, one so deep that the European Union (E.U.) itself, could break up.

As we noted above, Bannister’s lunchtime presentation was virtuosic, and by means of a number of sometimes exotic charts, he managed to provide convincing evidence that the resolution of the U.S. – China trade dispute could cause the E.U. to fracture.