As part of our overall coverage of freight markets, FreightWaves publishes a summary of the changes in the economy over the past month, both in terms of the data releases and in developments in public policy. The Economic Roundup is designed to synthesize the events of the past month as they relate to freight markets, and provide a guide on trends to keep an eye on in the upcoming month. The Roundup is published on the first business day of each month with the next release scheduled for Thursday, November 1st.

Overview:

Economic conditions remained generally solid throughout the month for portions of the economy that drive freight demand. As has been the case for the past several months, strength in consumer spending and business investment continue to drive overall demand for goods transportation in the economy. All is not perfect, however, as construction and housing activity continue to lag behind the rest of the economy. In addition, export growth has stumbled after robust growth in the previous several quarters weakening the fundamental demand for freight in the economy.

On the supply side, trucking capacity continues to expand gradually. The number of employees on payrolls in the economy continues to make positive strides, and the pace of hiring within trucking is exceeding the pace of hiring in the rest of the economy. The combination of moderating demand and continued additions to capacity has caused some easing in prices through August, though fluctuations from Hurricane Florence in September and rising activity due to the upcoming holiday season should keep conditions tight within the industry.

GDP

US GDP growth for the 2nd quarter remained essentially unchanged at a 4.2% annualized pace, as a rebound in consumer spending and continued strength in business investment helped drive activity. The details of the quarter showed some minor changes but the essential story for the quarter was the same, with the economy receiving a big boost from international trade and consumer spending, which helped offset a decline in inventories during the quarter.

Trend to watch: GDP results from the 3rd quarter will get released at the end of this month, and should show a significant drop off in growth from the rapid pace seen in the 2nd quarter of the year. Look for international trade to be a significant drag on economic growth in the 3rd quarter results.

Manufacturing and industrial production

Industrial output continued at a solid pace in August, rising 0.4% from July’s levels. Year-over-year growth in total industrial production is now nearly 5% higher than at this point last year, marking the fastest pack of growth since the end of 2010. Mining and drilling activity continued to be a highlight in the industrial space, and drove almost half of the monthly gain during the month. However, manufacturing production, which excludes mining production, also posted a healthy gain during the month as year-over-year growth climbed to 3.1%. Like the total, this reading for manufacturing growth is the strongest in years, and manufacturing remains a highlight in overall freight demand

Survey data has reinforced the general strength in manufacturing performance. The Institute of Supply Management’s purchasing managers index for the manufacturing sector hit a 14-year high in August before dipping down slightly in September. Readings have been elevated throughout the entire year, and forward-looking components show no indication of a significant slowdown in upcoming months.

Trend to watch: Despite the strong overall readings, there were some significant areas of weakness in the August data. The nondurable side of manufacturing actually declined during the month, and the losses were fairly broad-based. If this trend continues, it would suggest a manufacturing sector that is enjoying far less robust growth than the headline number might suggest

Retail and inventories

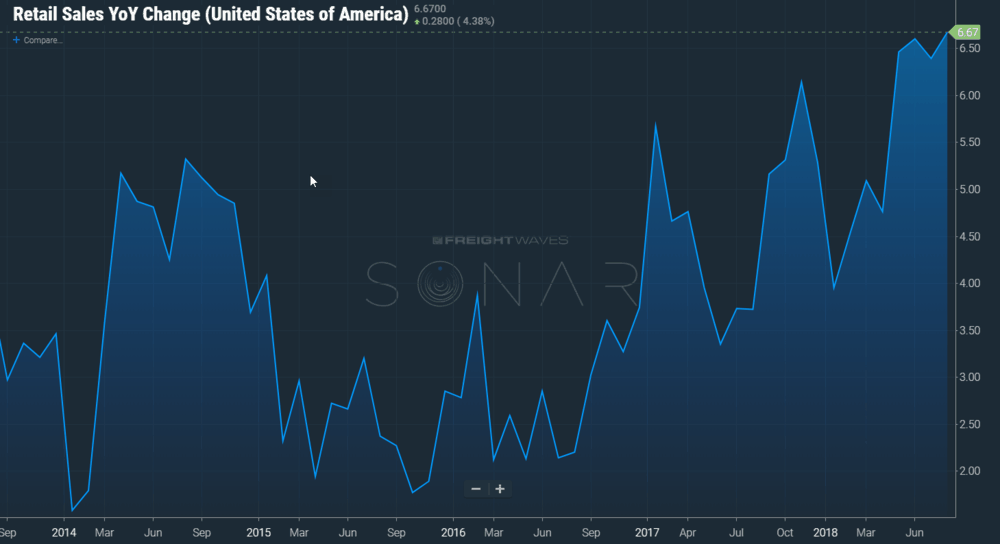

Retail sales saw some modest growth in August, rising just 0.1% from July’s levels. However, results from July were revised upward, leaving the level of sales for the month roughly in line with expectations. Retail spending has now grown in each of the last seven months in the economy, and growth over the last three months has exceeded 6% year-over-year. With job growth solid, the stock market and income rising, and elevated consumer confidence, consumer spending should be in a good space fundamentally in upcoming months

