Rise in expansion and efficiency projects comes after strong year of growth in company’s intermodal business.

BNSF (NYSE: BRK.A) plans to spend the largest amount since 2015 on expansion and efficiency projects, with the railroad’s major intermodal lanes seeing much of that investment.

The largest Class 1 railroad by track mileage, BNSF said its capital spending in 2019 would reach $3.57 billion, an 8 percent increase over last year and the largest amount of the major North American railroads.

Union Pacific (NYSE: UNP) plans to spend $3.2 billion this year, flat with last year. Canadian Pacific (Nasdaq: CSX) said its capital spending will be $1.2 billion for this year, a 33 percent increase from a year ago.

Track maintenance remains the largest part of BNSF’s program at $2.47 billion, roughly flat since 2017.

The biggest gain in spending will be for expansion and efficiency projects. BNSF plans $760 million in spending this year. That is the largest amount since 2015 when it spent $1.5 billion on similar projects.

The expansion plans could provide more freight opportunities for BNSF’s major intermodal partners such as J.B. Hunt (Nasdaq: JBHT), Schneider National (NYSE: SNDR), and Knight-Swift Transportation (NYSE: KNX).

Most of the expansion spending will be on projects for the railroad’s Southern and Northern Transcon, the main intermodal lanes connecting U.S. West Coast ports with the Midwest.

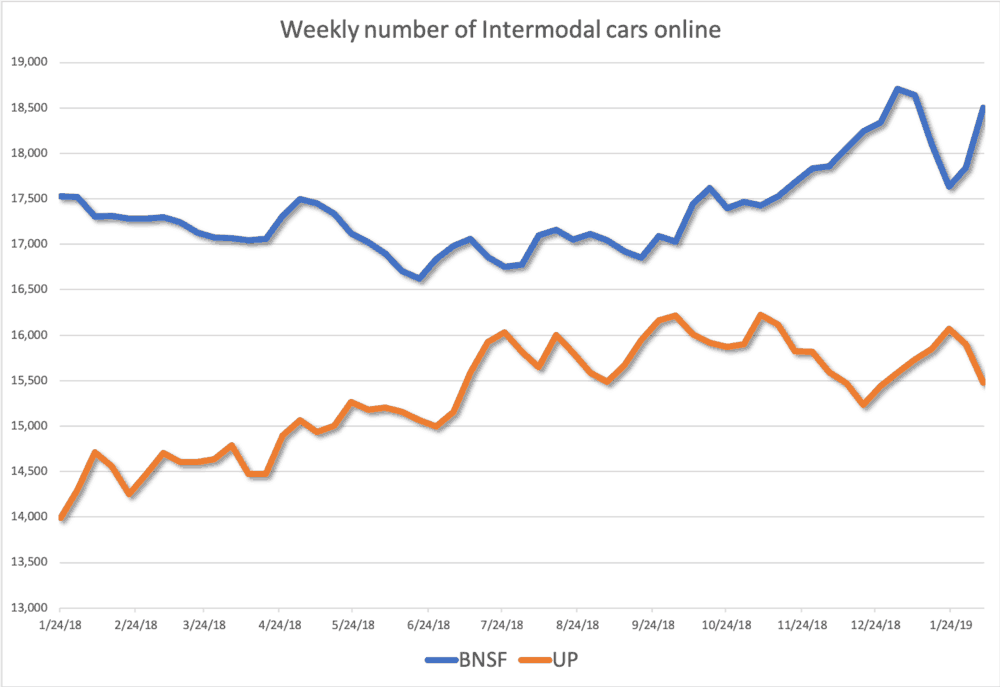

The spending comes after a record year for container movements into the U.S. West Coast pushed more domestic and international containers onto the rail. The weekly number of intermodal railcars on BNSF tracks hit a two-year high of just around 18,639 at the end of 2018, according to the Surface Transportation Board.

