Never-ending peak season may finally be peaking as shippers rush in goods; shipowners tallying up the cost of scrubbers.

The busiest two U.S. seaports saw little let-up in the volumes of goods heading into the U.S. ahead of China’s celebration of the Lunar New Year.

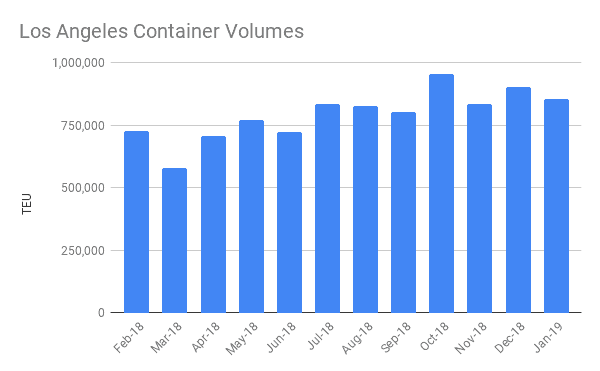

The Ports of Los Angeles reported a 5 percent yearly gain in container volume coming into the port during its “busiest January in the port’s 112-year history. Executive director Gene Seroka says the usual suspects are behind the volumes.

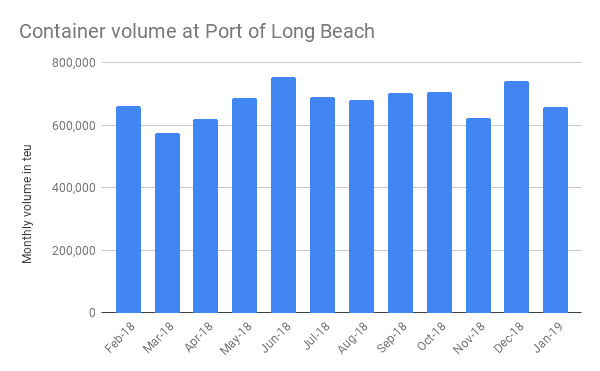

Next door, the Port of Long Beach saw a 0.1 percent drop in its January container volumes. Still, “It’s encouraging to see these healthy volumes to start the year,” said Port of Long Beach Executive Director Mario Cordero, who added that he expects modest growth in 2019.

The holiday marks the start of the traditional slowdown in ocean freight markets, and could finally provide some relief to the widespread reports of congestion in the region. According to SONAR, Detention Minutes for trucks in the Los Angeles market is average 128 minutes (SONAR: WAIT.LAX), a slight improvement over the 135 minutes seen in December. Seroka says the region’s warehousing inventory is getting tighter, leading to slowdown in the volumes the port has been seeing.

“With warehouses and distribution centers already full with spring goods and supplies, we will see softer volumes immediately after the Lunar New Year as anticipated,” Seroka said.

Futures exchange sees IMO 2020 prices rippling other commodities

Iron ore and coal prices could be affected due to shipping costs. (S&P Global Platts)

Marine fuel terminal de-stocking ahead of IMO 2020

Vopak sees less need to carry high-sulfur fuel oil ahead of switch. (Bunkerworld)

Port of Oakland targets 2019 growth

Port director looks to bigger DCs and cold logistics to attract containers. (Port Technology)

Brazil’s biggest port may privatize

Governor of Sao Paulo state says current operations are inefficient. (Port News)

Calculating costs of IMO 2020

The start of trading in two new financial contracts is helping the shipping industry get a better handle on where fuel prices will wind up. In December, CME Group launched its first futures contracts tied to the price of marine fuel that meets the upcoming 0.5 percent sulfur limit standard required for ocean carriers by 2020. That is followed by this month’s launch of a similar contract by Intercontinental Exchange.

Liquidity in the contracts remains low due to their newness, but they are developing small price curves, allowing transportation companies to better understand where prices are headed. The U.S. Gulf contract shows 0.5 percent fuel at $85.52 per barrel for April delivery.

That price would represent a $25 per barrel premium over the similar high-sulfur shipping fuel shipping fuel contract, based on CME prices. In shipping equivalent, the spread is approximately $178 per metric ton.

A similar spread for low- and high-sulfur fuel at Europe’s major port of Rotterdam shows a wider spread of $256 per metric ton. The higher spread partly reflects the higher demand at Rotterdam, but also that Europe’s refineries are less well equipped to process high-sulfur crude than their U.S. counterparts.

The other major shipping port, Singapore, has ample refinery capacity along with supplies from the Middle East. There, prices are showing a $175 per metric ton spread, according to FreightWaves John Kingston.

The price spreads are a major topic of interest as shipowners wrestle with installing devices to scrub sulfur from the lower cost high-sulfur shipping fuel. That spread determines how soon a payback shipping companies can get from installing scrubbers.

Scorpio Tankers (NYSE: STNG), one of the largest gasoline tanker owners, says its spending about $2 million to fit 75 of its ships with scrubbers. It says the annual fuel savings can be between $900,000 and $1.2 million.

Star Bulk Carriers (Nasdaq: SBLK) is spending $140 million installing scrubbers on nearly all its 100-plus fleet.

Its Chief Executive Office Petros Pappas says spread of $250 to $300 mean the investment is paid back in a year. Likewise, the ocean carrier is able to save on fuel costs even when rates remain weak.

“We may be able to repay the scrubbers within a year or so,” Pappas said. “The guys without, they will be paying higher bunker costs.” Pappas said.

But it’s also coming down to the issue of who will pay those costs, for scrubbers or low-sulfur fuel oil. Pappas said shippers and charterers could also be on the legally if a vessel does not have the proper fuel. That’s leading to some creative financing for the use of scrubbers, with shippers willing to pay for the devices in return for lower rates or some piece of the fuel savings. But the company said it would rather reap the benefit from the spread.

“There’s been a number of charterers that have approached us about financing scrubbers,” said President Hamish Norton. “But we’ll source cargoes ourselves and attempt to keep most of the benefit.”