As part of our overall coverage of freight markets, FreightWaves publishes a summary of the changes in the economy over the past month, both in terms of the data releases and in developments in public policy. The Economic Roundup is designed to synthesize the events of the past month as they relate to freight markets, and provide a guide on trends to keep an eye on in the upcoming month. The Roundup is published on the first business day of each month with the next release scheduled for Friday, June 1st.

Overview:

Economic conditions as they relate to freight generally improved during the month. With a few notable exceptions, most of the data released in April (largely covering March activity) either met or exceeded expectations and signal that freight demand will likely stay strong going forward.

The economy overall continues to benefit from healthy labor market conditions, strong business investment demand, solid global growth conditions, and general weakness in in the value of the US dollar. This has helped keep both consumer and business sentiment elevated and should translate to strength in consumer spending, capital spending, export growth, and manufacturing activity going forward. In addition, changes in the tax law implemented at the start of the year have improved household’s take-home pay and provided additional incentives for business to spend on investment.

On the flip side, many of the tailwinds that have been bolstering the economy in recent years are beginning to dissipate and may turn into headwinds towards the end of the year. Consumers have benefitted for years from sluggish inflation and historically low interest rates, which have helped sustain strong consumer spending growth and improved housing activity. But inflation has slowly crept up to the Federal Reserve’s target over the past several months, and the Federal Reserve has been gradually raising interest rates. As a result, while economic growth overall is likely to remain strong, rising rates and prices will likely limit some of the expansion

So what does this all mean for freight markets? Trucking markets have been volatile over the past couple of quarters, with poor weather, regulatory changes, and a generally improved economic backdrop bringing some of the challenges in freight into the spotlight. With weather reverting to calmer spring patterns and the ELD enforcement deadline in the rear view, some of the volatility in the market should subside. However, the industry will still be faced with the longer-term challenge of heightened demand for freight and a shortage of drivers. This should lead to continued increases in contract rates for carriers and higher transportation costs and increased delays for shippers.

Gross Domestic Product

Overall growth in the 1st quarter slipped to a 2.3% annualized pace, down from 2.9% in the previous quarter as consumer spending and housing construction slowed significantly at the start of the year. A look at the details of the GDP report suggests that the slowdown in activity during the 1st quarter was really just payback from exaggerated growth in certain areas in the 4th quarter of 2017.

Rebuilding efforts following hurricane damage helped boost spending on housing construction at the end of 2017 and fueled purchases of durable goods such as furniture and appliances. The pullback in spending in these areas during the 1st quarter likely just signals a correction to more normal spending patterns, and not any real lasting weakness.

Other areas of the economy showed more favorable growth, with business investment and inventory building making solid contributions to growth during the quarter. Net international trade also improved in the 1st quarter, although the improvement was largely driven by a reduction in import growth.

Trend to watch: The 1st quarter showed some areas of weakness in housing and consumer spending that is likely temporary. If consumer spending bounces back to join strength in other areas of the economy, there is potential for accelerating growth in the economy overall going forward.

Manufacturing

Results on the manufacturing side of the economy showed some modest gains throughout the month. Industrial production rose by a healthy amount during the month, but much of the growth was driven by utilities and mining activity. Manufacturing activity increased only slightly overall during the month, and outside of auto production, manufacturing declined in March. Durable goods orders had a similar story, where aircraft orders help boost activity in an otherwise disappointing month.

