Uber Technologies Inc. (NYSE: UBER) second quarter 2019 report probably won’t receive the accolades garnered by its ride-hailing competitor, Lyft (NYSE: LYFT).

Uber’s second quarter as a public company saw a loss of $5.2 billion (closer to $1 billion excluding stock-based compensation and one-time driver awards), or $4.72 per share, which was much worse than the $2.01 per share loss reported a year ago and the wide range of consensus estimates calling for a loss of slightly more than $3 per share.

Uber Freight

The results of Uber Freight, a digital freight matching marketplace, roll up through the company’s Other Bets division. Other Bets revenue increased 175 percent year-over-year to $195 million with gross bookings coming in at $182 million, 153 percent higher year-over-year. However, Other Bets lost $122 million in the period, much more than last year’s $28 million loss and higher than the first quarter 2019 loss of $71 million.

In an interview with CNBC, Uber’s Chief Executive Officer Dara Khosrowshahi addressed the recent weakness seen in trucking markets. “The freight industry hit a soft pocket in the first quarter and second quarter of the year. We went in and adjusted to that soft pocket to sell much more aggressively into accounts and if you look at the growth for Uber Freight now, the growth rates are exciting and we remain bullish. It is going to take a couple of years, but this is a multi-billion dollar industry and we think we have got kind of the best solution with the best tech and a great brand. And we think we can succeed there very much so.”

The company states that Other Bets revenue primarily consists of Uber Freight. Other Bets generated $373 million in 2018 revenue with a $152 million loss for the year.

“Uber Freight added new shipping customers across the enterprise, middle market, and small- and medium-sized business segments. Our platform for shippers targets the underserved long tail of small shippers with an automated self-serve tool that helped drive 10X year-over-year revenue on the platform,” stated the press release.

Consolidated results

Total revenue was up 14 percent year-over-year at $3.17 billion, well short of the consensus estimate of $3.36 billion. Gross bookings increased 31 percent year-over-year to $15.8 billion. Uber also announced that active users surpassed 100 million in July. Monthly active platform consumers increased 30 percent in the quarter to 99 million.

“Our platform strategy continues to deliver strong results, with Trips up 35 percent and Gross Bookings up 37 percent in constant currency, compared to the second quarter of last year. In July, the Uber platform reached over 100 million Monthly Active Platform Consumers for the first time, as we become a more and more integral part of everyday life in cities around the world,” said Khosrowshahi.

On a consolidated basis, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was a loss of $656 million, more than twice the second quarter 2018 loss, but roughly $200 million better than the first quarter 2019 result. The company now expects an adjusted EBITDA loss of $3.2 billion to $3 billion in 2019.

In comparison, Lyft saw a sizable revenue outperformance and trimmed its operating loss expectations moving forward when it reported second quarter financial results on August 7. Given the better than expected second quarter 2019 revenue result, Lyft said that the peak for operating losses was likely behind them.

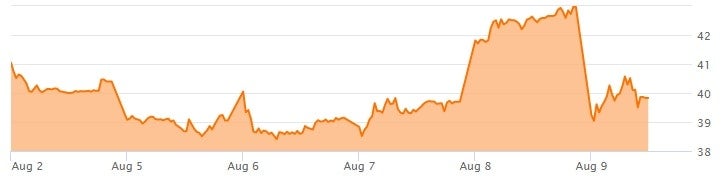

Shares of UBER are off roughly 7 percent on the news. The stock remains under its initial public offering price of $45 per share.

Steven

Very soon Uber will eat many alive.

They got everything what it takes to destroy competition.

CA Trucker

Call me old school but I remember the DOT Com bust of the late 90’s. Tech companies only worried about how many “eye balls” they had.

In the end you gotta make money performing the core task, in this case bringing shippers and consignees together moving freight. I don’t see UBER Freight doing this core function distinctively better than other brokerage services.

We shall see…

David Tildern

The Uber Freight team probably don’t remember the dot com bust. They were all just teenagers then 🙂

Friend To Truck Drivers

I think far too many have been fooled into buying into Uber as a whole. The next Enron???? I guess we will see.

Josh

Uber Freight is not a freight company. Uber is a tech company and tech company valuations are based on revenue and addressable market, not P&L. They are taking losses on loads – and that this is a fact – to grow the top line which justifies their fund raising and fund spending. It’s a “growth at all costs” mentality.

David Tildern

I call BS. Yes, data is important, but this business will never be just data. The dance that takes place to move just one load between shipper, broker, forwarder, asset company, asset driver, pickup staff, delivery staff, loading teams, cargo issues and claims, and all of the governmental agencies to do the job is IMMENSE.

Let’s call this as it is – Uber Freight is betting BIG of buying market share, forcing competitors to close or shrink, and hoping that customers stick around to keep doing business with them when they double their prices when the stock market forces them to by saying “enough is enough”.

At the end of the day this is a market grab at they are losing billions to get to the holy land – IF such holy land actually exists at all.

Reality Check

FooFoo dust is what this company is built on. They have been able to offer ZERO idea of when they will turn around and start to actually mitigate their losses. NOT “make” money…they don’t know when they will stop LOSING money. RED FLAG folks. And when the s#@t hit the fan, and it will be soon, far too may gullible people will lose big.

Daniel Green

I am reading this correctly, for each $1 of business they bring in to Freight, it looks like their profit is -$0.67. What kind of crazy business is Dara running???

JustSomeGuy

Their business is not about making money off of freight, but gathering data. As the industry continues to transition to full automation data will become the most valuable commodity. This will require short term losses, and is certainly a gamble to some degree, but in the end whoever has the data and technology will become the predominant carrier.