Port of Yantian, China (Photo: K + N)

World’s largest ocean freight forwarder outlines hurdles to automation in logistics even as it prepares to invest more in technology.

“Disrupt” is one of the most popular verbs in business right now, especially in the logistics industry. A host of start-ups and young companies promise to disrupt air, ocean and surface transportation markets by leveraging technology.

Large, established players are taking note of the changed transportation landscape, but also temper expectations that a diverse and unwieldy supply chain can instantly become a seamless, technological process.

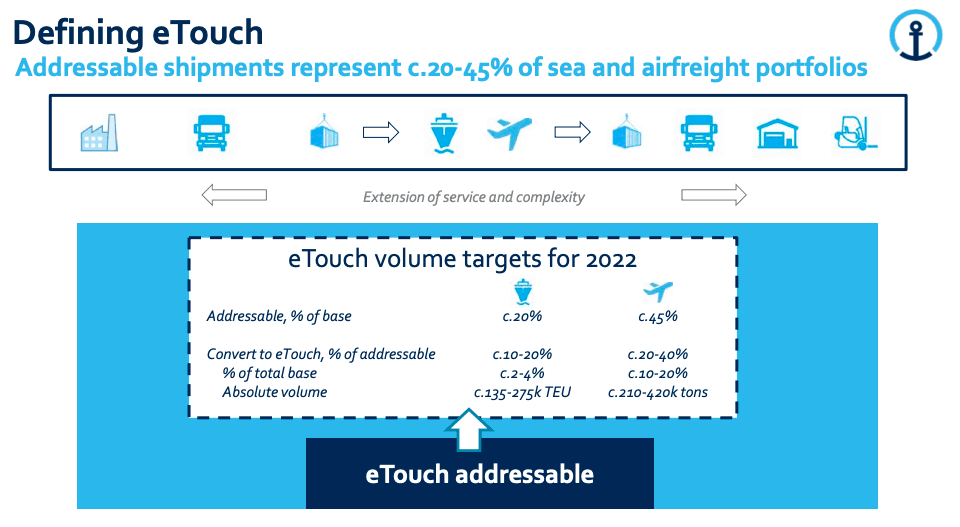

One example, Kuehne + Nagel (SWX: KNIN) rolled out its eTouch initiative in 2017. ETouch aims to bring automation and increased efficiency to commodity, high volume shippers. By moving shippers to online platforms, K + N could also reduce operating expenses for those shipments by over half compared to the highly manual process now involved in freight forwarding.

Now 18 months into the project, K + N said its still on track to migrate some, but not all, customer shipments to eTouch by 2022. In its last earnings conference call, the largest ocean freight forwarder by volume said only about 10 to 20 percent of its containers can be converted to eTouch. In air freight, about 20 to 40 percent of its volume may switch to eTouch.

Chief Financial Office Markus Blanka-Graff noted that the different dynamics facing ocean and air freight when switching to online platforms. Air freight runs on much tighter and accurate schedules than ocean freight, lending itself to more automation process. “That obviously helps and supports a larger number of shipments being fully automated,” Blanka-Graff said.

Moreover, the shorter timespan of air freight versus ocean freight means much less chance that human intervention will be needed in the process. “More unplanned things can happen within seven weeks than 72 hours,” he said.

Blanka-Graff said there is a lot of room to automate the handling of files and paperwork involved in a shipment, even something as simple as helping route a truck driver to the appropriate gate will someday be automated. But human intervention will still be needed to monitor when things go wrong, hence why even eTouch shipments will never be pure profit through eliminating humans.

To move more freight to online platforms, Blanka-Graff said more industry-wide cooperation will be needed on standards so communications between carriers, forwarders and shippers will be more fluid. “We also need other players on the execution side to get that accuracy and quality of service to the point that it is readable and workable for a machine.” Even with the many technological advances occurring in freight management, Blanka-Graff said “a lot of our cargo need some special handling. That’s going to difficult to automate entirely in a five to 10 year timeline.”

Just don’t call K + N’s switch to eTouch a disruption, though, because “disruption is a word we never use because disruption means you are not prepared,” said Chief Executive Officer Dr. Detlef Trefzger.

Port of Seattle funds new developments

First phase of development of Terminal 91 includes new warehousing space. (Queen Ann & Magnolia News)

Oil and gas majors create a blockchain consortium

ExxonMobil, Chevron and ConocoPhillips among the founding members. (MarineLink)

Russian gas producer looks at nuclear icebreakers

Developer of Arctic LNG project aims to use icebreakers year round. (gCaptain)

Port of Virginia gets okay for handling reefer boxes

U.S.D.A. signs off Port’s refrigeration system, allowing for fresh food imports. (Maritime Executive)

Norway ponders a carbon tax on shipping

Norway already has strict laws governing emissions from ocean shipping. Ships transiting portions of the North Sea near Norway are required to burn fuel that has 0.1 percent sulfur, much lower than the world standard of 3.5 percent and the upcoming International Maritime Organization standard of 0.5 percent. But the country may look to do even more to limit emissions, particularly for carbon dioxide. FreighWaves Nick Saavides reports the country is looking at a carbon tax on shipping. It currently levies a similar tax on nitrogen oxide emissions, which are also linked to pollution. The carbon tax, if successful, could be a potential model to push ocean shipping to the IMO’s other required target that the industry cut its carbon dioxide output by half by 2050.