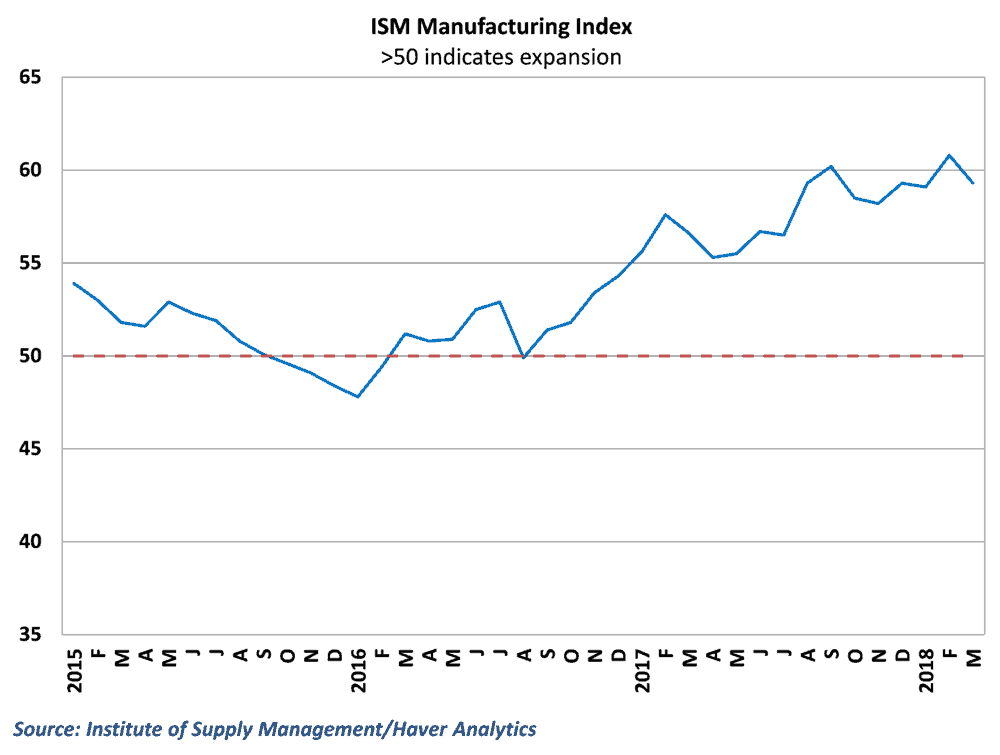

The survey data in the manufacturing sector was a bit more positive. Data from the Institute of Supply Management slipped slightly, but came down from post-recession highs. Responses from regional Federal Reserve surveys and the Fed’s Beige Book also suggest solid growth in manufacturing activity.

Trend to watch: Responses from the ISM surveys and the Beige Book have been suggesting that capacity constraints in the trucking industry are starting to affect production schedules in the manufacturing sector. Going forward, it will be interesting to see if constraints on the freight side beging to impose constraints in other industries.

