The job openings rate in the overall economy hovered at record highs at the start of the 2nd quarter, as companies across industries continue to struggle to find workers. Results from the transportation sector show an industry facing a significant challenge, and wages will likely face additional pressure to rise in upcoming months.

The Bureau of Labor Statistics released results from the monthly Job Openings and Labor Turnover Survey (JOLTS) this morning, showing job openings in the economy rose slightly to 6.7 million in April, up from 6.6 million in the previous month. The job openings rate, which measures openings as a percentage of total employment plus openings, remained at a record high 4.3% in April, indicating that opportunities for work remain plentiful in the overall economy

As has been the case for much of the past year and a half, the pace of hiring has failed to keep up with the available openings in the economy. The hiring rate improved slightly to 3.8% in April, but remains well below the rate of openings. This is a sign of very tight labor market conditions, as employers struggle to find available workers.

Tight labor conditions are not uniform across all industries of course, with the gap between openings and hires much larger for some sectors of the economy. Health care, manufacturing, and information services have seen openings outpace hires for several months now, while retail, hospitality, and mining show a bit more slack in the labor market.

Transportation openings surge as hires fall

This phenomenon is also playing out in the transportation and logistics sector. The job openings rate in transportation, warehousing, and utilities pushed to a fresh record high at 5.0% at the start of the 2nd quarter, while the hiring rate continued to hover at 3.8%

The size of the gap between hires and openings continue to point to a sector that is struggling to staff its carriers and warehouses with employees. This rings particularly true in freight transportation, where an aging driver pool and challenges in recruiting and retaining employees have led to a squeeze on labor over the past year.

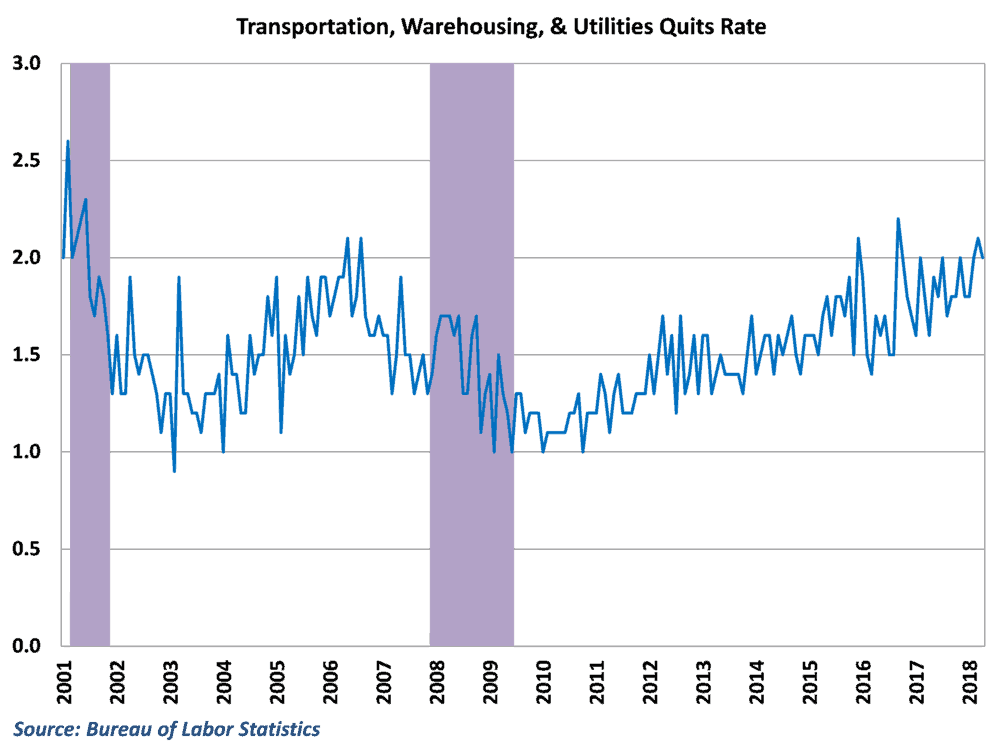

In addition, the number of workers in the industry who quit voluntarily remains elevated in the transportation sector. The quits rate, which measures the number of quits as a percentage of overall employment, remained elevated in April and continues to hover around 2% in the 2nd quarter.

All of these readings are signs that the job market for transportation and logistics workers remains very tight. Openings are plentiful, businesses can’t find drivers and warehouse workers, and the workers that are currently employed feel comfortable enough to quit their job. Historically this combination would suggest that wages need to rise to bring things back into equilibrium. Indeed, recent evidence suggests that pay is going up, but the numbers from the JOLTS survey suggest there is still more work to be done.

Behind the numbers

The JOLTS survey, like other measures of the labor market, continues to point towards historically tight conditions in the labor market. Unemployment matched a near-50 year low in the most recent jobs report, job growth has been solid but gradually tapering, and jobless claims remain close to historic lows.

This, of course, is especially true within the transportation sector. One of the themes within freight over the past year has been the inability of carriers to find drivers to meet the available demand that exists in the economy.

The puzzling thing has been how slow wages have responded to these tight labor conditions. The transportation sector has been better than most in terms of raising driver pay, but many companies across the economy have been reluctant to raise wages. Instead, companies have looked at offering bonuses or other one-time perks in an effort to attract and retain workers. These kinds of incentives don’t carry the permanence of a wage increase, but appear to not be enough to bring labor markets back into any kind of equilibrium.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.