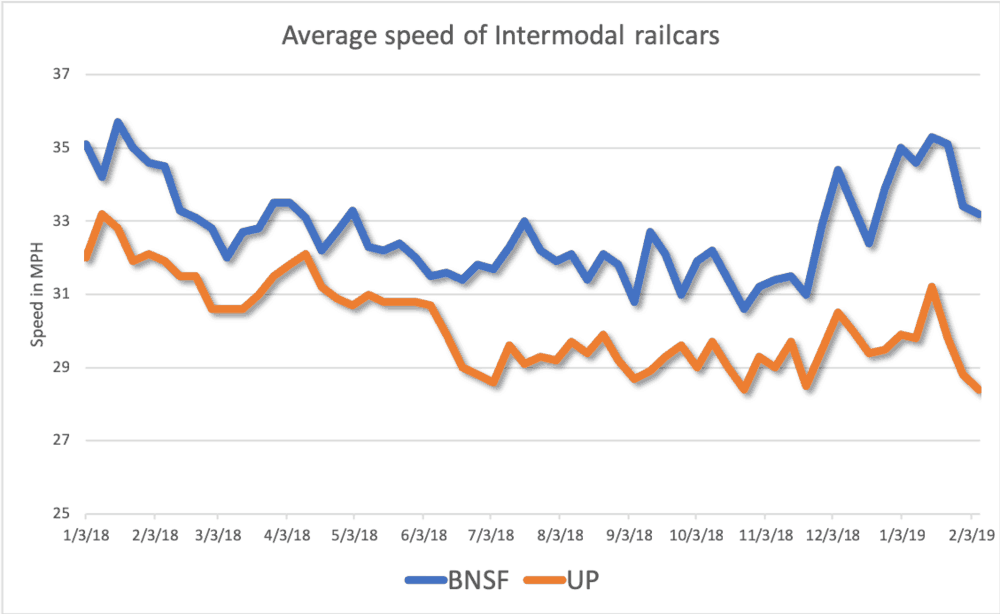

The increase in intermodal business last year also came with a decrease in speed, particularly at the start of the 2018 peak season. Intermodal railcar speeds did pick up late in the fourth quarter.

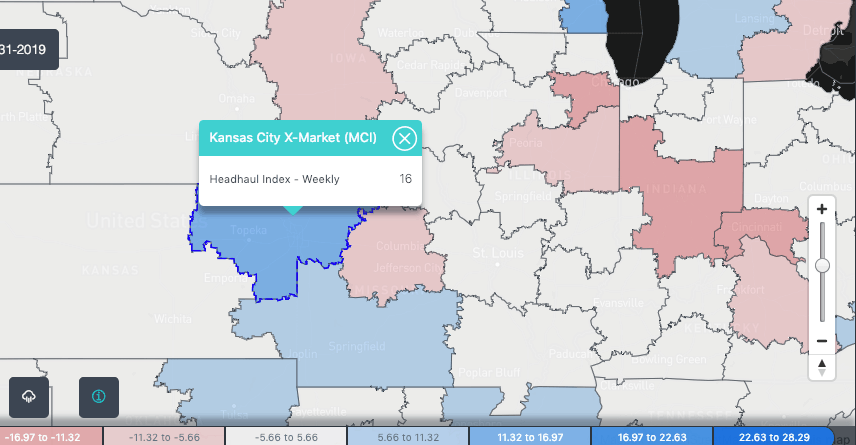

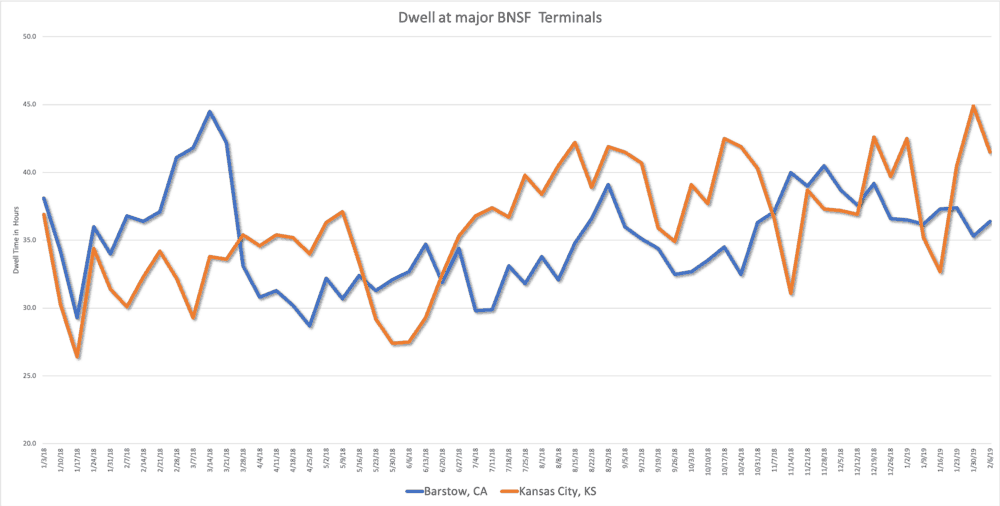

Still, the railroad is seeing dwell time for intermodal cars increase at its Kansas City terminal, one of the major stops on the Southern Transcon. The Kansas City market remains an active one for outbound trucking demand with SONAR showing a headhaul index of 16. (SONAR: HAUL.MCI)

BNSF sought to address network velocity last year with $500 million on expansion and efficiency projects, including adding track capacity in New Mexico and Texas subdivisions, a quadruple track project in California and additional crane capacity at its Alliance facility near Dallas.