An end to growth-stopping financial penalties on the Port of Newcastle is definitely not on the agenda after the New South Wales state government re-committed to its existing policy to keep the port in a crippled state.

The Honourable Andrew Constance, the State Minister for Transport and Roads, rebuffed recommendations made by an inquiry into the state government’s highly secretive and controversial ports privatization programme.

State will stick with existing freight plan

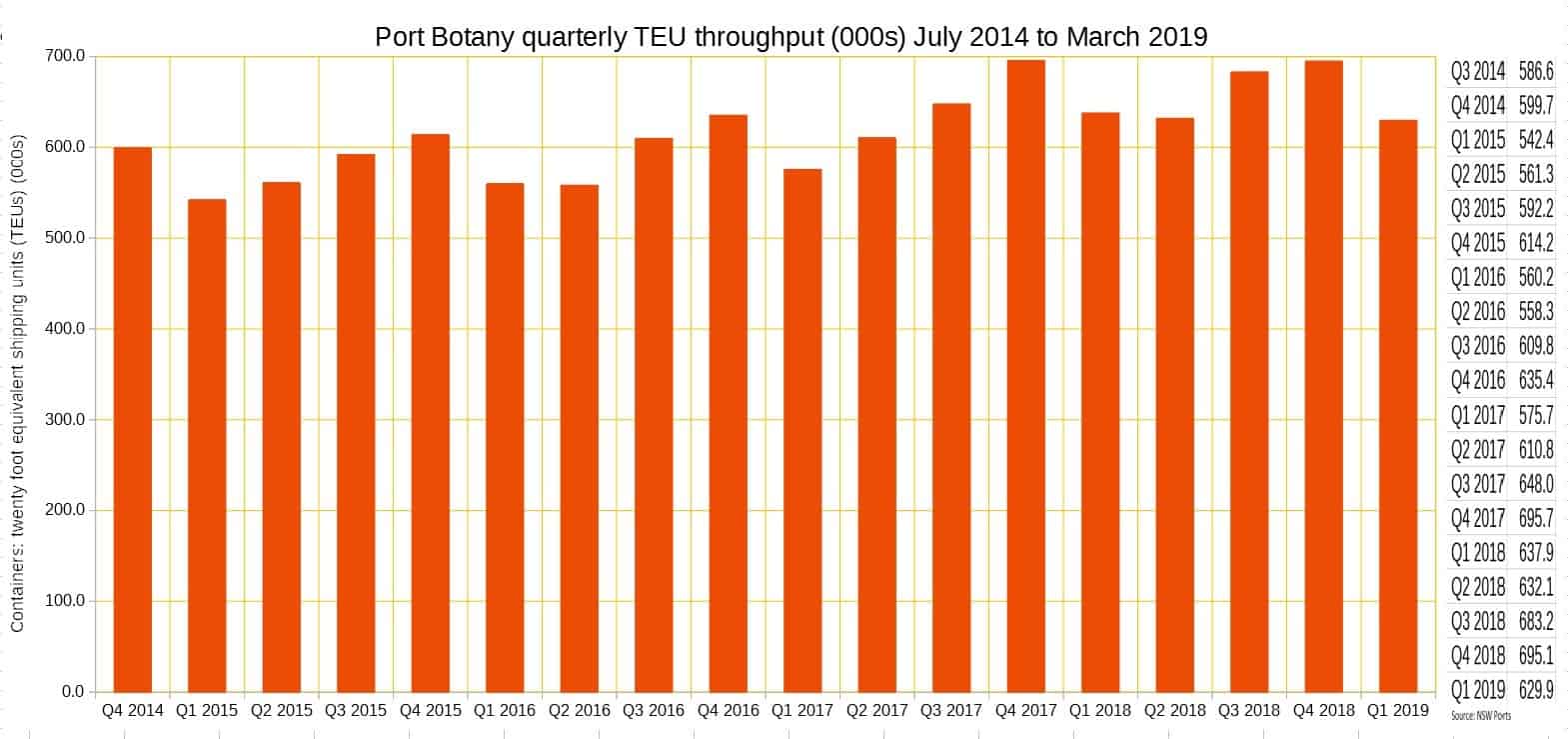

In a written government response to the public inquiry, Constance said that the state government is committed to its existing strategic freight rail priorities, which includes maximising the use of rail freight at Port Botany to 28 percent by the end of next year.

“We do not believe that there is a case for conducting additional investigations of rail freight options between Ports Botany, Kembla and Newcastle,” Constance wrote.

Constance also reaffirmed that the state’s policy for meeting the state’s future container trade is to realise the full capacity of Port Botany before investing in another port. He added that, as the state has invested in creating container freight capacity at Port Botany then the full use of that capacity will maximise benefits to industry, consumers and taxpayers.

Privatization realized billions of dollars

Back in 2012, the New South Wales State Government, which was then (and still is) being run by the Liberal–National Coalition, decided to bundle together the ports of Botany (Sydney’s port) and Kembla (a major coal export port and car import terminal to the south of Sydney) in a 50-year lease. The combined ports raised A$5.07 billion (US$3.53 billion) in April 2013. Port Kembla was also designated as the second main container terminal for the state of New South Wales.

That decision to bundle the two ports together under private ownership was, and still is, highly controversial as they could have otherwise been competitors.

The Liberal-National state government then decided to privatise the world’s largest coal export port, the Port of Newcastle, for 98 years in return for A$1.75 billion (US$1.22 billion) from a consortium of financial investors which originally included Hastings Fund Management (currently re-branded as “Vantage Infrastructure” and China Merchants. There have been changes in the shareholder base since then.

