The trade war with China is forcing U.S. shippers to look for new sources of low-cost consumer goods. Southeast seaports are benefitting from those switches as shippers opt for lower cost and more accessible gateways.

The value of China’s exports to the U.S. are down 12.3 percent through the first half of 2019 to $219 billion. The drop stems from President Donald Trump’s escalation of tariffs against China with another 10 percent tariff slated to take effect this coming September 1 and December 15 on $300 billion worth of imports coming from China.

The tariffs continue to raise the cost of sourcing from China. Chinese-made goods carry an average tariff rate of 18.3 percent, according to the Petersen Institute for International Economics, up from an average 3.1 percent in 2017.

The natural result is that U.S. shippers are using other low-cost countries to replace Chinese manufacturing. More of the goods from those countries are reaching the U.S. outside of its biggest seaports, according to intermodal executives.

“We are seeing a realignment of steamship service strings from China to other exporters like Vietnam, Indonesia and Cambodia,” RoadOne Chief Executive Officer Ken Kellaway told FreightWaves in an interview. “Some of the inbound containers are shifting a little because the ports might not have the right string to service those new sources.”

Savannah is one of the major beneficiaries of that service change. Once roughly tied with the Port of Los Angeles as the main gateway for goods from Bangladesh, Savannah has pulled ahead in April with the value of goods imports from that country reaching $162 million in June 2019, up 24 from a year ago.

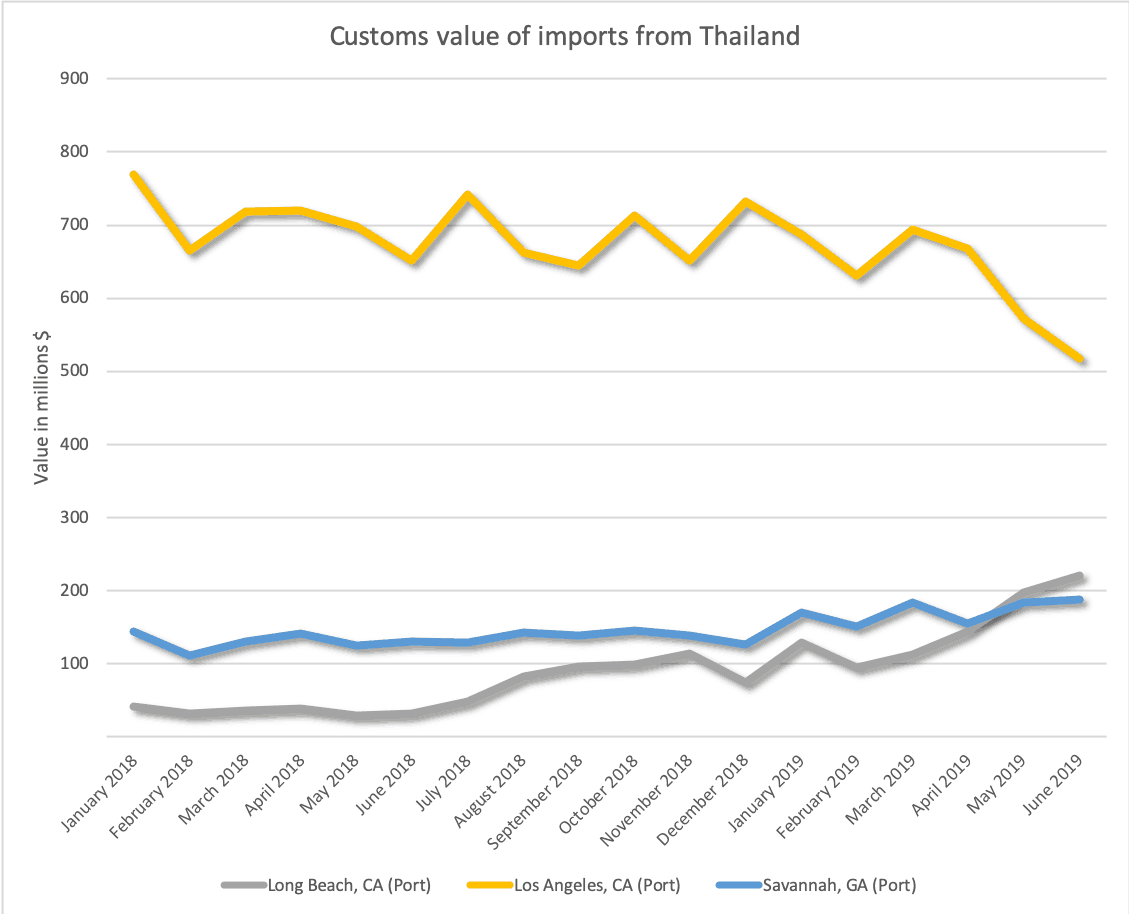

Savannah is also vying for an increasing number of goods coming from Thailand. Los Angeles saw the value of container imports coming from Thailand fall 21 percent from a year earlier to $517 million in June 2019. Meanwhile the value of container imports coming from Thailand through Savannah was up 43 percent in June to $187 million.

Mason George, president of national accounts at drayage and intermodal carrier IMC Companies, said IMC’s Southeast market unit Atlantic Intermodal Services “is still growing pretty well” amid the uncertain trade outlook hitting volumes at other ports.

Part of the reason for the growth comes from the sourcing changes taking place in the U.S. Shippers’ preferred ports of entry are switching as Southeast ports add vessel services from more Asian origins.

“Bigger shippers are asking what if we source this elsewhere, how does this affect which port we ship to?” George said.

RoadOne’s Kellaway also said the company is seeing better growth in its Southeast business compared to its West Coast business. The lower cost of shipping through the Southeast is one reason. But the optionality that East Coast ports offer in terms of shipping options is another appeal

“For a steamship line, you have options on these Southeast Asia ports through the Panama or Suez Canal, and the East Coast ports are more reachable through the Suez Canal. The impact is the need to realign drivers and have the capacity when steamship services realign.”

Seized Iranian tanker now free to sail

Grace 1 has left Gibraltar despite U.S. request to seize vessel. (TradeWinds)

Shipowners say scrubber retrofits taking too long

Vessels kept off water longer than expected for gear to remove sulfur. (Ship & Bunker)

British ports face chaos under no-deal Brexit

Leaked memo paints worse case scenario for U.K.’s exit from European Union, (Lloyd’s List)