Growth in the U.S. economy improved 3.2 percent during the first quarter, but details related to freight demand suggest a weaker environment to start the year.

The Bureau of Economic Analysis (BEA) released results for first quarter gross domestic product (GDP), showing that overall growth in the economy improved to a 3.2 percent annualized pace. This is up from the 2.2 percent pace of growth in the fourth quarter of 2018 and far exceeded consensus estimates of 2.1 percent growth. Year-over-year growth for the first quarter climbed further to 3.2 percent, marking the fastest pace of yearly growth in the economy since the middle of 2015.

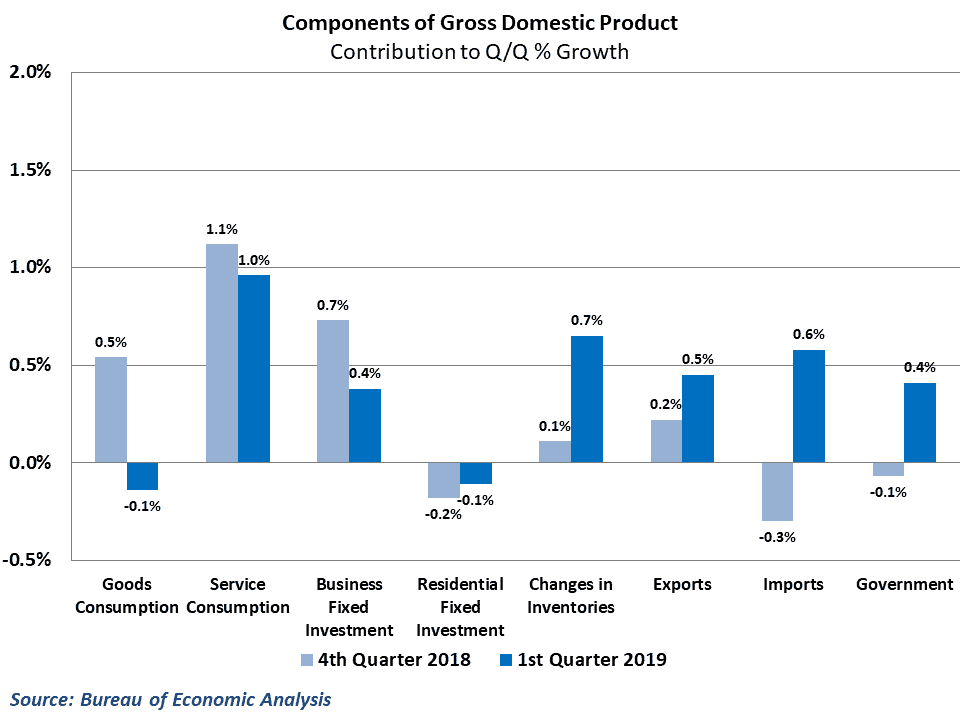

Much of the improvement in growth during the quarter came from international trade. Exports grew at a solid pace overall in the quarter while imports plunged, which contributed a combined 1.0 percent to overall growth. Inventory building also accelerated at the start of the year, which contributed an additional 0.6 percent to growth in the first quarter.

Consumer spending, which makes up approximately 70 percent of all expenditures in the economy, slowed down further in the first quarter but still managed to contribute a respectable 0.8 percent toward quarterly growth. This gain was entirely driven by the service sector, however, as consumer spending on goods actually declined. Business fixed investment also slowed during the first quarter, contributing just 0.4 percent. Residential investment, which struggled throughout 2018, declined for the fifth consecutive quarter and subtracted 0.1 percent from quarterly GDP growth.

Freight economy details look less favorable

While GDP is the most commonly referenced measure of overall economic health, it is far less useful as an indicator of the state of the freight economy. GDP measures the value of all goods and services produced within an economy during a given period, but the service sector has far less influence on freight demand and the movement of goods. Spending on things like healthcare, recreation and financial services are a significant portion of economic production, but are not going to drive tonnage and miles within freight.

It is more useful, then, to focus on the areas of GDP that reference the goods side of the economy. Consumption of goods, business investment in equipment and structures, residential investment, and trade in goods all serve as key drivers for freight demand in the economy.

From this perspective, the details in the GDP release were far less favorable. The decline in consumer spending on goods, combined with an overall decline in trade volume weighed heavily on freight demand at the start of the year. In addition, business investment spending grew at a slower pace, further underscoring the weaker freight environment during the first quarter. In addition, while the buildup in inventories should eventually translate into freight flowing through the economy, there is little evidence to suggest that the inventory-building in the first quarter helped boost freight activity.

Behind the numbers

The first quarter GDP results serve as a useful illustration of the disconnect between overall economic growth and freight demand. Almost all of the details within GDP were discouraging for freight demand during the quarter. The declines in imports and goods consumption were obviously not good for freight. In addition, the respectable 0.4 percent contribution from business investment was entirely driven by gains in intellectual property, which is mostly spending on software and research & development instead of equipment and structures. Also, the positive contribution from the export sector was boosted by the February surge in commercial aircraft exports instead of broad-based activity.

The second quarter will likely see a reversal of these conditions. Retail spending is likely to be stronger going forward, as is business spending on capital goods. In addition, the inventory cycle should begin to turn, which will weigh on economic growth but should stimulate freight activity as these goods make their way through the supply chain. As a result, economic growth may slow from the impressive pace seen during the first quarter, but freight conditions are likely to improve.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.

One Comment

Comments are closed.