Industrial production rose at a solid pace to round out 2018, helped by a jump in manufacturing activity during the month. The gain in output in December rounded out the strongest year for the industrial sector since 2010, and eased fears after a string of negative releases from manufacturing.

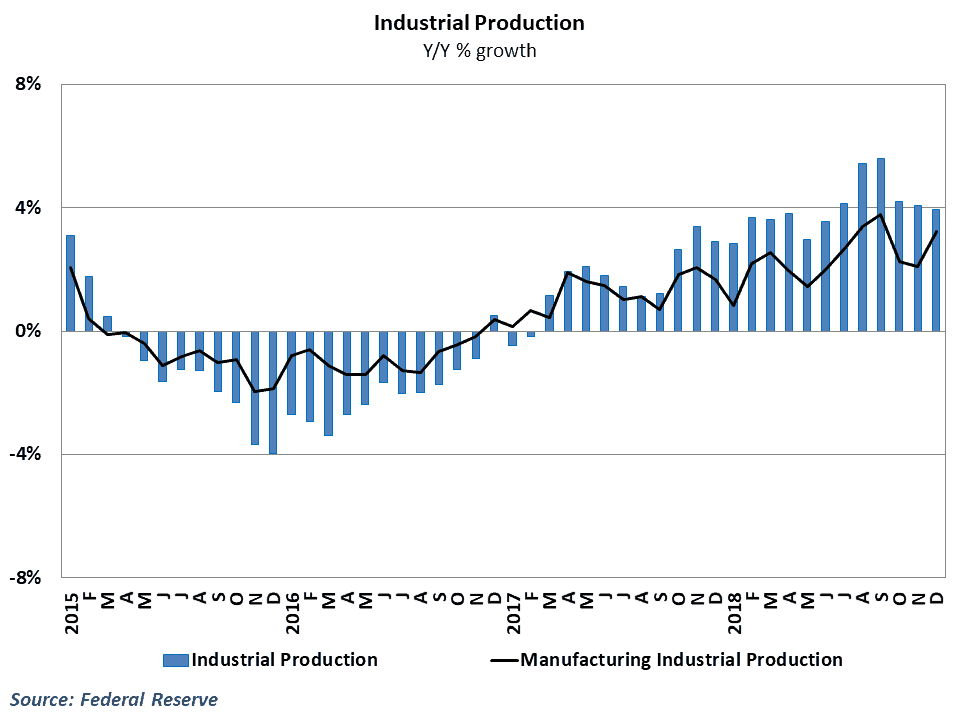

The Federal Reserve released results from the industrial sector this morning, showing that total industrial production rose by 0.3 percent in December. This exceeded consensus expectations of a 0.2 percent gain and marked the seventh consecutive monthly gain for the industrial sector. Year-over-year growth moderated slightly during the month, but remained generally strong at 4.0 percent. For all of 2018, total industrial production also rose 4.0 percent, making it the strongest year of growth for the sector since 2010.

The details of this morning’s report were even more encouraging, as the gain in industrial output came despite a weather-related 6.3 percent decline in utility production, reversing the surge seen in November. Manufacturing industrial production, which excludes mining and utilities from the total, rose 1.1 percent in December as year-over-year growth climbed to 3.2 percent.

Growth during the month was generally broad-based, led by a 4.7 percent surge in motor vehicle production. Of the 20 major industries within the manufacturing sector, only four (paper, textiles, machinery and miscellaneous) saw monthly declines. Non-durable manufacturing, which includes things like petroleum products, chemicals, and food production, rebounded nicely in December after a string of four consecutive monthly declines. Overall, December’s performance marked the largest gain in manufacturing since February of 2018, and serves as a sign of relief after a string of survey reports that suggested growth was decelerating rapidly.

Behind the Numbers:

The past month or so has been a difficult one for manufacturing data, as the Institute of Supply Management’s index, regional Federal Reserve reports, and durable goods orders all pointed towards a decelerating manufacturing sector. This, combined with manufacturing production numbers which saw growth decline to around 2.0 percent year-over-year, raised some serious concerns about one of the key drivers of freight demand for 2019.

It is worth noting that today’s data is just a single data point. The manufacturing sector is still faced with the headwinds of slowing global growth, a diminished capital investment appetite, and uncertainty over tariffs. However, this morning’s report went a long way towards reversing much of the weakness that was seen in the sector in November 2018. While November’s headline industrial production was strong, it was boosted by cold weather while manufacturing was dismal. Here, the headline number was decent, but the manufacturing details were quite strong. There were also some favorable revisions to previous data buried in this morning’s report, showing that performance in the sector was stronger than previously thought throughout the fourth quarter.

Headed forward, we still expect that the headwinds facing U.S. manufacturing will weigh down performance in the sector, and growth in 2019 is not likely to match the strength seen in 2018. Still, the industrial production results should give some pause to the talk of an imminent contraction in that part of the economy,

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.