Back in March, FreightWaves reported on a “perfect storm for lumber markets”: a confluence of strong global demand and critical supply issues that caused futures prices for 1,000 board feet of lumber to break $500 for the first time ever. To put that number in perspective, lumber broke $400 only 8 times in the decade from 2001-2010.

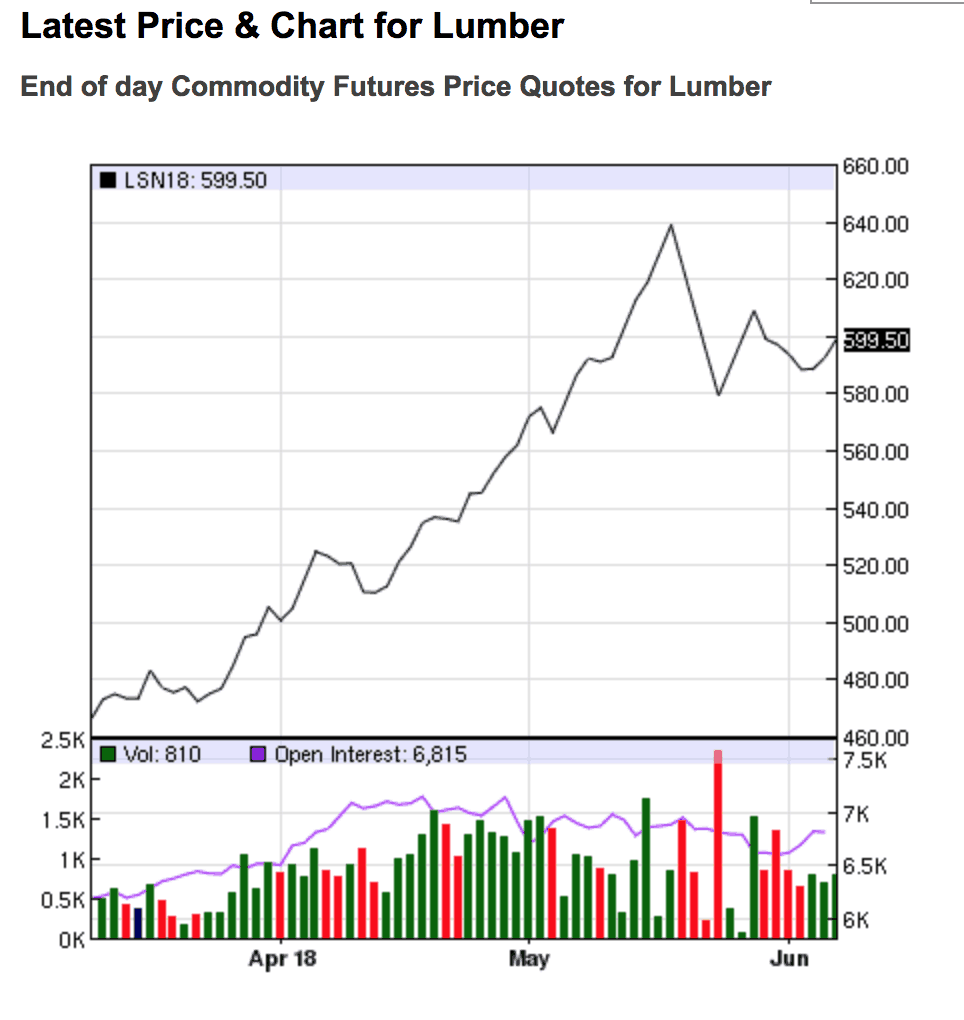

A little more than three months later, lumber prices have not backed off at all. Futures contracts for 1,000 board feet recently touched $639, a new record, before settling around $600, up 70% YOY according to Business Insider, and far above the level lumber sold for during the housing bubble.

“We’ve never seen anything like this. It’s been unprecedented,” said Deb Maples, risk management consultant at futures brokerage INTL FCStone Financial Inc, to the Wall Street Journal on June 5th.

Our earlier article listed beetle infestations in the United States, forest fires in Canada, tariffs on Canadian lumber, and labor shortages in everything from logging, trucking, and lumber mills as factors constraining the available supply of lumber. China’s gradually slowing deforestation rate, which has flipped the country to a net importer of wood, and a rare synchrony in economic growth across the world’s major regions were forces making demand very strong.

Another supply bottleneck has emerged since then: a Canadian railroad capacity crunch. A glut of other commodities like grain and coal meant that demand for boxcars to carry lumber outstripped supply. A number of companies, including Canfor Corp., West Fraser Timber Co., and International Paper Co. complained to Bloomberg in April that inventories at their sawmills and pulp mills were piling up for lack of trains.

According to Susquehanna’s Railroads Industry Update for Week 22, dated June 6, in the last four weeks, Canadian National’s coal volumes grew 27.1% and its grain volumes grew 7.1% over the prior four week period; Canadian Pacific’s grain volumes grew 13.4% over the previous four week period. Meanwhile, in the ‘Forest, Lumber, & Paper’ category, Canadian National’s volumes contracted 3% year to date, and Canadian Pacific’s volumes were up only 2.7% year to date.

There is some evidence that higher building material costs—lumber and other wood products like plywood and OSB—are contributing to higher housing prices. Average home prices are at an all time high and growing twice as fast as wages and overall inflation: a Reuters poll of analysts in 20 major cities conducted May 16 through June 6 revealed a consensus expectation that home prices would rise 5.7% this year.

“House prices have been outrunning family incomes for several years in the U.S. and while demand has cooled off a bit, the supply side is still very tight,” Sal Guatieri, senior economist at BMO Financial Group, told CNBC.

Rising interest rates and higher materials costs pushing home prices higher may have already begun affecting demand for housing: in April, new building permits, housing starts, and single family home purchases all decreased. Structural factors like the entry of the millennial generation into the real estate market and low national inventories are conspiring to bolster demand, though, and estimates for housing price growth in 2019-20 vary widely.

Still, according to DAT’s RateView tool, flatbed rates in the Southeast are maintaining their firmness. Intra-regional flatbed spot prices in the Southeast are averaging $3.19 per mile over the past seven days, which reflects a healthy construction industry as well as accelerating capital expenditure in the Southern Yellow Pine-dominated timber regions. CCJ reported that “flatbed rates jumped 9 cents in May to $2.75 a mile, the segment’s highest average since Truckstop.com began distributing monthly rates data.”

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.