Industrial output rose for the fifth consecutive month in October, with strength in the manufacturing sector outweighing softening activity in mining production. Hurricane season again disrupted activity, with Hurricane Michael restraining total production slightly during the month.

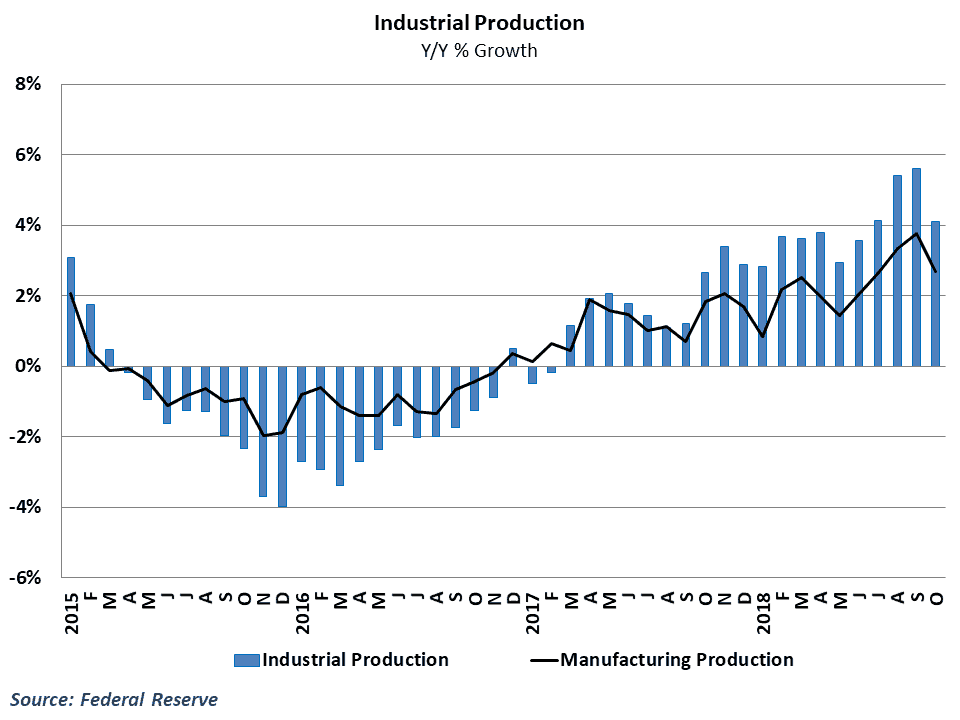

The Federal Reserve reported this morning that total industrial production rose 0.1% in October from September’s levels. This fall slightly below consensus estimates of a 0.2% gain, but marks the fifth consecutive gain in the industrial sector. In addition, results from previous months were revised upward, leaving the overall level of production higher than expected. Year-over-year growth fell to 4.1%, however, as tougher comparisons to last year have begun to reduce yearly growth rates.

Gains in the industrial sector came despite monthly declines in the both the mining and utilities sectors. Manufacturing industrial production, which excludes mining and utilities, rose 0.3% during the month and is now 2.7% higher than at this point last year. Results were generally broad-based during the month, though a 2.8% decline in motor vehicle production weighed down what was otherwise a strong month in the manufacturing sector.

Minor hurricane impacts continue to affect growth

Like September, which saw Hurricane Florence reduce industrial output, October’s results were negatively affected by Hurricane Michael’s impact on the Gulf Coast in the middle of the month. The Federal Reserve estimated that Hurricane Michael reduced total output by 0.1%, matching the amount of lost production from Hurricane Florence.

Typically, when there are disruptions due to weather events, production usually gets made up in subsequent months. Since both September and October were negatively affected by hurricane season, November’s results will likely see a small boost as business make up the lost production.

Behind the Numbers:

Activity in the industrial sector continues to be one of the standouts in the economy. The headline number was a bit of a disappointment, but growth in the 3rd quarter was bumped up to a 4.8% annualized pace from initial reports of a 3.2% pace, so on balance production looks to be stronger after this morning’s report. The sharp drop in yearly growth rates was largely expected given the strength of the 4th quarter of 2017, and tougher comps are going to keep growth well below the multi-year highs that industrial production enjoyed in the 3rd quarter.

The declines in the mining sector are likely going to be an issue going forward. Oil prices plummeted nearly $20 per barrel since the beginning weeks of October, which will reduce the incentive to invest in the oil and drilling sectors of the economy going forward. The surge in oil prices at the end of 2017 through the first three quarters of 2018 translated into a surge in mining production and strong growth in industries that support the energy sector. If oil prices remain low, the pace of growth in mining production is likely to slow significantly, effectively muting one of the key areas of support for industrial output and freight demand.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.