The U.S economy added over 300,000 jobs in January, marking the best monthly performance in nearly a year. Transportation and logistics employment continued to increase at an impressive pace, led by healthy gains in warehousing, parcel and trucking jobs.

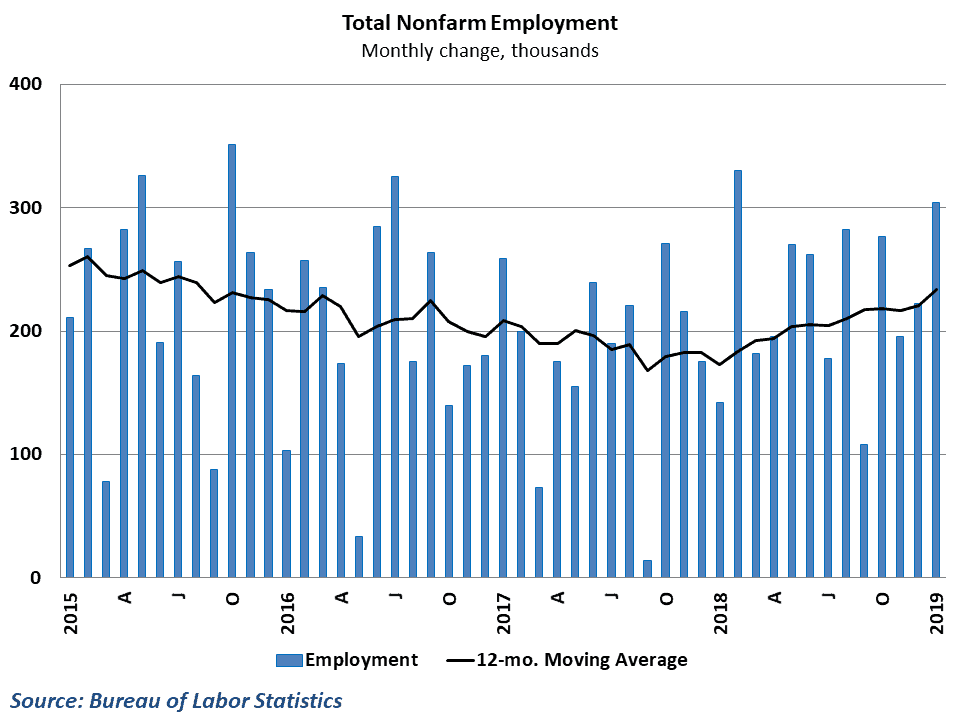

The Bureau of Labor Statistics (BLS) reported that the economy added an impressive 304,000 workers to payrolls in January, up from a downwardly revised 222,000 gain for December 2018. January’s gains far exceeded consensus estimates of 170,00 and is the strongest monthly gain since the 324,000 jobs added in February 2018. Job growth has averaged 241,000 per month over the last three months and 234,000 per month over the last year.

Despite the strong pace of hiring, the unemployment rate increased for the second straight month to 4.0 percent in January. The government shutdown was likely to blame for the uptick, however, as several government agencies asked non-essential workers to stay home during the partial shutdown. These furloughed workers would be considered unemployed if they were furloughed during the unemployment survey period. These same workers would not count against the headline payroll employment statistics, however, as they remained on government payrolls during the shutdown. Wage growth cooled in January, rising just 0.1 percent from December’s levels, but year-over-year growth in hourly earnings remained solid at 3.2 percent.

Job growth continued to be dominated by the service sector in January, which added 222,000 workers to payrolls led by big gains in health care and leisure & hospitality services. On the goods side of the economy, construction experienced a second consecutive large increase in hiring in January, adding 54,000 jobs during the month.

The January release also brought the annual benchmark revisions to the employment data. This process involves adjusting previous results to align with new data that the BLS receives from the Quarterly Census of Employment and Wages. Changes were fairly minor as a result of the benchmarking process; the total number of jobs added throughout 2018 was revised upward by a total of 36,000 jobs. However, revised data did show a stronger pace of wage growth towards the end of 2018.