Inventories growth also posted some solid gains in August, as companies look to build up inventory levels after a surprise decline during the 2nd quarter. There has been increasing evidence that businesses in the economy are bringing in some imported goods earlier than usual in an attempt to circumvent any potential future tariffs. This likely played a role in the strength in inventory building in August, and may continue in the months going forward, as the Trump administrations trade spat with China continues to escalate.

Trend to watch: All signs point to solid holiday season growth this year in the retail sector. Tough comparisons to last year may keep growth more moderate than the current 6+% pace seen in the retail sector, but holiday spending should advance close to 5% in November and December this year. This should drive trucking freight activity in October as retailers gear up.

Labor markets

Labor market conditions were also generally solid during the month, as job growth rebounded to 212,000 in August after a downwardly-revised 147,00 job growth declined in the previous month. Unemployment continues to hover near multi-decade lows, holding steady at 3.9%, and other measures of the labor market such as initial claims and job openings point o a historically tight labor market. The lack of availability of workers has begun to put upward pressure on wages in the economy, as hourly earnings growth continues a slow creep up towards 3%.

Trucking hires continued to make strides in August, with adding 5,700 workers to payrolls. This beat out the number of hires among couriers and messengers (3,800 jobs added) and warehousing (2,400 jobs added) as well as every other mode of freight transportation in the economy. Trucking employment is now 2.1% higher than at this point last year. This is faster than the 1.6% pace of growth in the overall economy, as is the fastest pace of hiring in the industry in three years.

Trend to watch: Many businesses have announced plans for higher than normal seasonal hiring this year during the holidays. With unemployment already low and the pool of available labor relatively small and shrinking, there will be significant challenges for

Housing and construction

Housing activity showed some improvement in August, as housing starts rebounded nicely to a 1.28 million annualized pace. The beat out consensus expectations and comes on the heels of back to back declines in June and July. Home building activity still faces challenges from a shortage of available labor and a lack of developed lots for building, but materials prices have come down over the past couple of months. As a result, construction activity in the residential sector should improve some, but remain subdued going forward.

On the sales side, purchases of both new homes also beat out expectations in August, rising to a 629,000 annualized pace. Sales have been following starts fairly tightly, indicating that the demand for housing is there if hoes are made available for sales. This is also true for existing sales, which failed to grow for the 5th consecutive month in August as the inventory of available homes for sale remains very low. Existing sales are on track to decline for the year overall in 2018

Trend to watch: Housing activity is often sensitive to weather, and housing data overall may be affected by Hurricane Florence in mid-September. Home starts are reported by region, and activity in the South may see some headwinds in September results. However, much of this will likely be madeup in following months as rebuilding efforts take place

International Trade

In international trade, the goods deficit widened for the third consecutive month in August after narrowing throughout most of the 2nd quarter. Weakening exports again were the culprit in August, as the economy continues to experience the payback from shifting agriculture exports into the 2nd quarter to avoid Chinese tariffs.

This kind of effect is likely playing out now on the import side. The Trump administration announced an additional $200 billion in Chinese imports that will be subject to a 10% tariff, with tariff rates scheduled to increase to 25% at the start of 2019. US importers are likely bringing in additional imports now to avoid these tariffs.

On a positive note, the US reached a deal to replace NAFTA with both Mexico and Canada over the last several weeks. This agreement keep most of the structure of NAFTA, making minor changes to rules for auto origin and Canada’s treatment of US-made dairy products. This clears up some of the concern over strained trade relations with US’ two largest export markets.

Trend to watch: Tariff-induced volatility has caused a lot of noise the trade data lately but the fundamentals are also pointing toward a tougher export environment. The strengthening of the dollar and softening global growth conditions will likely make US exports a tough sell in upcoming quarters, even without the threat of tariffs.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.