A weekly look at what occurred in the oil markets of the U.S. and the world this past week and what’s ahead.

There have been a slew of articles wondering whether the lack of any signs in the market regarding price movements tied to IMO 2020 mean the transition to the new rules won’t be a big deal and won’t impact diesel prices.

Not so fast. It’s true that there are few price signals in the market – certainly not the outright price, but also other market spreads – signaling any impending spike in diesel prices. But that doesn’t mean that nothing is happening that could have an impact.

One of the more intriguing developments is the fact that crudes with high sulfur content, and the high sulfur fuel oil (HSFO) that IMO 2020 is supposed to displace, aren’t collapsing in price as the new rule gets closer. (It goes into effect January 1, but the cleaning out of HSFO from ship fuel tanks to be replaced with compliant 0.5 percent sulfur fuel is expected to commence as early as September.)

There are several reasons for that, and they aren’t necessarily related to IMO 2020. In particular, the crude market has seen several sources of high sulfur crude oil retreat. Venezuelan crude oil output is dropping as a result of both the country’s collapse and sanctions placed against it by the U.S. Canadian crude oil production had been restricted by a policy decision implemented by the Alberta government; and the OPEC cuts were heavily weighted toward reductions in crude oil produced by sulfur-heavy grades from places like Saudi Arabia.

The result was that high-sulfur crudes narrowed their normal differential to the global dated Brent crude oil benchmark.

For example, Platts recently noted on its Insight blog that about a year ago, the Canadian Energy Research Institute projected that the differential for Western Canadian Select, the key Canadian crude, could widen out to as much as a $33/barrel discount to WTI between 2020 and 2025. And maybe it will; it isn’t 2020 yet. But the report noted that the historical spread is closer to $13 per barrel and it’s recently been as tight as $4 per barrel.

It’s so high compared to what conventional wisdom might have suggested that there’s a quote in the blog from a trading executive: “Nobody is talking about IMO 2020 anymore.”

Which brings us to the fuel that is supposed to get hit the hardest – the HSFO that is to be cast aside as IMO 2020 arrives. In a recent report, Petroleum Argus notes that far from declining in value, it’s been surprisingly strong.

“Several ports across Asia are coping with limited availability of high-sulfur fuel oil (HSFO) for bunkers, with price spreads relative to Singapore rising to record highs,” the report said. The market is at all-time high numbers, as expressed in differentials to various other benchmarks.

Why is this important? If HSFO is going away, how will its high price – for now – impact the transition to IMO 2020?

Because it isn’t completely going away. It will continue to be used to power ships through two methods. One is non-compliance with the rules. But most forecasts that saw non-compliance running as high as 20 percent of the roughly 3.5 million barrels per day (b/d) marine fuel oil market have now pulled back on that. Some key ports are making it clear that they aren’t going to welcome non-compliant ships, and insurers are telling shipowners that their insurance is at risk if they don’t comply with IMO 2020. On top of all of that, if the price of HSFO isn’t that cheap relative to the alternatives, the financial advantages of thumbing a ship’s nose (or more accurately, its bow) at the rules becomes less lucrative.

Even more than that, the price of HSFO is important because its differential to alternative compliant fuels such as marine gasoil or very low sulfur fuel oil (VLSFO) is the starting point for the process whereby a ship owner determines whether it is economical to install scrubbers on a ship. A scrubber enables the ship’s emissions to be compliant with the IMO 2020 rules even if it still uses high sulfur fuel. The economics of the capital paid for a scrubber – and the added weight to a ship and therefore its fuel burn – are enormously dependent on what the spread is between the price of HSFO and the lower-sulfur alternatives. Are the savings of buying HSFO enough to justify the cost of the scrubber?

With HSFO running at record highs in Singapore, which is the most important market for HSFO, the numbers for now at least would be discouraging to the economics of installing a scrubber. Every scrubber installed equals a ship that won’t need to burn marine gasoil, which is a diesel product, or VLSFO, the new fuel being made by refiners to comply with IMO 2020 but which needs a great big helping of a diesel intermediate product called vacuum gasoil to be produced.

Ultimately, the spread between HSFO and VLSFO is important to truckers. The spread has picked up the moniker “the high five” in the industry, because it’s a spread between high sulfur fuel oil and 0.5 percent compliant fuel. It’s an important number going forward. And right now, the “high five” isn’t working to truckers’ favor.

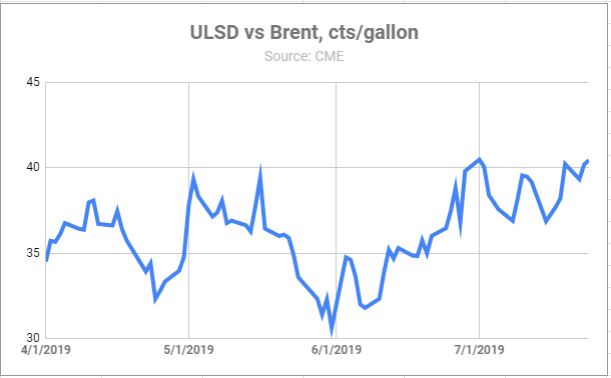

The most visible sign of whether diesel is starting to move higher would not necessarily be a leading indicator – the CME Brent financial contract and the ultra low sulfur diesel (ULSD) contract. A simple “crack” between the two can be constructed by taking the ULSD price (which is in gallons), multiplying it by 42 to produce a per barrel equivalent, and subtracting the price of Brent from that. A chart of that spread shows that ULSD has trended slightly higher since April 1, but certainly not enough for anyone to declare: “Ah-ha! That’s IMO 2020 at work!”

The other problem with looking to the Brent-ULSD spread on CME is that futures markets take their cues from the physical markets most of the time. IMO 2020 will be like that. Any movement in diesel prices resulting from IMO 2020 is first going to be seen in the daily assessments produced by price reporting agencies such as Platts or Petroleum Argus. What’s the spread between the benchmark CME price and physical diesel in the Gulf Coast? (It’s been little changed for weeks, according to reports.) What’s the price of marine gasoil doing relative to the rest of the barrel? Is the price of VLSFO soaring compared to HSFO?

These are the price relationships that will come first, with the CME ULSD contract likely to follow after that. But that does not mean the CME spread should be ignored. It will be one more sign on the road to wherever we’re going, which nobody seems totally sure about yet.