Five-year high in growth seen last year thanks to tariff front-loading and tight truck supply, but shippers likely to put brakes on growth this year.

Intermodal volumes saw strong growth in 2018 as a limited truck supply met strong demand for containerized freight into the U.S. the Intermodal Association of North America (IANA) said. But the intermodal growth slowed toward the end of 2018, thanks to looser trucking markets.

As for this year, the growth of intermodal will ebb as the supply of trucks increases.

IANA said intermodal volumes rose 5.6 percent last year, the highest growth in five years.

The rise in intermodal volumes came during a year when transportation networks across North America were hit with the one-two punch of more limited (truck) supply and higher demand.

The start of the electronic logging device (ELD) mandate limited drivers’ road time. At the same time, a record number of marine container imports came into the U.S. last year, driven by strong consumer demand and tariff-related front-loading.

“All intermodal markets recorded an increase, and all regions saw traffic climb during 2018,” said Joni Casey, president and CEO of IANA.

Marine containers, the main load of intermodal networks, saw a 5.4 percent gain, reaching 9.55 million containers last year. Domestic container volumes saw a smaller growth rate of just under 5 percent last year to reach 7.9 million containers.

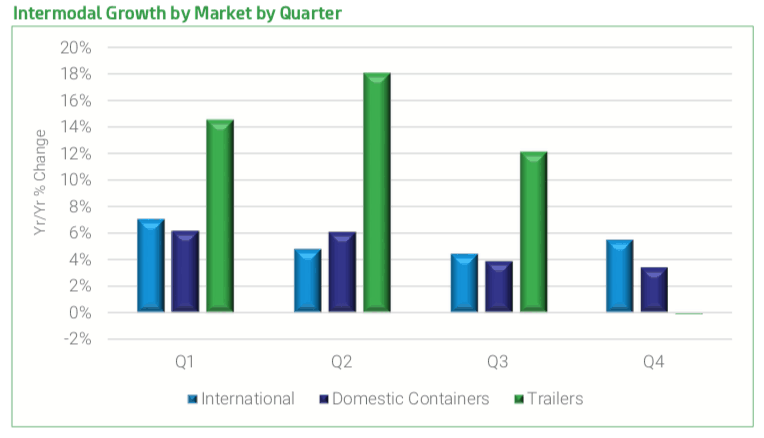

With fewer drivers available, trailer volumes were up almost 11 percent to 1.44 million for the year. Since the start of the ELD mandate, trailers carried on railcars have seen strong growth – 10 percent between the fourth quarter of 2017 and the third quarter of 2018. IANA noted that “trucking capacity was very tight through June 2018. But the growth tapered during the fourth quarter.” Trailers carried on railcar saw a small decline during the quarter, with domestic containers rising just 3.4 percent.

Regionally, the trade lane between the Pacific Northwest and the Midwest was one of the strongest in the fourth quarter, with volumes gaining 13 percent. Marine containers led the gain thanks to high numbers of import containers coming into U.S. West Coast ports from China. The Northwest Seaport Alliance saw inbound container volumes coming into the ports of Seattle and Tacoma rise 13 percent through November 2018.

The Southwest-to-South Central trade lane also saw growth – nearly 10 percent for the quarter thanks again to growth in container imports. The Ports of Los Angeles and Long Beach combined saw 3.5 percent growth for inbound container volumes, reaching 8.125 million through November 2018. The Southwest-to-Midwest was still the largest trade lane for intermodal, but saw only small growth in volume.

The 2018 results roughly mirror what the Class 1 railroads saw for intermodal last year. Union Pacific (NYSE: UNP) saw carload volumes in its intermodal business rise 6 percent last year to 4.38 million. BNSF’s (NYSE: BRK.A) intermodal volumes were up 4 percent through the first nine months of 2018.

The intra-Southeast market saw volume growth of 9.4 percent thanks to the record number of marine containers moving through the Port of Savannah last year. Northeast-to-Midwest trade lanes were up 9.8 percent as well. Norfolk Southern (NYSE: NSC) saw similar gains in its intermodal volumes last year.

For 2019, IANA warns not to expect a repeat performance. While intermodal volumes will again grow, it will be “a bit slower than 2018.” Along with economic risks and the uncertain trade outlook, IANA said that trucking capacity “is not expected to be as tight in 2018, a major factor for intermodal growth.”

The loosening of truck supply means the trailer segment may only see slight growth in 2019. Marine container volume also remains uncertain as the U.S. and China still grapple with how to resolve their trade differences. IANA says marine container volumes will likely rise between 2 and 3 percent this year, absent a further escalation of the trade war.

Some of the major markets do appear to be cooling ahead of the upcoming Chinese New Year.

Last year’s growth markets are showing some cooling. SONAR’s outbound tender rejection index for Seatte (SONAR: OTRI.SEA) saw an 8 percent decline from a year ago. The Los Angeles market (SONAR: OTRI.LAX) is off 11 percent from year-ago levels.