Its best performance in year-over-year increases in revenue per hundredweight (excluding fuel surcharge) in years was not enough to turn a first quarter profit for YRC Worldwide, which posted a net loss of $14.6 million, although that was done from $25.3 million in the first quarter of 2017 and inline with company expectations, said Darren Hawkins, CEO.

“The overall financial results were in line with our expectations and let me reiterate what we said we would do. We are executing our strategy to secure the right price and freight mix with our customers who value the service and capacity that Holland, New Penn, Reddaway and YRC Freight provide,” Hawkins said. “The pricing and demand environment remained favorable and we’re especially focused on improving yield and our corporate channel.”

Net loss in the quarter fell to $14.6 million from $25.3 million in the first quarter of 2017 on consolidated revenue of $1.21 billion, up from $1.17 billion in 2017 Q1. On an adjusted EBITDA basis, YRCW posted results of $45.7 million in Q1 2018 versus $43.2 year-over-year.

Hawkins said the company continues to invest in new equipment, taking delivery of 500 new tractors in the quarter with 400 more scheduled for delivery this year.

“The tractors [come] with improved safety equipment and are more fuel efficient and require less maintenance than the units they replace,” he said. “We also took delivery of more than 400 trailers in Q1, with approximately another 2,100 expected to be delivered in 2018.”

Reinvestment in the business continued with $23.5 million in capital expenditures and new operating leases for revenue equipment with a capital value equivalent of $73.7 million, for a total of $97.2 million, which is equal to 8.0% of operating revenue for first quarter 2018. The total represents a $72.5 million increase over the $24.7 million investment in first quarter 2017. The majority of the investment was in tractors, trailers and technology, the company said.

YRC Worldwide Financial Results

“We knew YRC was going to struggle through the ice and snow that pounded the Northeast and upper Midwest more than usual in 1Q18, but the company held it together and survived the beating, maybe even better than some expected,” said an analysis from David Ross at Stifel. “There is still much work for newly appointed CEO, Darren Hawkins, and his team to do to improve the profitability of the business (see Exhibits 1-2) and reduce leverage further. Old equipment remains an issue, and the company is doing what it can to bring in new tractors and trailers. YRCW is still the high risk/high return stock in this “hot” trucking market, and depending on execution in 2Q18-4Q18, it will likely either double by the end of the year or be a total dud, in our view.”

YRC Freight was impacted by the brutal weather in the Northeast in January and March and the Upper Midwest, Hawkins said, leading it to post lower results compared to last year. YRC Freight saw tonnage per day slide 2.4% while it increased 0.2% in the regional segment overall. Revenue per hundredweight at YRC Freight improved 6%, including fuel surcharge, and revenue per shipment was up 8.3% year-over-year. At regional, those same numbers were up 5.3% and 9%, respectively.

“On a segment basis, YRC freight improved its year-over-year results and was positively impacted by an increase in revenue from stronger yield,” Hawkins said. “The regional segment reported similar positive yield results. However, this segment was unfavorably impacted by severe weather in early January and the series of nor’easter’s in March which concluded it to a decline in the regional segments financial results compared to last year.”

YRC Freight generated $751.3 million in revenue in 2018 Q1 versus $728.9 million in 2017 and had an operating ratio of 100.9, down slightly from 2017’s 101.0. The company’s Regional unit posted revenue of $463.3 million, up from $441.8 million and an operating ratio of 98.9, up from 2017’s 97.2.

“Preliminary April results indicate YRC Freight’s year-over-year tonnage per day was down approximately 3.8%,” explained Stephanie Fisher, CFO. “As a reminder the year-over-year comp has shown with April 2017 reporting a 6.2% year-over-year increase in tonnage per day which was the biggest month of increase at YRC Freight in 2017.”

Regional tonnage is also down in April, Fisher added, falling about 1.6%.

YRCW’s purchased transportation costs increased to $20.9 million due to rising costs in related to third-party logistics and increases in rail rates and rail miles equivalent to $16.2 million. The company also logged a $9.9 million increase in equipment lease expense. That was offset by a $4 million decrease from lower usage of local and over-the-road purchased transportation.

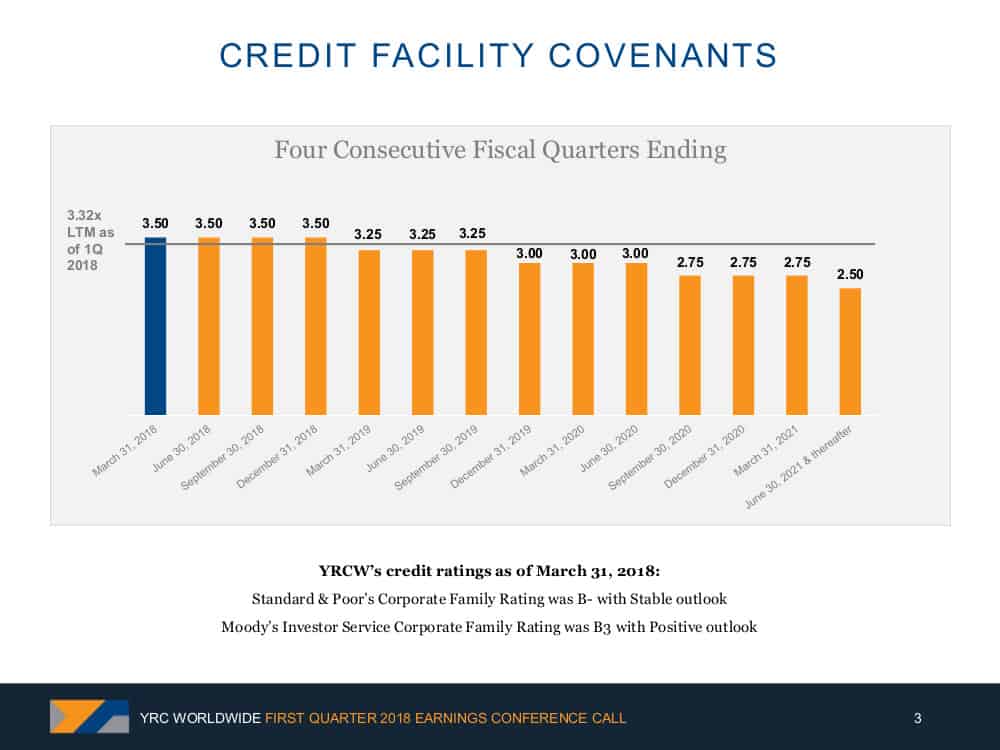

Fisher said that YRC Worldwide reduced its debt load in the first quarter to the lowest it’s been in 13 years at $918.7 million, down $86.1 million from a year ago.

T.J. O’Connor, president of YRC Freight, spoke specifically to his unit, noting the strong freight environment that has led to a 6.2% average increase in contract negotiations and eight new distribution centers that came online in the first quarter of 2018.

“This is clearly, one of the strongest freight environments in several years,” he said.

Hawkins remains optimistic for the remainder of the year, although the gains are likely to be seen in the second half as YRCW gets control of short-term rentals needed to meet transportation needs.

“The yield momentum that we are seeing, along with the investments we’re making in our fleet continues to give me confidence that YRC worldwide is moving in the right direction,” he said.