Retail and inventories

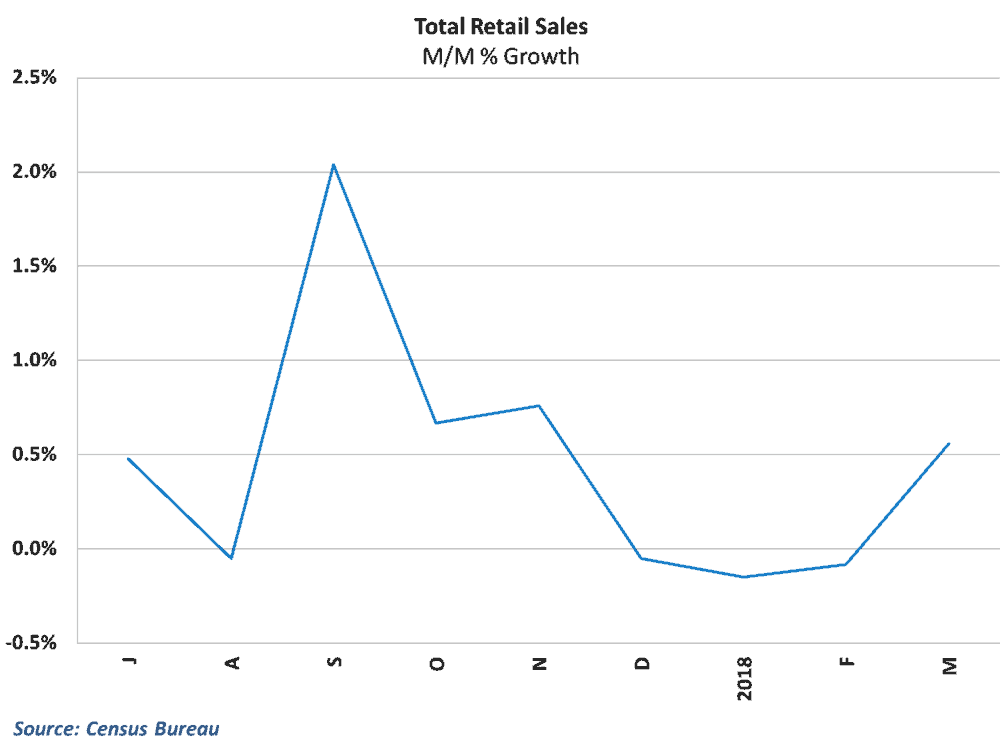

Retail performance rebounded nicely after a few consecutive weak months. Sales grew for the first time of the year, easing some concerns that the recent weakness was more than just a post-holiday season hangover. For the quarter, sales were still very disappointing, but the gain in March would suggest that worst is behind the US on the retail front.

Inventories also posted a healthy gain during the month, but inventory-sales ratios remain at relatively low levels headed into the 2nd quarter. This would suggest that inventory turnover remains high as businesses continue to rely on just-in-time inventory management. This helps businesses manage warehousing costs, but puts considerable pressure on carriers to hit shipping deadlines.

Trend to watch: Results on April’s retail performance will be released in mid-May. Strong results will be a sign that consumers are taking advantage of the tax cuts implemented at the start of the year and consumer spending will accelerate going forward.

Labor markets

Job growth fell short of expectations during the month as just over 100,000 workers were added to payrolls. This was the smallest job gain since the hurricane-affected numbers last September, breaking a string of five consecutive months with gains over 150,000. Wage growth appears to be accelerating however and will likely accelerate further as unemployment remains near historical lows.

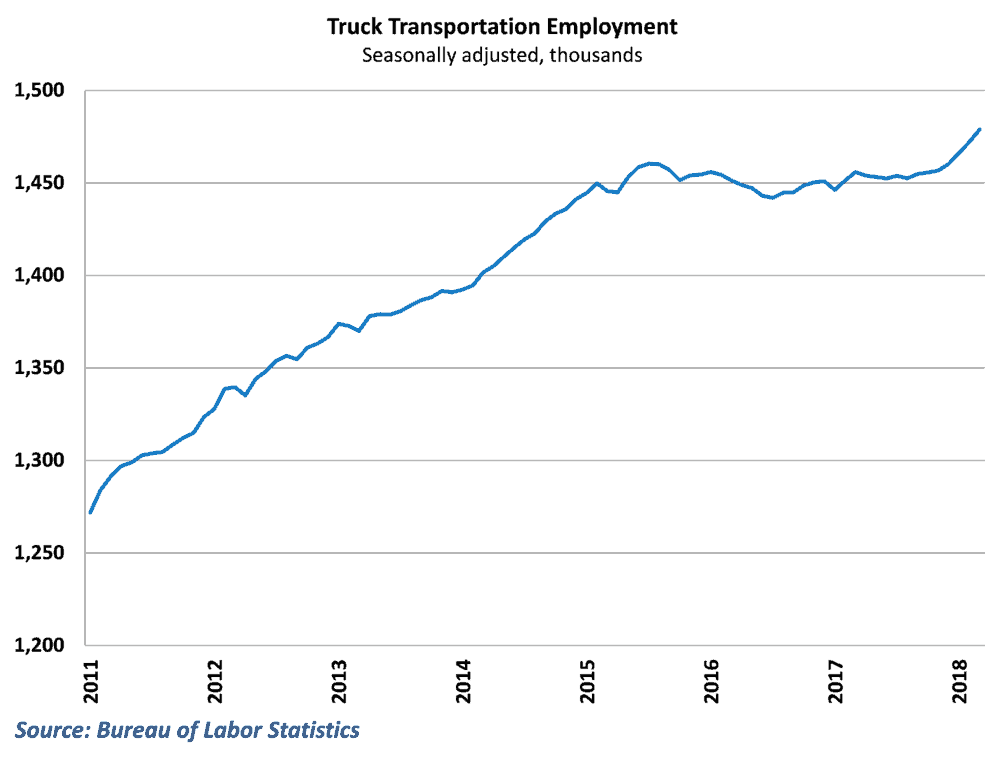

The weak month of hiring overall had little impact on the trucking industry, however. Trucking hires jumped by 6,700 in March and have improved in each of the last five months as the industry looks to alleviate the capacity crunch in freight.

