Factory orders for durable goods rose in March, driven by a large increase in commercial aircraft orders. Excluding aircraft, orders actually fell during the month in the latest sign that freight demand may be normalizing.

Advance readings from the Census Bureau show that orders placed for durable goods in the economy rose a healthy 2.5% in March from February’s levels. This comes on the heels of last month’s impressive 3.5% gain and places current orders for durable goods 9.5% higher than at this point last year.

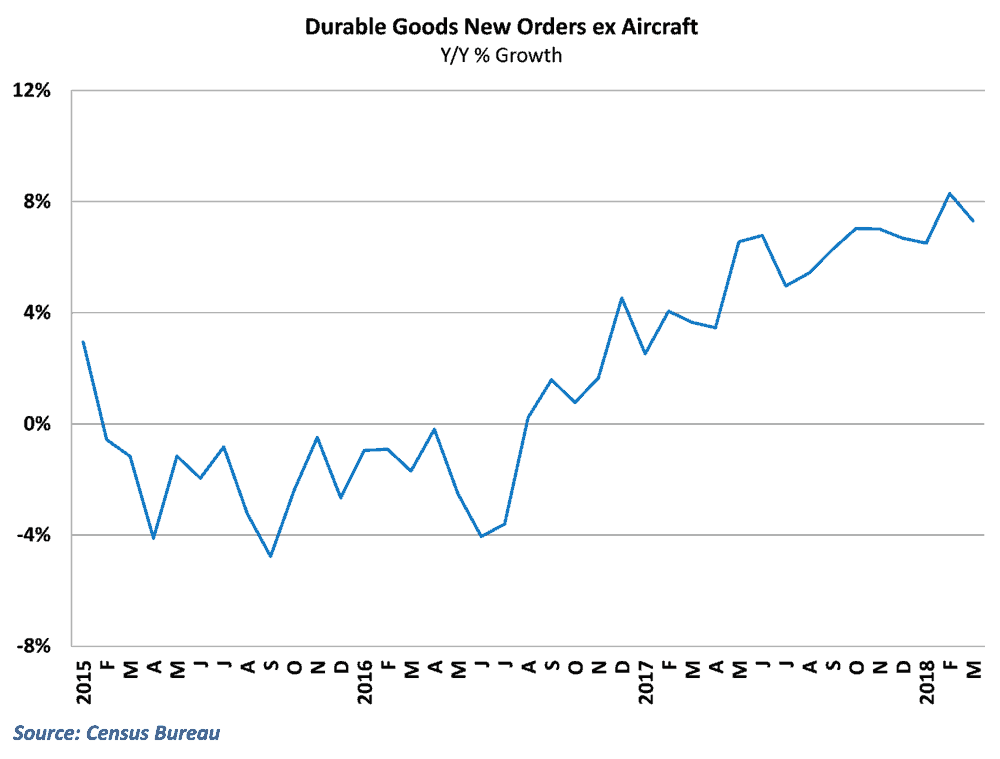

However, the strong growth during the month was primarily driven by a surge in the often-volatile aircraft sector. New orders for commercial airlines rose 44% in March after a 39% surge in the previous month to help boost the overall number. Excluding aircraft, durable goods orders barely eked out an increase in March as year-over-year growth dipped down to 7.3%.

(Story continued below)

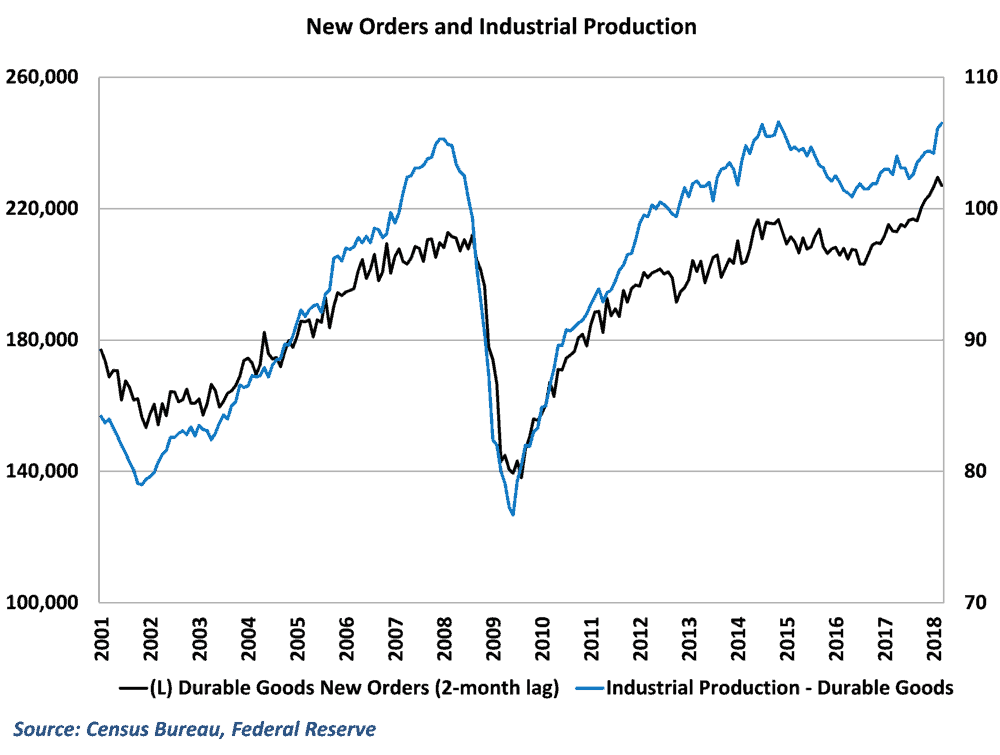

Historically, durable goods orders provide some forward-looking insight into the state of the durable manufacturing sector, as orders that are placed in the current month become production and shipments in upcoming months. New durable goods have a tight correlation with the durable component of industrial production, with orders leading manufacturing by a couple of months.

Because of this, the state of new orders for durable goods gives valuable insight into the upcoming state of freight demand. Domestic manufacturing helps provide the foundation for freight demand in the economy, as goods that are produced here either travel throughout the domestic supply chain to their end destination, or make their way to ports to be exported to the rest of the world.

Behind the numbers

Again, transportation orders helped exaggerate the overall performance in the headline numbers. Unlike last month, however, the results outside of airline surges were pretty weak, with machinery and computer equipment orders taking a significant hit during the month

It is worth noting, however, that despite the softness in March results outside of aircraft, the state of new orders remains generally healthy. Core new orders enjoyed healthy growth in the previous month, and still managed to grow at a 5.1% annualized pace in the 1st quarter. Year-over-year growth dropped in the March report, but is still very high by historical standards. As a result this feels a bit more like normalization after hurricane season and strange winter weather patterns cause some faster than usual growth.

Results on the nondurable side of the goods economy, and additional detail for durable goods, will be published in early-May and should give a more complete picture at an industry level for orders growth and upcoming manufacturing demand.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.