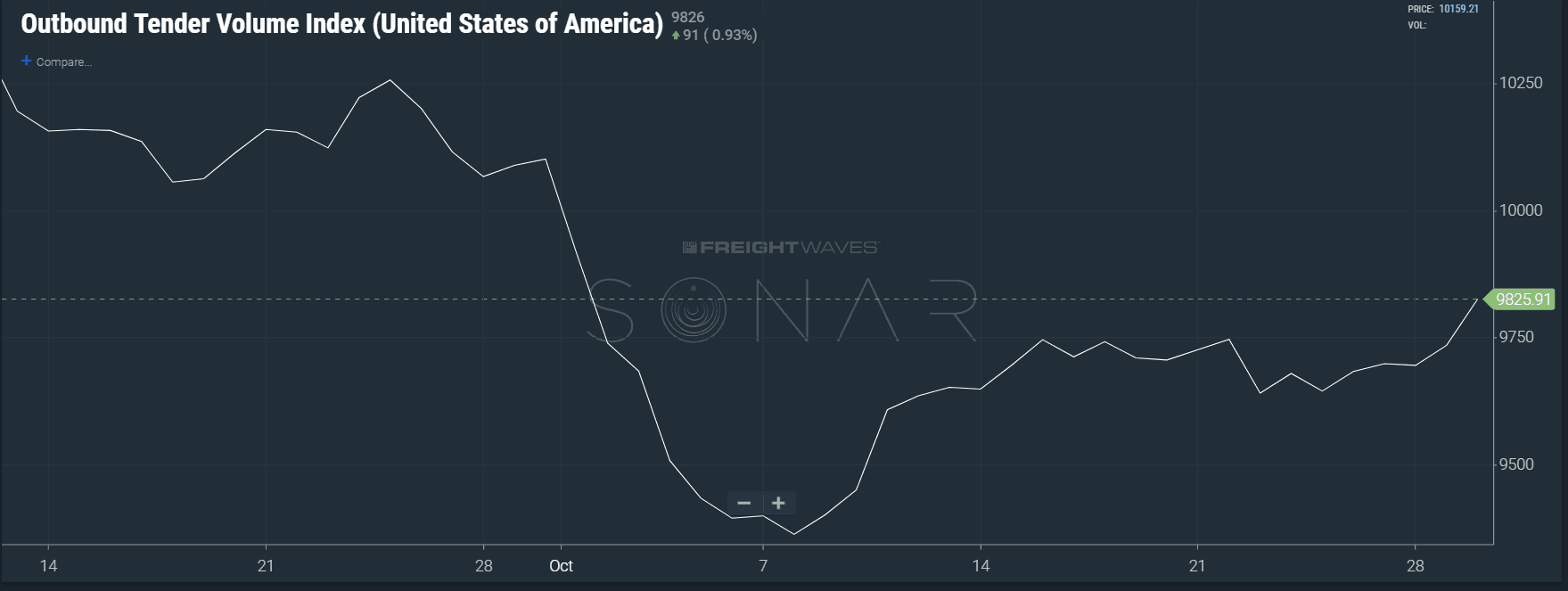

The freight market has hit the brakes and made a u-turn over the past few days. As expected, the end of month cycle has shown early signs of course change with volume and tender rejection levels increasing two days in a row. The national outbound tender volume index (OTVI), an index that measures load volume in the U.S., hit its highest level for October yesterday with a value of 9,825. The national tender rejection index (OTRI), an index that measures carriers’ propensity to accept contracted loads, has also shown early signs of changing direction making its first significant increase in value since September. Increasing tender rejection levels are an indication that contracted capacity is decreasing.

Volume increases tend to lead to some level of destabilization in freight markets. Not all volume is equal, and available capacity can absorb general increases. This week, freight volumes are sitting roughly 2% higher than in the first three weeks of the month, but are still 2% lower than late winter levels.

The lower volume has led to a more stabilized marketplace where capacity is readily available. This is evident in the OTRI, which has gradually dropped 500 bps since the first of the month, bottoming out a few days ago at 12.28%, the lowest value of 2018.

Since October 27th, OTRI has increased every day–it currently sits at 12.73%. This is significant, considering that the index has not had a positive movement over .03% or consecutive day increases since late September.

These increases have not been drastic enough to come to the conclusion that the market is turning. There is also a seasonal component to this time of year involving retail inventory leading up to the holidays, and the beginning of that freight push generally occurs over the next few weeks each year. Any change of direction at this point is worth noting.

Port volume has been widely discussed, specifically on the West coast, as imports flood the country. That freight must move eventually as warehouses fill up. To that point, load volumes out of the L.A. market have increased 12.2% over the past two weeks according to the outbound tender volume index (OTVI). Inbound volume has not proportionally risen–only up 3.8% in the same timeframe–leaving the market exposed to reduced capacity. Subsequently, OTRI has risen 111 bps out of L.A. in the past week.

The L.A. market is important to watch this time of year due to the heavy inbound from China that lands in the two largest ports in the U.S. before making its way inland. A lot of the holiday purchases are made in China and the retailers order their inventory ahead of time based on expected sales.

Retail shipments this time of year become more service dependent the closer it gets to Thanksgiving, so any surges can end up impacting spot market volatility due to increasingly tightening service requirements. Shippers will fall out of their route guide to ensure capacity is available and may pay a premium for it.

It’s not all about L.A. this year, as concerns over tariff increases have overwhelmed transpacific carriers to the point they are discounting containers to the North American East Coast ports of Savannah and Charleston. The OTVI in Savannah is the highest it has been all year, sitting at a value of 110. Prior to October, the highest value attained had been 90.15 in May and averaged 71.56. So the current value indicates that Savannah outbound is operating 35% above normal and 18.1% above statistically high levels.

If we have learned anything over the past year, it’s that markets can shift quickly and any indication of a change of direction is worth noting. But is this turn a trick or a treat?