Trend to watch: Job growth overall has been healthy but remains on a general decelerating trend as the labor market has gotten tighter. Going forward, the pace of hiring will likely gradually get slower, so better wage growth will be necessary to maintain healthy growth in income in the economy.

Housing and construction

Housing data was generally positive during the month, as home prices, home sales and home starts saw solid gains during the month. There was some weakness in the construction sector, however, as single-family home starts saw a substantial decline in March.

The data early in the year has been fairly volatile, as is common for the winter months where weather evens can derail construction and home-buying patterns. These weather-related disruptions likely affected March data as well, as several areas in the country experienced unseasonably severe weather well into the month. Data from coming months will likely paint a better picture of the true health of the housing sector going forward.

Trend to watch: Housing currently faces supply concerns, as the stock of existing inventory for sale has been low and the pace of new homes being built is not enough to meet the growing demand. As a result, home prices have seen significant gains over the past several months. With weather events (hopefully) in the rear-view, the key will be the pace of home building and single-family home starts over the next several months.

International Trade

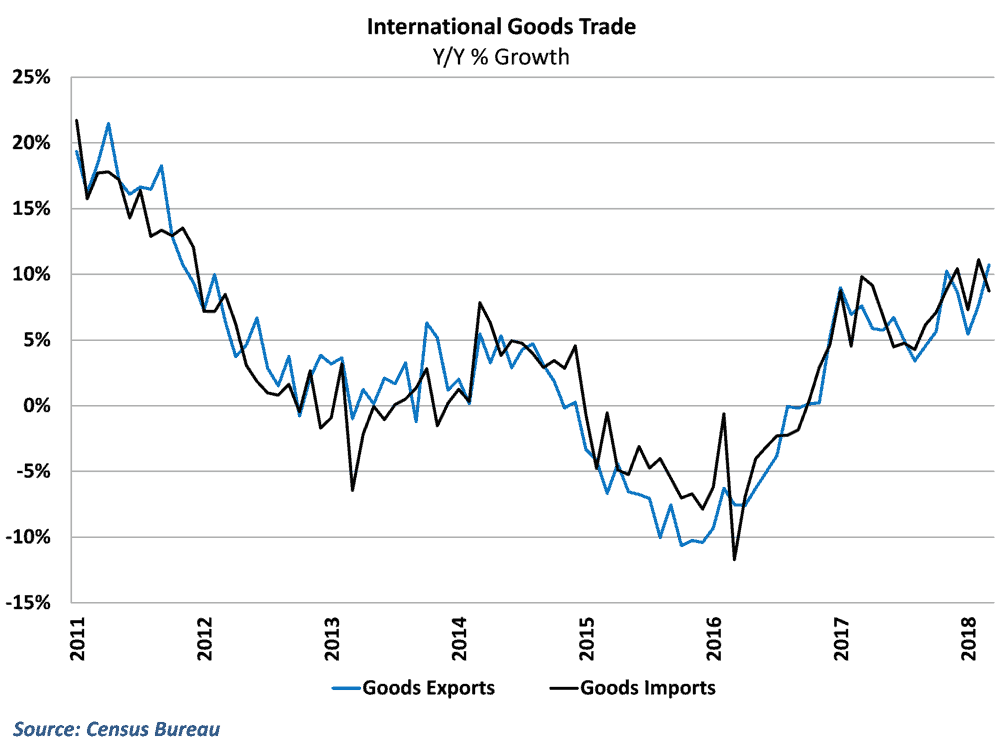

On the trade front, the goods deficit fell for the first time in seven months as export growth improved while imports fell in March. The large drop in the trade deficit helped play a role in the solid overall GDP numbers released for the 1st quarter. However, the fall in imports outweighed the gain in exports, leaving the overall value of traded goods lower in March than it was in February.

Much was made headed into the month about the effect that recent tariffs would have on trade performance. The broad-based nature of the decline in imports suggests that this was bigger than a tariff story and likely reflects some of the effects of a weak dollar and an economy that is normalizing.

Trend to watch: The total value of traded goods has now fallen in two out of the last three months. While there wasn’t much evidence of a big impact coming from tariffs, it will be interesting to see if these policy changes do begin to affect the data in upcoming months.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.