Data on producer prices shows that wholesale inflation pressure jumped in March, driven by rising gas prices. Industry detail showed that overall trucking rates continued to decline in March, led by the largest monthly decline in long-distance truckload rates in over four years.

Core producer price inflation has retreated in recent months

Core producer price inflation has retreated in recent months

The Bureau of Labor Statistics reported that the producer price index (PPI) rose 0.6 percent in March from February’s levels. This beat consensus estimates of a 0.3 percent gain and follows a 0.1 percent gain in the previous month. Growth during the month was driven by gains in energy prices, which rose 5.6 percent as gasoline prices jumped 16.0 percent during the month. The core PPI, which excludes the often-volatile energy, food and trade services components of wholesale prices, was flat during the month as year-over-year growth slipped to a 19-month low of 2.0 percent.

Market watchers and policymakers typically use the PPI to gain some insight into what the underlying pressures of inflation are in the economy. The PPI measures the prices that businesses receive for the goods and services that they provide, and is often seen as a bellwether of upcoming increases in consumer prices. Trends in producer price inflation have softened significantly over the past several months, relieving much of the underlying inflation pressure in the economy.

Trucking rates decline, led by another drop in long-distance trucking

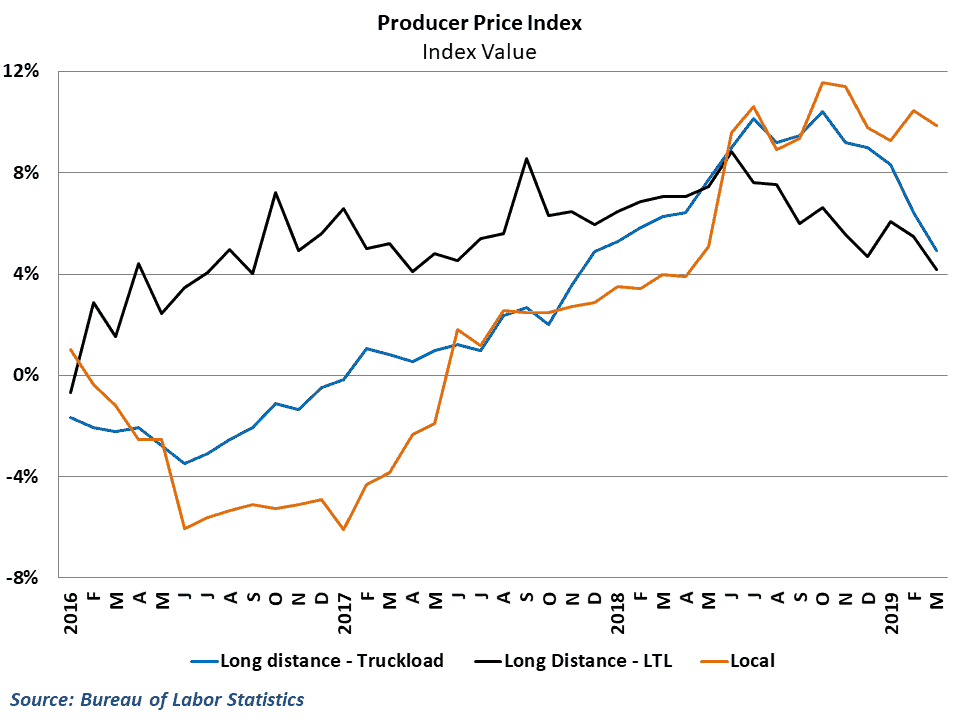

Industry detail in this morning’s release showed that rates in the trucking industry continued to decline in March. Producer prices for General Freight Trucking fell 1.1 percent in March on the heels of a 0.3 percent decline in February. Year-over-year growth in overall trucking rates has now fallen all the way to 5.7 percent, a mere five months after reaching multi-year highs late last year.

Rate growth in long-distance trucking has decelerated significantly in recent months

Rate growth in long-distance trucking has decelerated significantly in recent months

Details in the trucking industry show that the weakness in truckload rates continues to stem from the long-distance side of the industry. Full truckload long-distance rates rates fell by a whopping 1.4 percent in March, marking the largest monthly decline in over four years. Long-distance less-than-truckload (LTL) rates also stumbled during the month, falling 1.2 percent in March. Year-over-year growth for long-distance truckload and LTL rates has now dropped to 4.9 percent and 4.2 percent respectively. These rates of growth are still relatively high by historical standards, but a far cry from the double-digit pace of increases seen in the middle of 2018. Local rates held firm in March, remaining unchanged as year-over-year growth stayed strong at 9.9 percent.

Behind the Numbers

March’s headline results were not terribly surprising given the recent jump in oil and gasoline prices. Core inflation has been cooling over the past several months since hitting a multi-year high back in September 2018, and March data did little to change that trend. From a monetary policy standpoint, the Federal Reserve has been adamant that the bar for raising or lowering rates from their current level is pretty high, but the continued weak inflation data supports the idea that they may reverse course and drop interest rates if the economy continues at a subdued pace over the next couple of quarters.

On the trucking side, the recent decline in rates in the PPI data only confirms what many already know about the industry. Carriers spent the better part of 2018 adding capacity in the industry in an effort to keep up with what was at the time a strong economic expansion. This increased capacity has been met with slowing demand growth in the economy, particularly during the first quarter of 2019, which has put downward pressure on rates in the trucking industry. There are still quite a few reasons to think that freight volume activity will begin to pick up in the second and third quarters, but the amount of additional capacity in the industry suggests that this decline in rate inflation is likely to continue going forward.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.