Last week our market analyst Zach Strickland wrote a piece called “Los Angeles freight market gets a wake up call off inflow from China” that correlated spiking outbound turndowns from the LA market with the surge in port activity in Los Angeles and Long Beach that occurs every May. Now we’re seeing data in SONAR suggesting that freight is working its way through the nation’s transportation network, and right on schedule, Dallas is heating up.

The ‘container freight working its way through the network’ thesis is supported by SONAR’s Trucks in Market heat map. Capacity has left southern California and is moving through a southern corridor across Texas and into the Southeast: San Diego is at 90% of its average trucks in market, while Ontario and Los Angeles have dropped to 91% and 92%, respectively. Meanwhile, Dallas is being crowded by 106% of its average trucks in market, Laredo is experiencing 110%, Houston is at 107%, Shreveport is bustling with 109% of its average trucks in market, and Texarkana is absolutely overflowing with 111% of its average trucks in market.

The chart below demonstrates just how well Dallas is performing compared to the rest of the country: over the past three months, Dallas’s outbound tender rejection index (SONAR code: otri.dal, orange line) has grown 54%, while the national average (otri.usa, blue line) has contracted by 6% in the same time period, a 60% spread.

Container freight inbound from China doesn’t just ship directly to a retail outlet like Walmart or Best Buy—it goes through a series of warehouses and distribution centers that de-consolidate the freight, figure out where its final destination should be, package it with final touches, and build truckloads out of it. These facilities aren’t necessarily right in downtown Los Angeles, either—the Ontario market east of L.A. has cheaper real estate and a huge amount of warehouse capacity.

Many of these distribution centers are also located in Texas, where land is plentiful and relatively inexpensive, at least compared to LA and New York City. Dallas’ central location as an entry point for outbound LA freight, warehousing and distribution capacity, and high-traffic lanes to Chicago and Atlanta make the city an extremely important freight hub for the entire United States.

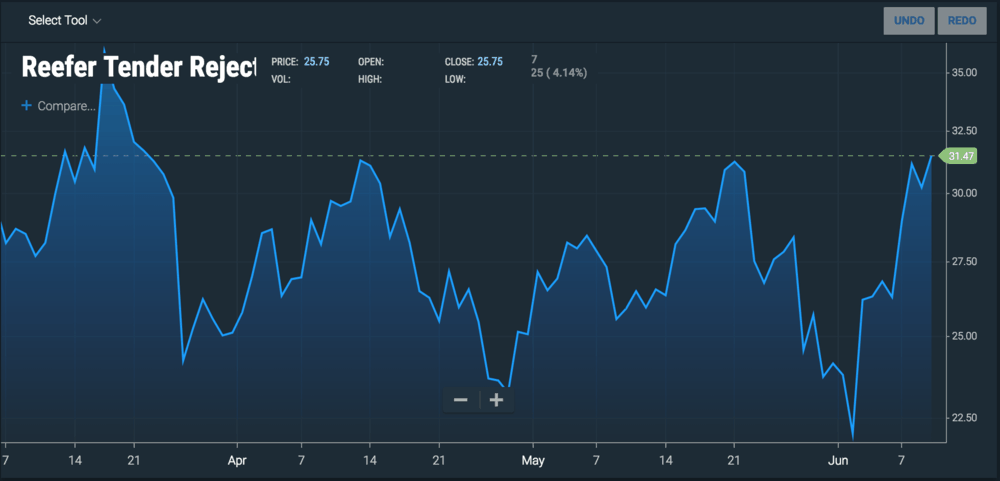

Beyond its role as a logistics hub for freight leaving the West Coast, the Dallas-Fort Worth metroplex is home to 7.4M people, the fourth-largest metropolitan area in the country, so it consumes and produces plenty of freight of its own. To get a sense of how this can affect the Dallas market’s outbound turndowns, take a look at the chart below, which displays reefer turndowns leaving Dallas over the past three months.

Reefer turndowns outbound from Dallas (rtri.dal) have spiked by about 50% in the past week. We’ve heard from brokers at a nationally prominent logistics firm that MillerCoors, which has a large brewery producing 9M barrels of beer per year in Fort Worth, has been dumping reefer loads onto the spot market. Temperatures in the Southeast and Southwest are at summer levels, even if the first day of summer this year is technically June 21, and demand for beverages has exploded.

Other commodities affect the demand for temperature-controlled trucks in Texas, especially agricultural produce, which, with Texas’ long growing season, generates a lot of reefer activity. In the past month or so, crops like tomatoes, watermelons, zucchinis, pears, hot and sweet peppers, and green onions have all begun their harvests. To some degree, then, Dallas outbound turndowns are being led by the reefer segment.

If our thesis is correct, markets like Atlanta, Chicago, and Philadelphia will be the next to heat up.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.