The Federal Reserve’s meeting of the Federal Open Market Committee (FOMC) begins this morning, with expectations that the central bank will raise the federal funds target rate a quarter of a percentage point. This meeting marks the first of new Fed Chairman Jerome Powell’s tenure, and a rate increase here would continue the general trend of gradual tightening that the central bank has followed since the end of 2016.

The impending rate increase comes as no surprise and has largely been expected by markets since the last increase in December. However, the path of future increases remains uncertain and could have implications for the broader economy going forward.

What is the federal funds rate and how does it affect the economy?

The federal funds rate is the interest rate at which banks make overnight loans to other banks to maintain the reserve requirements set by the Federal Reserve. Most businesses and consumers do not have access to these types of loans, but the federal funds rate influences a number of other interest rates in the economy. The Federal Reserve does not directly set the federal funds rate, but sets a target for the rate and buys and sells in the market to achieve the target.

Short-term and adjustable interest rates, such as those found with credit cards, adjustable-rate mortgages and home equity loans, have the closest tie to the federal funds rate. As the Fed tightens monetary policy these types of rates also rise, which suppresses business and consumer spending.

Longer term rates, such as auto or home loans, generally move in the same direction as the federal funds rate, but are not as closely correlated. For example, the Fed has increased rates fairly steadily over the past year and a half, but mortgage rates have fluctuated. Still, increases in the federal funds rate typically suppress longer term purchases, though the Fed has far less control over the size of the impact on this type of consumer spending.

Why have rates been rising?

The Federal Reserve generally follows its mandate to maintain full employment in the economy and keep inflation moderate. It uses the target federal funds rate to help smooth out fluctuations in the economy, lowering the rate when the economy is weak and raising it to keep it from overheating and prevent inflation.

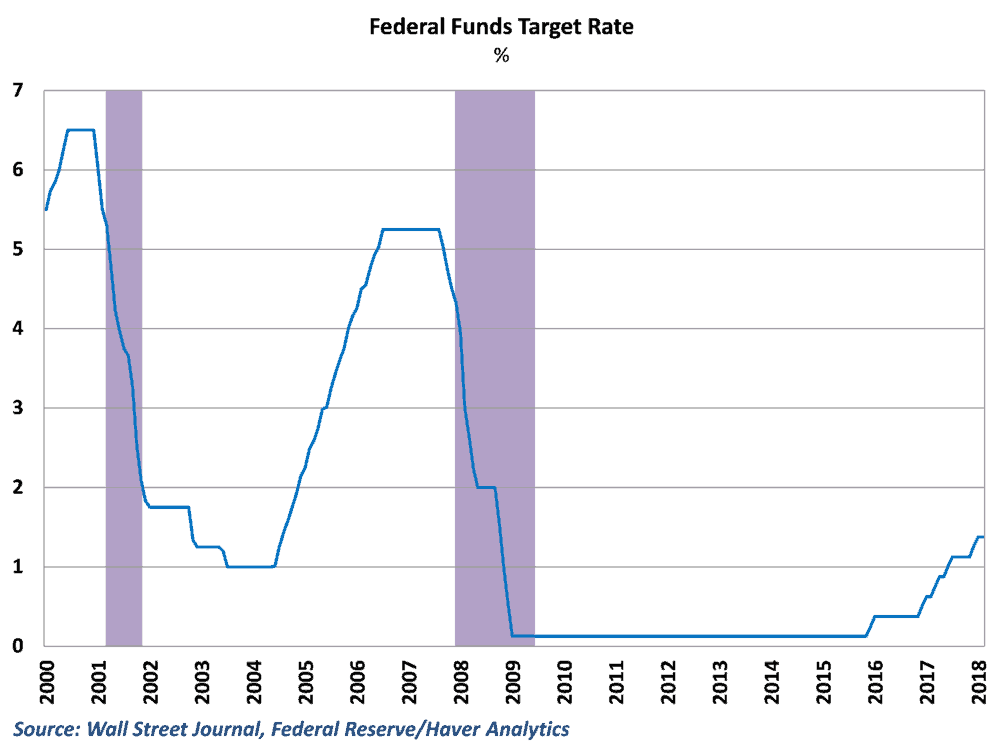

The Federal Reserve responded to the financial crisis in 2008 by dropping the rate to essentially zero and kept it there for nearly seven years in an effort to help boost an economy that was plagued by high unemployment and little to no inflation. As the economy improved, the Fed called for a small rate increase at the end of 2015 before beginning the recent gradual path of rate hikes in 2016.

This path of rate hikes has largely been because of the general health of the labor market. Job growth has been impressive over the past few years, pushing the unemployment rate down near historical lows at 4.1%. Even broader measures of unemployment, which include people who left the labor force discouraged by job prospects and those that are part-time for economic reasons, have drifted to more normal levels. This would indicate that there is not much room left to boost the economy and rates can be returned to more normal levels. Fed officials have previously indicated that they expect three rate hikes this year, with the first coming this week.

What does this mean for freight markets and carriers?

Freight markets generally feel the impact of a rate hike in a couple of ways. First, interest rate increases affect economic activity, thereby affecting the demand for goods and the transportation of those goods. Taken in a vacuum, a rate increase depresses consumer and business spending and curbs manufacturing, construction, and imports. However, part of the reason for rate hikes is that the economy is accelerating already and should be able to weather the negative impacts of a rate increase. The result of this generally is continued solid demand.

Carriers of course will begin to notice higher rates throughout the economy. Financing terms on truck and equipment purchases are likely to increase along with the interest rate hike. In addition, tighter monetary policy generally makes it more difficult for smaller, less credit-worthy carriers to receive loans from banks.

Again, much of this has been expected by markets, lenders, and businesses for quite some time, and a small increase in rates will just be a continuation of an extended trend. What matters is whether or not the central bank deviates from its general message of gradual tightening.

The case for and against faster hikes

Because the expected path has been communicated extensively, there will likely be little reaction in markets if the Fed stays committed to a gradual pace of rate increases. The absence of any real sign of inflation in the economy has removed much of the pressure from the Fed to raise rates faster. In addition, while unemployment is low other data from the labor market, such as participation rates and wages, suggest that the economy is still a ways away from overheating.

Still, there are a number of compelling reasons for the Fed to tighten policy quicker than previously communicated. For one, the recent tax cut package passed in December and is expected to boost growth even further throughout the rest of 2018. Fed officials seem wary that this may lead to overheating economy and may decide to act now to curb some of those effects.

In addition, evidence from the past two recessions suggests that an overheating economy need not manifest itself in accelerating inflation. Instead, an overstimulated economy may drive instability in financial markets, creating speculation and asset bubbles in markets. The central bank may decide to preempt this type of behavior and tighten more quickly despite the lack of evidence of any type of inflationary threat.

Because of the indirect nature of monetary policy, interest rate hikes often take several months before the effects take hold in the economy. As such, the Fed does not have the luxury of waiting until economic threats are imminent before acting. Because of this and recent developments in the economy, it will be interesting to see how committed each of the FOMC members are to gradual hikes after this week.