Surge in low-sulfur fuel use by ships could usher in two to three year period of uncertainty in refining industry.

The world’s shipping fleet is running out of ways to avoid the use of cleaner burning, but more expensive, marine fuel as the industry’s global regulator confirms a ban on carrying high-sulfur fuel oil.

The International Maritime Organization (IMO), the United Nations agency in charge of maritime rule setting, wrapped a nearly weeklong meeting this friday. Among the most closely watched agenda items, the IMO confirmed that ships will not be able to carry fuel with a sulfur content above 0.5% unless they are equipped with an exhaust gas scrubber as of March 1, 2020.

The so-called “carriage ban” aims to limit any cheating by shipowners who hope to use less expensive high-sulfur fuel oil past the deadline requiring ships limit sulfur emissions.

The March date, which is two months after the official start of rule for burning low-sulfur fuel, is intended “to support consistent implementation and compliance and provide a means for effective enforcement by states,” the IMO said.

But the three of the world’s largest ship registries – Panama, Liberia, and the Marshall Islands – and major trade groups had sought a longer extension through an “experience building phase,” which aimed to allow shipowners an extended period of testing and data collection on marine fuel meeting the 2020 specification. The proposal also garnered support of the U.S.

The request for an experience building phase was effectively “a plea for lax enforcement initially,” said S&P Global head oil analyst Rick Joswick.

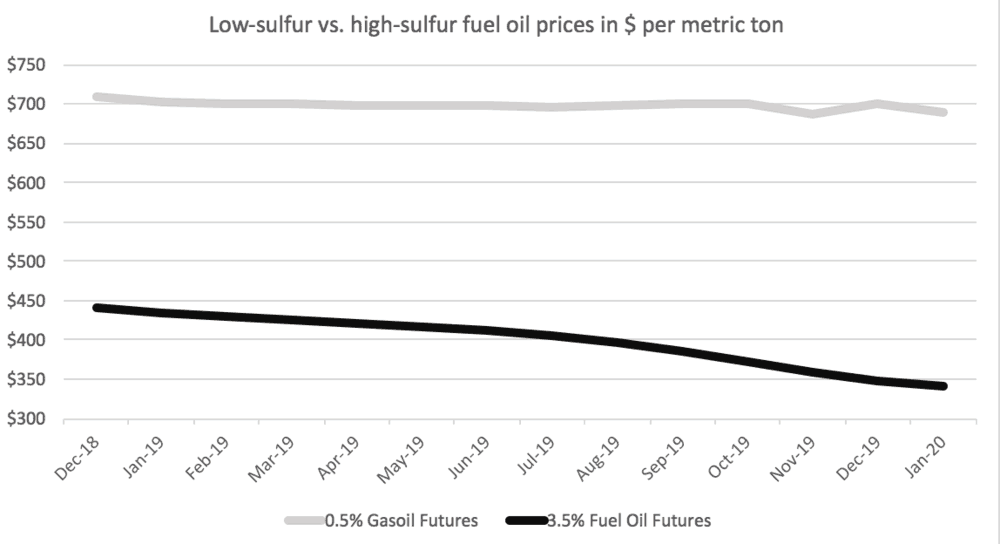

Backers of the extension cited a Goldman Sachs report that the 2020 shift to low-sulfur fuel would be a “game-changer” for the refining industry.

The report says world refineries would need to create 1.3 million barrels per day more of diesel fuel than currently produced.

The higher production would have to come from a 1% increase in total refinery utilization and 1% switch of production away from gasoline and fuel oil to diesel. Additionally, refineries would need to create close to 1 million barrels per day more of low-sulphur fuel through adding more de-sulfurization capacity and expanded refining of low-sulfur crude oil.

But all those moves will take time to implement, resulting in the potential for more volatility in global fuel markets for several years after 2020. The report says

the effects of the transition to the 0.50% global fuel oil sulfhur limit are expected to normalize by 2022-2023.”

But the world’s largest refiner are beginning to roll out plans for distributing low-sulfur marine fuel. ExxonMobil (NYSE: XOM) said it will supply a fuel to meet the IMO 2020 standard at major ports in Singapore, Antwerp, Rotterdam, and Marseilles. Energy major Shell said its version of low-sulfur fuel oil will be available at 12 major ports globally.