Sales of new single-family homes beat expectations in May as a surge of sales in the South helped offset softness in other areas of the country. This serves as a sign that construction activity should remain strong, though other downstream industries face challenges.

The Census Bureau reported this morning that sales of new single-family homes rose to a 689,000 unit annualized pace in May. This marks a 6.7% increase from April’s level and exceeds consensus expectations of 665,000 new homes sold. The South continues to lead the charge in housing activity, as sales jumped 17.9% in the region. This helped offset softness elsewhere in the economy, as sales in the West and Northeast suffered declines in sales during the month.

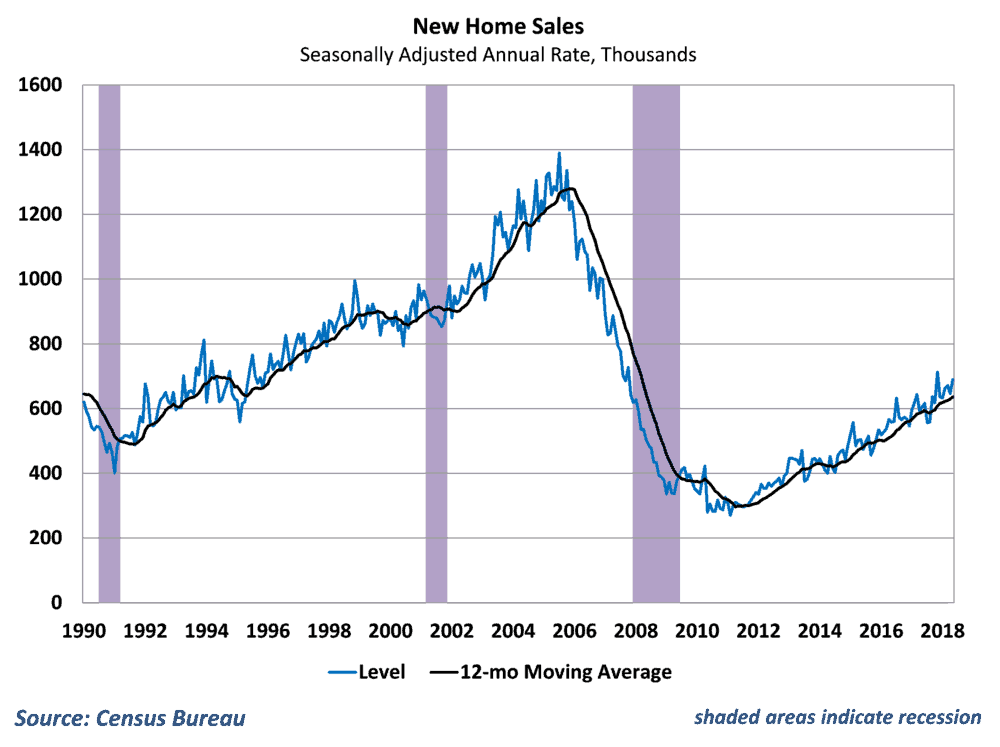

New home sales performance has been choppy in recent months, but remains on a clear upward trend in the second quarter of the year. Solid job growth and recent tax cuts have helped support housing demand over the past year, helping to offset headwinds from rising mortgage rates in the economy. (Story continued below)

Home sales and freight movements

The strength in new home sales helps boost freight demand in a number of ways. Housing inventory remains lean in the economy, so the increase in new home sales should provide a boost to new construction activity going forward. Details in this morning’s report showed that the number of homes sold but not yet started jumped to a six-month high in May. This, combined with last week’s report of rising housing starts, should mean increased movements of lumber and construction materials in upcoming months as these homes get completed.

In addition, rising home sales and homes offered for sale often boost sales for heavy consumer durable goods like furniture, air conditioning units, refrigerators, and stoves (often referred to as “white goods”). This provides a boost to freight movements to ship these items to and from warehouses and distribution centers. In addition, these white goods sales have increasingly opened up to e-commerce channels in recent years, helping to drive some of the growth in last-mile delivery services for truckers and LTL carriers.

Existing sales still struggling

Not everything in housing is moving in the right direction however. Last week’s report on existing home sales showed that previously-owned sales declined for the second consecutive month. Tight inventory, higher mortgage rates and rising prices have crippled sales performance for existing homes, which has essentially flat-lined since the middle of last year. It is worth noting that existing home sales make up approximately 90% of total sales, so weakness in this area is holding back many of the downstream industries that benefit from home purchases and drive freight movements.

As is the case with new homes, it appears as though the demand for existing homes for purchase is high. The same fundamentals of tax cuts and solid employment growth that have stimulated new home demand are also helping demand for existing homes. However, rising prices and expectations for future price increases for existing homes has restrained inventory considerably.

Behind the numbers

The housing data overall has been fairly mixed this month, with the performance of new and existing homes standing in sharp contrast to one another. Prices for new homes have actually come down some in recent months, helping to offset some of the increased costs from rising mortgage rates and keep sales growth on an upward trend. These kind of price declines have yet to be seen on pre-owned housing.

From a freight perspective, the good news is that construction activity should remain strong, which should give a boost to flatbed carriers who are already in high demand. Still, the housing market is not hitting on all cylinders yet, and there remains some room for housing to contribute more to freight markets in the economy.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.