Business inventories increased for the fourth consecutive month in January, but remain lean relative to sales volume as companies look to manage their inventory costs.

The Census Bureau reported earlier this week that total business inventories rose 0.6% in January from December’s levels. Retail inventories posted the strongest growth in a year, improving 0.7% in January. Much of this gain in the retail space was driven by the auto industry however, as motor vehicle and parts inventories surged 1.7% during the month. Retail inventories excluding motor vehicles rose a more modest 0.1%.

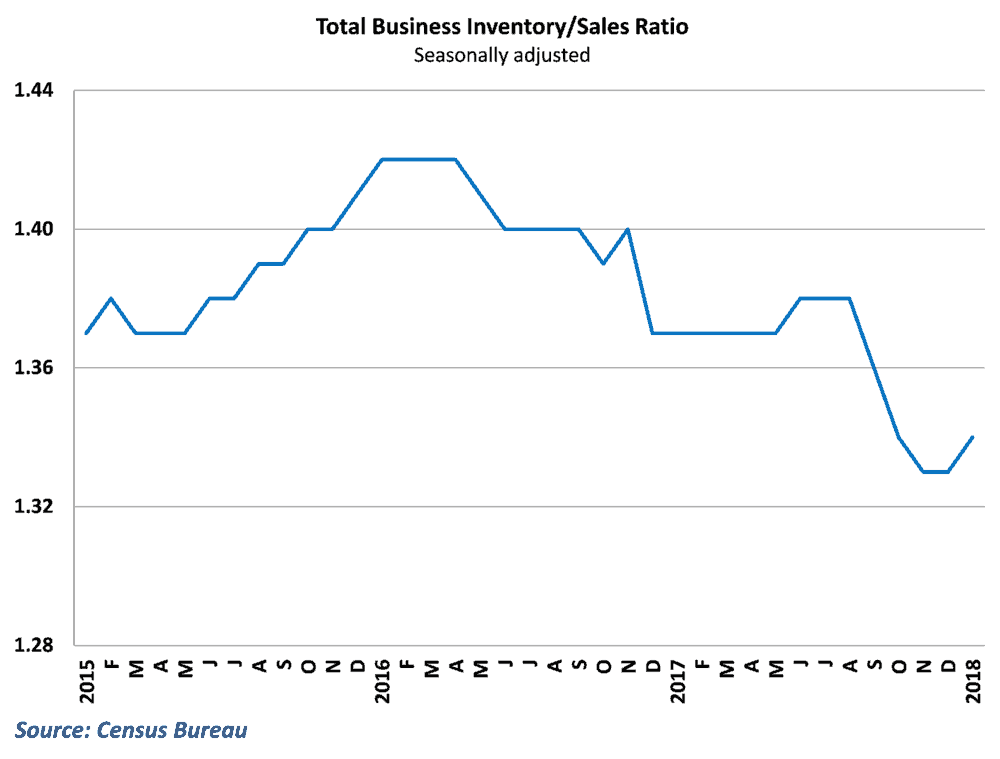

The gains in inventories combined with soft sales results led to a slight increase in the inventory-sales (I/S) ratio in January. This uptick follows an extended period of light inventory building and solid sales growth in the 2nd half of last year, which helped push the I/S ratio down.

(Story continued below)

The I/S ratio measures how many months of sales would be required to exhaust the existing stock of inventory. High I/S readings either mean that sales have disappointed leaving businesses with an inventory overhang to work off, or that expectations for future sales are particularly high and businesses are preparing for improved conditions.

Conversely, low I/S readings would suggest that businesses either experienced a surge in sales requiring a drawdown in inventories, or businesses are expecting relatively sluggish growth in sales and thus don not require high inventories on hand. In today’s economic environment, with steady growth and expectations for improved growth going forward, the generally low I/S reading would suggest that businesses are simply opting to run with lean inventories.

This type of behavior lowers the cost of carrying inventory, as businesses instead opt for just-in-time methods of production. However, this approach carries some risk. First, just-in-time inventory control requires accurate forecasts of customer demand. Inaccuracies on demand expectations could easily put a business in the position of not having the goods on hand to meet the existing demand.

In addition, with high levels of inventory, businesses can weather an occasional supply chain disruption by simply drawing from inventory to fulfill demand. However, with inventories lean, businesses are far more sensitive to any disruption that occurs along the supply chain.

This, in turn, puts additional pressure on carriers to be able to deliver what is needed in a timely fashion. Freight, LTL, and parcel companies are increasingly asked to meet tight deadlines as part of the broader effort to manage inventory levels. With many trucking companies already facing longer delivery times due to the ELD mandate and tighter regulation on hours of service, meeting critical deadlines becomes an arduous task. In addition, shippers have been increasingly aggressive in charging late fees to carriers who fail to meet these tight shipment deadlines. All of this drives up costs for freight carriers, and is contributing to the rise in rates seen in trucking and LTL markets.

Behind the Numbers:

The rise in inventories during the month was large, especially in the retail sector, but not terribly surprising given the weak retail sales results. The I/S ratio enjoyed a slight uptick, but there is still more room to grow inventories going forward. Current levels of the I/S ratio feel low given the generally optimistic view of growth in the economy throughout the remainder of 2018.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.