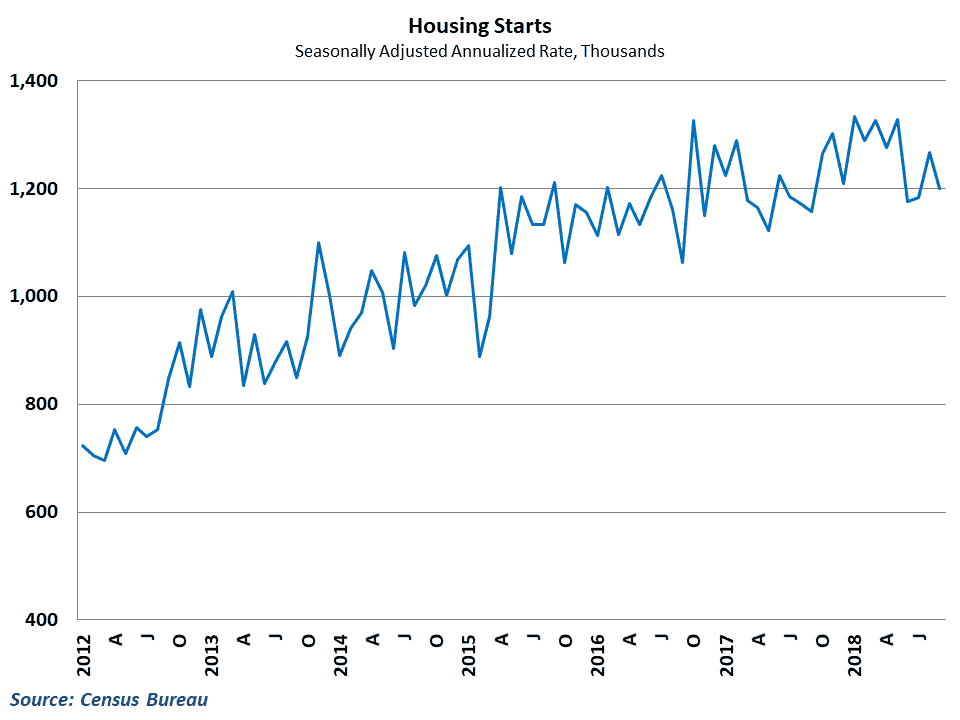

Housing starts fell more than expected in September, as the impact of Hurricane Florence caused a massive decline in construction activity in the South. This put a damper on what would otherwise be a decent report and leaves some uncertainty about the underlying strength of one of the key components of freight demand.

The Census Bureau reported this morning that total new housing starts fell 5.3% in September to a 1.201 million seasonally adjusted annualized pace. This fell below consensus expectations of a decline to a 1.216 million pace as housing construction continues to struggle to find its footing.

Much of the decline during the moth was driven by a sizeable decline in apartment complex construction, which fell nearly 13% during the month. Single-family home starts saw a more modest decline, falling 0.9% from August’s levels. Despite the recent struggles, home starts have seen decent improvement so far in 2018, rising 6.4% over the first nine months of the year compared to the first nine months of 2017

A look at the details of this reports gives reason for hope going forward, however. Multifamily home starts are historically a volatile series, and large swings in that number can alter the total significantly even if the fundamentals for building have not changed much. Moreover, the decline in single-family home starts was almost entirely driven by an almost 7% drop in starts in the South region. This offset healthy gains in single-family home starts in both the West and Midwestern regions.

The impact of Hurricane Florence is likely to blame for the poor performance in the Southern region. Construction activity is particularly sensitive to weather conditions, and the flooding and mass evacuations in the Carolinas clearly took its toll on the housing results in the area. Typically, home starts in the South make up more than half of all of the starts in the entire country, so disruptions in that region can have an outsized effect on the national numbers.

Behind the numbers

Ignoring the erratic swings on the multifamily side, it’s still tough to get a feel for where housing stands headed towards the end of the year. The results for September clearly had hurricane impacts pushing them, and October data is likely to be swayed again from Hurricane Michael and rebuilding efforts from Hurricane Florence. From there, we will enter the colder months of the year, where home building activity often hinges on how mild the winter is. Ultimately all of the hurricane damage and displaced housing construction should lead to some additional pent up demand, but when this gets unleashed and what the underlying strength of housing is outside of weather fluctuations is still unclear.

This is unfortunate because unlike other drivers of freight demand like retail and industrial production, there are still many questions about the fundamentals of housing construction. Home building had sputtered months before any hurricanes hit, as builders had been dealing with rising materials costs, labor shortages, and a lack of developed lots all through the 2nd quarter. Demand for new units appears to be strong and should remain that way as long as job and income growth stays solid, but whether builders can meet this demand remains uncertain.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.