Transportation hiring slips, but trucking continues to add workers

The transportation and logistics sector also experienced a healthy month of job growth to kick off the year, adding 26,600 workers in January. More than half of this gain was driven by the warehousing industry which added 15,100 jobs. Parcel companies also experienced strong job growth during the month, nearly reversing last month’s decline with 6,800 jobs added.

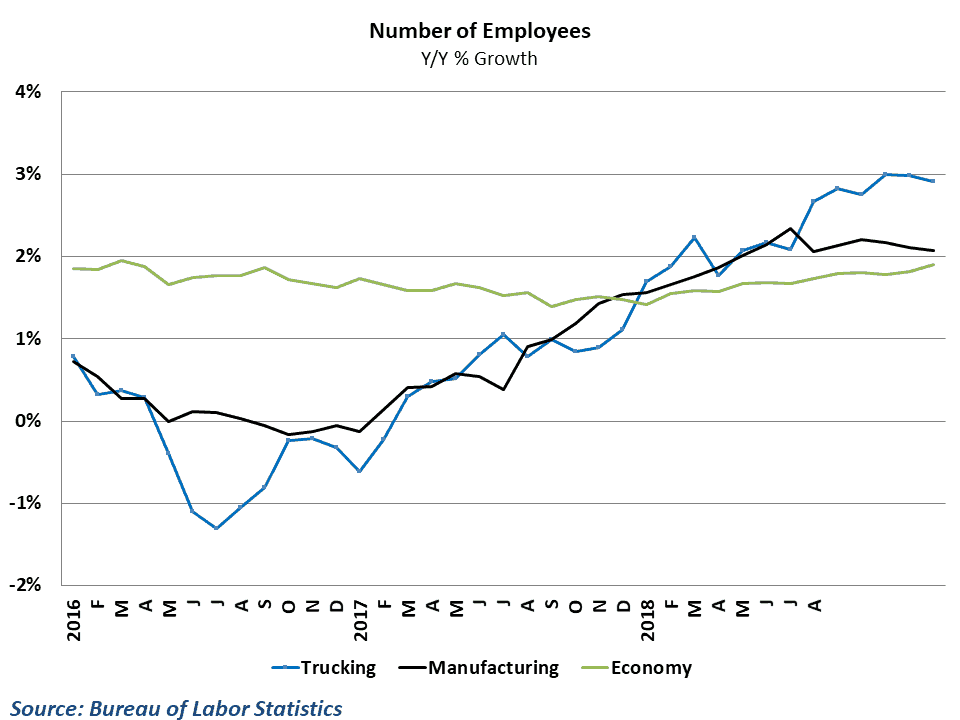

Hiring within the trucking industry also performed well by adding 3,600 workers to payrolls during the month on the heels of upwardly revised gains in both December and November. This marks the ninth consecutive month with positive job growth and puts trucking employment 2.9 percent higher than at this point last year. To put this in perspective, consider that employment in the overall economy is up 1.9 percent year-over-year, and jobs in manufacturing are up 2.1 percent. Signs continue to point towards expanding capacity within trucking, relaxing some of the constraints felt a year ago.

Behind the numbers

The January report had a great deal of potential noise going into it, but in the end was fairly straight-forward and positive. The benchmark revision and government shutdown both ended up having only a small effect on the headline numbers, and the overall picture of strong, tight labor market conditions remained intact following this morning’s data release.

On the transportation side, trucking job growth continues to impress. Employment growth has been hovering around 3 percent year-over-year for the past few months now, and the fact that job growth in the industry continues to outpace growth in manufacturing serves as a sign that capacity constraints are loosening. Given the expectation of a slowing pace of growth in the economy going forward, there is some concern that the trucking industry may find itself with more capacity than it can fill.

The FreightWaves view is that as long as growth remains generally above average in the U.S. economy (2.5 percent GDP growth expected in 2019 vs 2.1 percent “trend” growth), this is not an imminent problem. However, there are still quite a few risks to some of the key drivers of freight demand which could cause the situation to change quickly. Employment historically is a lagging indicator of performance, so demand will likely die down before the hiring trends shift significantly.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.