New analysis of China’s international ocean port throughput has revealed that the nation has experienced solid growth in both year-on-year terms and in month-to-month terms for cargo (all kinds), foreign goods and for shipping containers.

However, as China’s Ministry of Transport publishes data with a month time-lag, this data will not show the effects of President Trump’s last round of tariffs, which took effect from the first day of June. So that means next month’s set of data, and the month thereafter, will make for particularly interesting reading.

All freight, foreign trade goods, container throughput

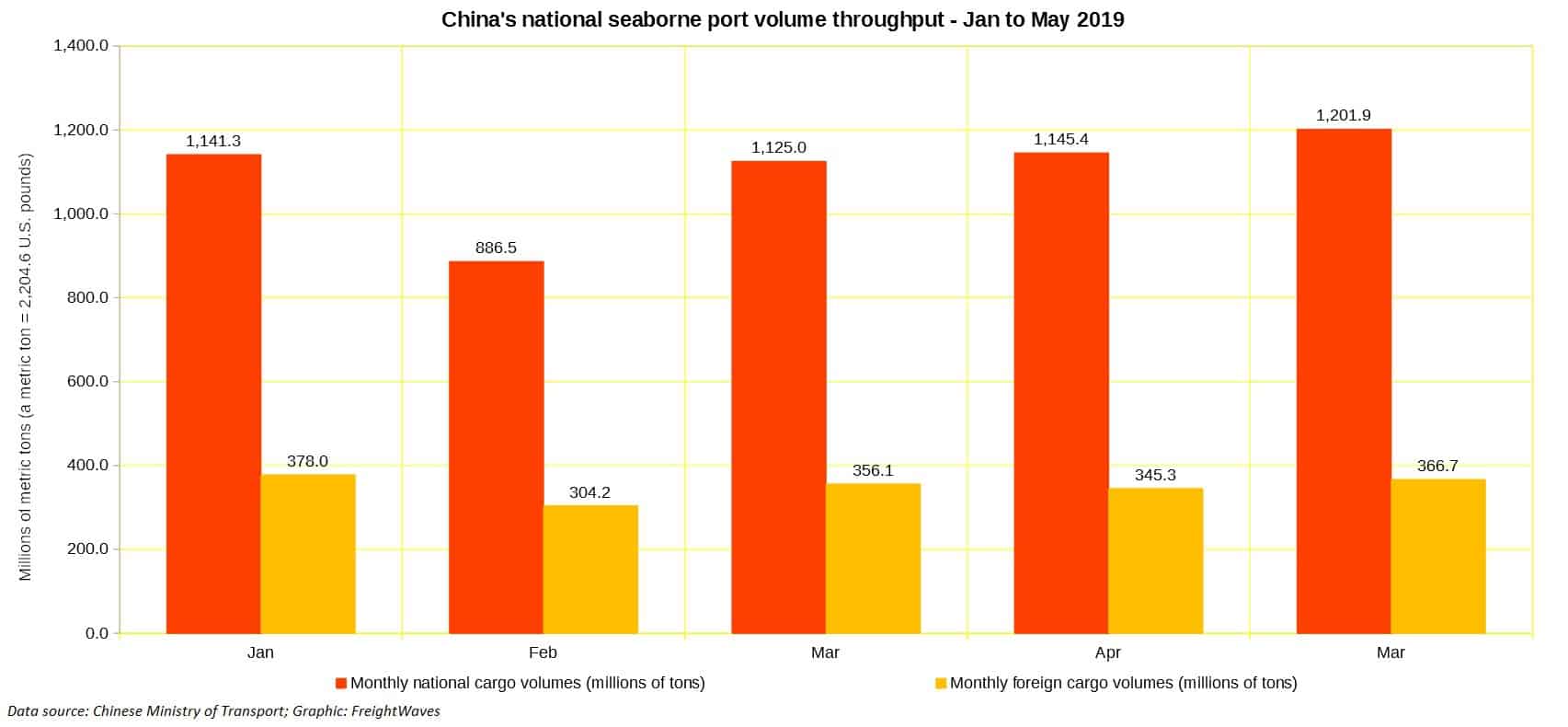

But back to the business at hand. The headline statistics from the Ministry of Transport show that China’s port throughput (all freight; data is not split into commodity nor import/export cargo) in 2019 from January through to the end of May stands at 5.5 billion metric tons. A metric ton is equivalent to 2,204.6 U.S. pounds. That’s 6.7 percent growth on the same period last year. In May, China’s ports handled 1.2 billion tons of cargo, a 4.9 percent jump on the April’s figure of 1.15 billion tons.

About 31.8 percent of the year-to-date’s 5.5 billion tons is “foreign trade goods.” That’s 1.75 billion tons of port throughput in the months from January through May. The volume of foreign trade goods shipped through China’s ports has increased by 2.3 percent compared to the same period last year. In May itself, the volume in weight of foreign trade goods shipped through China’s ports stood at 366.7 million tons, which represents 6.2 percent growth over April.

Container throughput at China’s ports is markedly up too, both on a year-on-year basis and also on a month-to-month basis. In the five months to the end of May, China’s ports handled 104.7 million containers (twenty foot equivalent units, or TEU), which is a 5.2 percent increase on the same time frame last year. TEU volumes rose on a month-to-month basis too. Last month China’s ports handled 22.4 million TEU, which is a 2.1 percent rise on the volumes handled in April.

Port-by-port – foreign goods

The port that handled the most foreign goods from January through May is Ningbo Zhoushan with 208.9 million tons. That figure represents a fall in the volume of foreign goods of minus 1.5 percent growth on the same period last year.

