Freight volumes took a dive this past week as freight volumes took a mini vacation. The Outbound Tender Volume Index (OTVI) that measures national contracted freight volumes fell 4.8% compared to the previous week. From a year-over-year perspective, volumes are also off a similar 4.85% compared to the same week in 2018. The decline in volumes is not a great sign for the freight market, but it is not as bad as it may appear.

Most of the drop can be explained by the timing of Easter weekend. Last year’s Easter landed on April 1, which coincided with the end of the month and quarter. The OTVI averaged 1.08% higher in the first week of April 2019 versus 2018 due to the impact of the holiday. A better comparison would be comparing volumes for April thus far to last year. Up to April 24, volumes are averaging roughly 1% lower in 2019 versus 2018.

Capacity is a much different situation when comparing annual discrepancies. National tender rejection rates are averaging roughly 1700 bps less this April, indicating carriers are far more willing to honor their contracted freight agreements and trucks are in the areas where needed. Tender rejection rates increased briefly in mid-April leading into Easter weekend, but quickly recovered this week to find a new bottom as of April 24 at 4.45%.

The increasing acceptance of contracted loads means rate upward rate pressure will be minimal except in isolated locations. Rates did jump about $0.04 per mile on Thursday prior to Good Friday last week according to the DAT Van Freight Rate index which measures base freight charges with no fuel or assessorial charges, but the increase was limited to the period surrounding the weekend.

A big reason national volumes are sliding is the decreasing amount of activity in the California markets. Los Angeles has been a hotbed for regional outbound volume over the past 3 months and after experiencing a brief surge last week prior to Easter weekend, volumes slid 14% this week according to the OTVI for the market. The neighboring Ontario market also fell 13.4% this week. The two markets combine to represent approximately 8% of the total outbound freight volume in the U.S., so any change in volumes in these markets will be felt nationally.

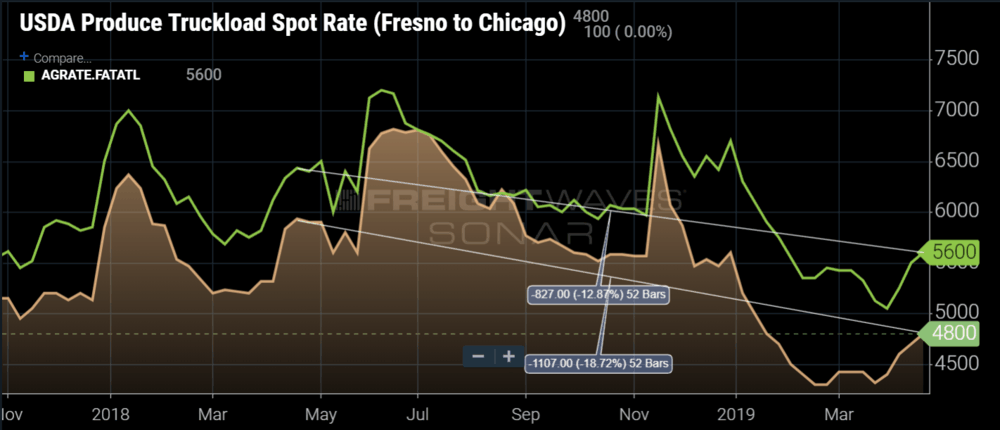

One of the first signals of increasing freight market volatility is the increasing amount of produce shipment volumes coming off the West Coast in April and May. Produce shipment rates are starting to have significant increases out of the Fresno market. The average spot rate from Fresno to Chicago has increased 9% since the first week of April according to the USDA weekly report. The Fresno to Atlanta lane has reported a similar increase in the same timeframe, indicating the produce shipments are hitting their stride.

It should be noted, the rates are 15% to 20% lower this year than were reported last year, indicating a muted impact comparatively, which seems to be the running theme in the national freight market this year compared to 2018.