Anyone in the transportation industry knows that there are certain times of the year (June, September, and October) when it is more difficult to find capacity even when the overall economy is weak or in recession. Conversely, we also know that even in the strongest economic times that is will be easier to find capacity in January and February. It is why most shippers prefer to renegotiate their rates in January and February.

Whether we look at the current data from DAT Solutions or Cass Information Systems, we get a very clear indication of continued strength in the truckload and domestic intermodal segments. The current level of strength would be notable if it were June, September, or October, but it’s not. It’s February data. It is impossible to predict exactly how long this will last, but at least through 2018 we expect capacity to remain tight.

What Does the Data Look Like?

After hitting an all-time high, in January no less, the DAT Solutions Barometer has stayed in record territory despite February being a seasonally weak period for demand. This barometer is a pure measurement of the balance between capacity and demand, and since it is not ‘seasonally adjusted’ the current level of strength is even more extraordinary. The current strength being reported in spot rates by DAT Solutions is leading us to believe contract pricing rates should keep rates in positive territory well into 2018.

What About Pricing?

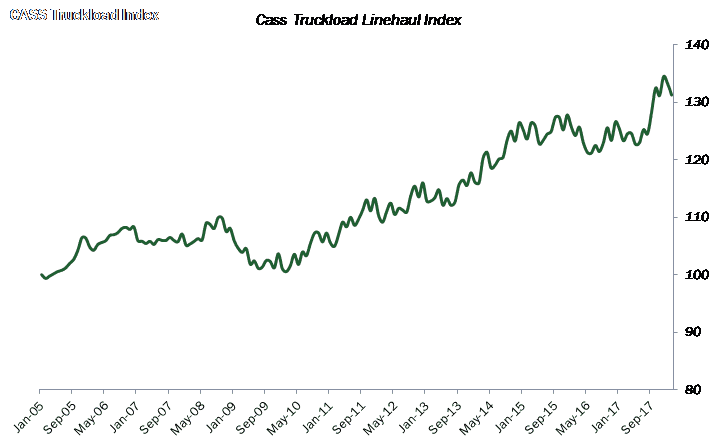

The strength in demand is already being reflected in realized pricing. February’s Cass Truckload Linehaul Index continued the acceleration established in November, December, and January (up 6.3%, 6.2%, and 6.3% respectively) by posting a 6.5% YoY increase (the strongest percentage increase yet in this recovery), to 131.3 (just shy of December’s 134.5 all-time high). Pricing for trucking is growing ever stronger and “gaining momentum” continues to be an understatement. After signaling an industrial recession in the U.S. and being negative for 13 months in a row (from March 2016 through March 2017), the Cass TL Linehaul Index has not only been positive now for eleven months in a row, but the strength is continuing unfalteringly. In just the last seven months, our pricing forecast has improved from -1% to 2%, to 6% to 8%, and now giving us reason to believe the risk to our estimate may be to the upside. We believe that this is the strongest normalized percentage level of TL pricing achieved since deregulation (normalized meaning except for extreme periods of recovery from recession).

Truckload Driving Intermodal?

Pricing is so strong in Dry-Van Truckload and capacity is so tight that it is spilling over into the domestic intermodal segment as shippers look for alternative ways to get products moved.

Our latest data point shows total intermodal pricing rose 5.4% YoY to 137.9 in February. We are encouraged by this data point and would point out that this brings the three-month moving average up to 4.8%. January marked the seventeenth consecutive month of increases, and pricing momentum is improving. Higher diesel prices are creating demand and pricing power for domestic intermodal. Longer term, we continue to foresee oil trading in the $45 to $65 range and diesel in the $2.50 to $3.25 range throughout 2018 (sans the refining interruption pressure produced by hurricanes or other catastrophic events).

Total pricing for intermodal carriers jumped 5.4% in February, after increasing 5.0% in January, 4.0% in December, 3.9% in November, 1.9% in October, 4.0% in September, 1.3% in August, 0.6% in July, 1.8% in June, 2.2% in May.

Bottom Line

As we’ve suggested in previous columns, this is a period in which shippers would be well served to grant price increases to asset providers who are willing to guarantee capacity; and asset providers would be well served to ask for as much price as they dare, but make sure they deliver on capacity later in the year.