Last New Year’s, FreightWaves wrote an article about Renren’s (NYSE: RENN) acquisition of Trucker Path where we asked if the transaction was an acquihire. An acquihire is defined as an acquisition where a tech-startup is purchased below the amount of money where it was previously valued, usually to acquire talent or technology.

At the time, we had limited information on the Renren/Trucker Path transaction, but it was clear from the way the transaction was announced that something was amiss. After all, what high-powered tech startup would announce a deal after the close of business on a major holiday weekend, unless they wanted to bury the news? This only reinforced rumors and discussions around the industry that Trucker Path was low on cash and trying to find a buyer.

Fast forward months later, the details of the Trucker Path transaction are now public record. Renren is a publicly-traded company and required to file an annual report with the SEC. In the 2017 annual report, Renren outlines the Trucker Path transaction details. The company paid $7.6 million at the time of the acquisition. Add the firm’s existing equity of 29% (for which they paid $11.5M) and the fair value was $10.3M.

For a company with little revenue (according to sources familiar with the firm), Renren appeared to pay a premium. But this is not the case. In June 2015, Trucker Path was valued over $180M when it raised $20M from Wicklow Capital and StartX, according to Pitchbook.

Basically, investors that participated in the Series A got less than their money back and had a nasty write off. Management and employees usually get paid after all of the company’s investors are paid and debt obligations are met. It is unlikely that any benefitted from the transaction.

The alternative could have been much worse for both Trucker Path stakeholders and other FreightTech startups. If the company had not been purchased, it could have been seen as a black eye by future would-be investors in the space.

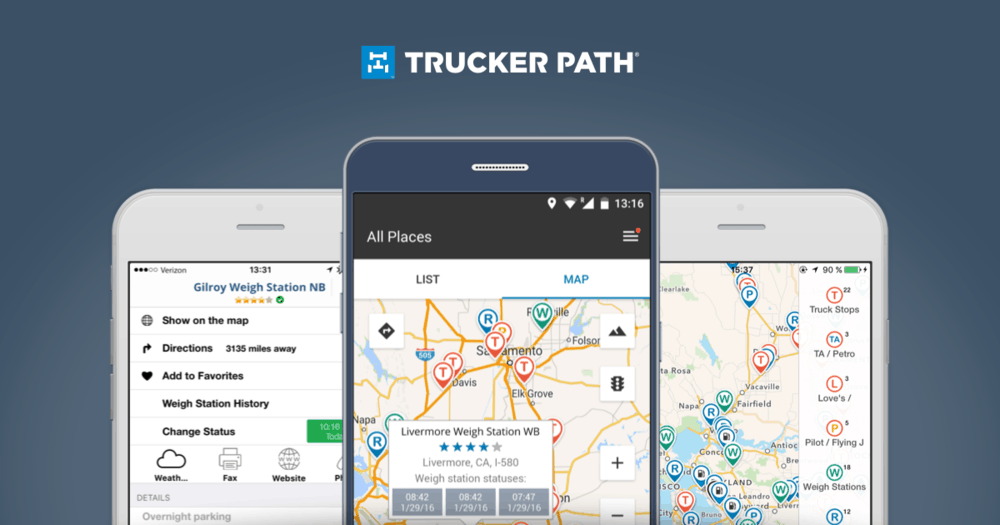

By most Silicon Valley standards, Trucker Path was a success. After all, the firm had accomplished the unthinkable: getting 700,000 truck drivers to download the app and use it on a regular basis. A community that large is comparable to the audience that Truckstop and DAT see on a monthly basis.

But something was wrong with the business model. The company didn’t figure out how to monetize the community in a way that created a sustainable business model and generate cash flows. Before selling off, the firm launched a free load board called “Truckloads”, that listed freight primarily from Post Everywhere (now apart of Truckstop.com). To monetize the users, the company added factoring services.

The problem with factoring services is the intense competition from other factoring companies and the customer acquisition cost is quite high (mostly because of the process for converting from one factor to another and the UCC filings that are required). If you are a startup that is trying to show high revenue growth, factoring is a difficult way to get there.

If Trucker Path didn’t get bought by Renren and the firm had shut-down, it would have been a high profile failure in the VC community. Trucker Path was one of the first firms to raise a Series A with a $100M+ valuation in the trucking space. Before that, few investors had considered the space to be attractive. Convoy, Transfix, Project44, FourKites, and KeepTruckin’ all had smaller valuations back in 2015 than Trucker Path. All of these companies have raised venture capital in 2018 at valuations that exceed Trucker Path’s peak valuation.

The fact that a firm with the deepest set of users in the space was not able to monetize it would have likely caused some questions from future investors that considered the space. Luckily, Renren was able to assume the company and bury the company’s VC blow-out along with it.