Qingdao is in a far distant second place (170.9 million tons but with 6.4 percent year-on-year growth) and Shanghai is third (165.8 million tons; 1.90 percent growth). There is then a substantial drop-off with Rizhao claiming the fourth spot (128.8 million tons; 1.1 percent growth) followed by Tangshan (113.1 million tons; 2.2 percent growth).

For the month of May, the top five listing is nearly identical to the year-to-date listing except that the port of Tianjin has muscled its way into fifth place with 24.1 million tons handled last month. Otherwise the top five list in May was Ningbo Zhoushan (44.0 million tons); Qingdao (35.1 million tons); Shanghai (34.8 million tons); Rizhao (25.5 million tons); and then Tianjin.

Port-by-port – boxes

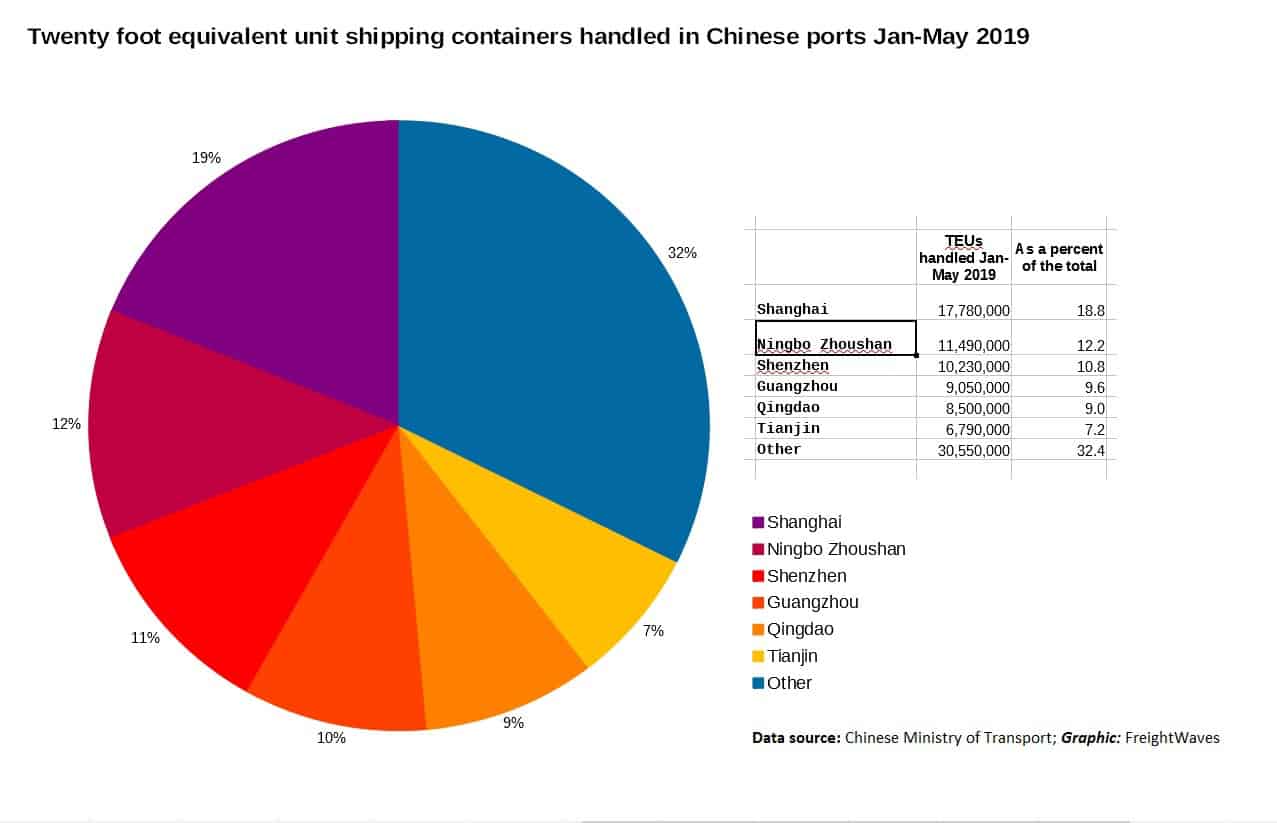

It’s a different story when the throughput volume is considered in terms of ocean shipping boxes (TEU).

The port of Shanghai leads the pack with at throughput of 17.8 million TEU handled between January and May this year, which is 5.2 percent year-on-year growth. That’s followed in a far distant second place by Ningbo Zhoushan with 11.5 million TEU and 4.1 percent year-on-year growth. Taking the third spot is Shenzhen (10.2 million TEU; 1.8 percent year-on-year growth). Next up are the ports of Guangzhou (9.0 million TEU; 5.1 percent) and Qingdao (8.5 million TEU; 9.2 percent year-on-year growth).

In the month of May the top five listing is Shanghai (3.8 million TEU); Ningbo Zhoushan (2.6 million TEU); Shenzhen (2.09 million TEU); Guangzhou (1.9 million TEU); and Qingdao (1.8 million TEU).

Around the world…

MSC to upgrade cargo handling on six ships

Cargotec will upgrade box handling gear during drydocking in 2020. (MarineLink)

Korean oil refiner announces high-sulfur fuel upgrading

S-Oil says new upgrading units to cut output of heavy marine fuel 70%. (Bunkerworld)

Freight forwarding executives indicted for price fixing

U.S. prosecutors say duo managed to raise shipping costs 20% through side agreements. (Maritime Executive)

Study says sulfur scrubbers bad for oceans

Swedish researchers find significant pollution in the wash water from ship sulfur scrubbers. (ShippingWatch)