Halfway through the earnings season when publicly traded companies report their financial results from the fourth quarter of 2018, truckload carrier stocks are outperforming the S&P 500, some by a wide margin.

Transportation stocks in general are considered high ‘beta’—that is, in a typical year they will move up or down more than the stock market as a whole. A stock with a beta above 1.0 is more volatile than the market and adds risk to a given portfolio; a stock with a beta of 1.0 essentially matches the market. A stock with a beta between 1.0 and 0 has lower volatility than the market (think utility stocks), while the rare stock with a negative beta is inversely correlated to the market (think gold miners, because demand for gold as a risk-off safe haven tends to go up when stock markets aren’t doing well).

Trucking stocks have a high beta. The chart below compares the relative performance of the S&P 500 to truckload carriers who have reported their Q4 earnings during the past month, including Heartland Express (NASDAQ: HTLD), Knight-Swift (NYSE: KNX), J.B. Hunt (NASDAQ: JBHT), Covenant Transport (NASDAQ: CVTI), and Marten Transport (NASDAQ: MRTN):

On Sunday, in a trucking earnings season ‘halftime report,’ Stifel’s (NYSE: SF) David Ross addressed the solid performance of both trucking companies and their stock prices.

“It appears some buyers are coming back to the group, and it’s definitely more than short covering,” Ross wrote. “Valuations remain reasonable and may increase some this year, if the economy proves it can hang in there and carriers remain disciplined on pricing and capacity.”

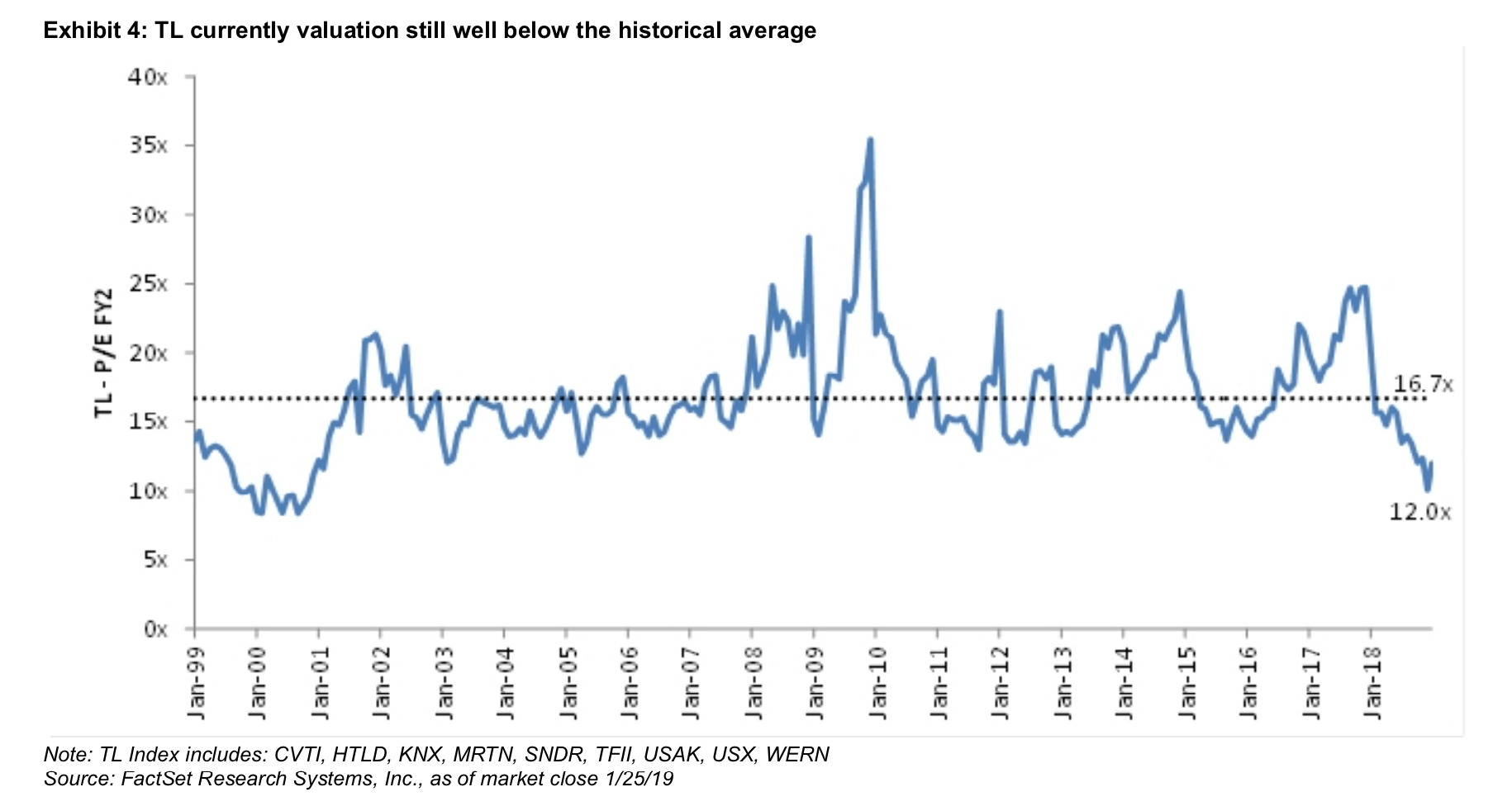

Ross pointed out that despite the sector’s recent gains, truckload valuations on a price-to-earnings (P/E) multiple basis, which is the share price divided by earnings per share, are still well below the historical average of 16.7x—now the sector costs roughly 12x earnings.

P/E multiples are affected by two things: the numerator (price) and the denominator (earnings). Price is largely determined by investor sentiment—if investors think a company or sector will earn more in the future they’re willing to pay more for it, but if investors have bearish expectations they will pay less. Earnings are determined by the performance of the company, and sometimes drastic swings in earnings can create counter-intuitive P/E multiples.

For example, during the 2008 – 2009 financial crisis and economic recession, freight demand slowed considerably, and truckload carrier earnings plunged. At first blush one would think that investor demand for high-beta trucking stocks would dry up, depressing P/E multiples, but P/E multiples actually soared to nearly 35x because earnings fell so swiftly. Likewise, a year of strong earnings in 2018 also pushed the price-to-earnings ratio down to its lowest point in nearly twenty years.

Some transportation equities analysts do not believe that truckload stocks have reached peak revenue or earnings—the best is yet to come, analysts from two investment banks wrote in recent notes.

“We have been adamant that 2018 was not the ‘peak’ – for earnings or margins – although it may have been for valuation multiples (which are just a gauge of sentiment) and a favorable pricing environment for carriers should continue to support EPS growth this year,” Stifel’s Ross wrote on January 27.

“Despite some of the data points we will mention below,” wrote Seaport Global’s Kevin Sterling in a January 24 note, “the carriers we spoke with are seeing continued shipment and tonnage growth without the presence of any tariff pull-forward fueled freight ‘vacuum’ to begin the year. While all networks have unique features and comps may vary it appears business is good and the execs we spoke with are happy with margins.”

Morgan Stanley’s (NYSE: MS) Ravi Shanker remained somewhat bearish on asset-based carrier stocks in a January 23 research note titled “Truck Stop/TLFI: It’s Still Cold Out There.” Morgan Stanley’s demand index was lower than typical seasonality, and its supply index was higher than typical seasonality.

“January tends to be one of the weaker trucking months so we will monitor for signs of pick up in the spring months, but remain concerned that 2019 could trend similarly to 2015 as we’ve mentioned in our downgrade note and 4Q18/2019 preview,” Shanker wrote.