Deal was shrouded in secrecy

At the time, and for several years afterwards, the mechanics of the privatizations were shrouded in secrecy. There were literally hundreds of questions in Parliament by members of the state legislature to find out the details. This reporter tried Freedom of Information Act requests but to no avail as the release of relevant documents was denied on the grounds of commercial confidentiality.

Eventually, persons unknown leaked completely anonymous copies of the relevant documents in the post which were then acquired and published by local media.

Liberal-Nationals deliberately crippled Port of Newcastle

And the reasons for the secrecy became evident – the state government had sought to boost the leasing-price of Botany and Kembla by imposing a series of financial constraints on the Port of Newcastle to prevent it developing a viable container terminal.

During the privatisation of Botany and Kembla, the Liberal-National state government had realised that a container terminal at Newcastle would negatively affect the value of bids. And a bidder then asked for reassurance that a box terminal would not be developed at Newcastle.

Clause 3 of the “Port Commitment Deeds” (the Botany and Kembla privatization documents) require the state government to pay compensation to the operator of Botany and Kembla if three conditions are met.

These are: (1) neither Port Botany nor Port Kembla is at full container capacity; (2) the volume of boxes going through Newcastle exceeds 30,000 twenty-foot equivalent containers (TEU); (3) the operator of Botany and Kembla can prove that the box traffic through the Port of Newcastle has caused a reduction of containers at its ports.

The compensation to be paid is the weighted average wharfage charge per TEU charged by the Botany/Kembla operator multiplied by the number of boxes in excess of the 30,000 TEU limit.

To make sure that the arrangements to cripple the Port of Newcastle stuck on the new owner, the State Government required the successful bidder in the Port of Newcastle Privatisation to enter into a deed to reimburse the State of New South Wales for any compensation payments it had to make to the owner of the Ports of Botany and Newcastle.

Terminal operators walked away from port development

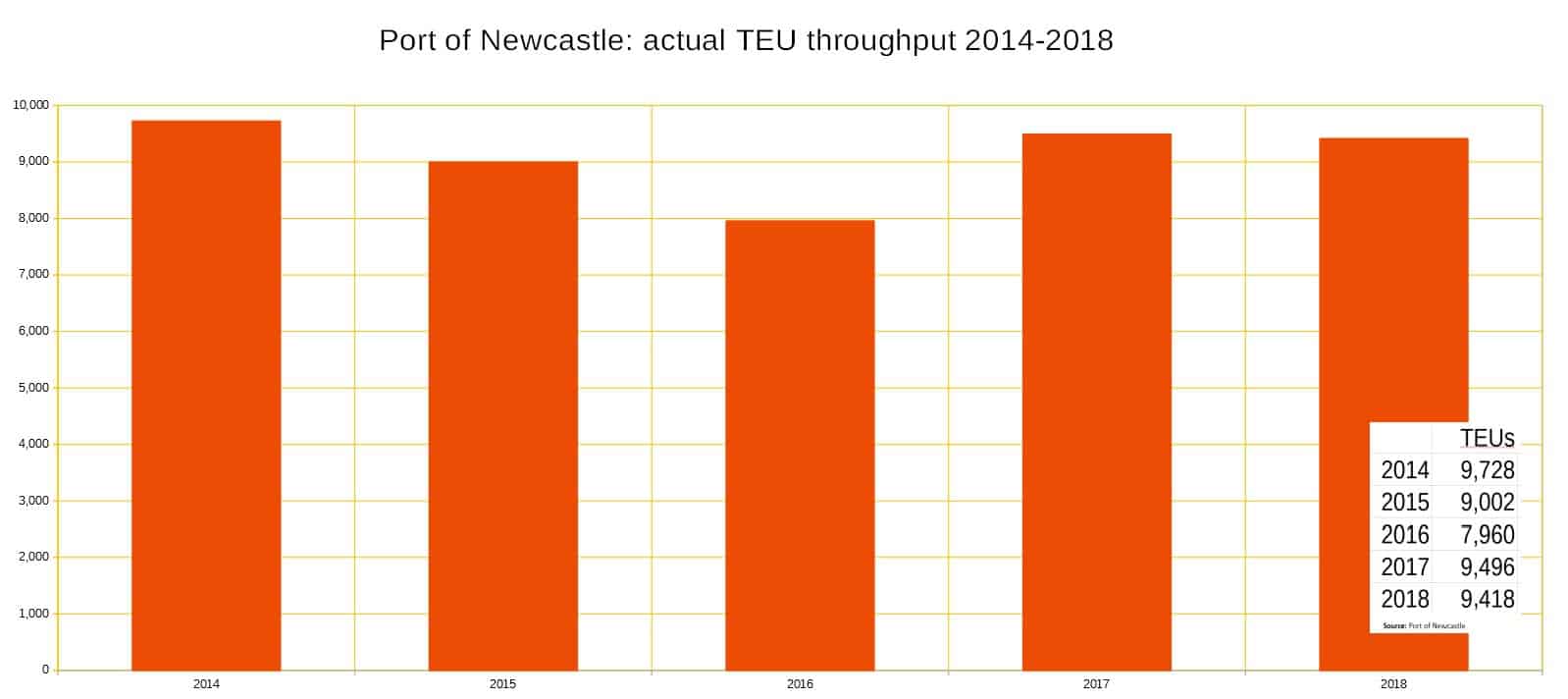

So far the annual container volumes through the Port of Newcastle are running at about 10,000 TEU a year (see graph, below). The port has had development approval for nearly two decades to build a container terminal that can handle up to 350,000 TEU shipping containers a year. But it could be so much more.

The Port of Newcastle is built on the Hunter River. The port has deep water channel and available land. The land itself was formerly contaminated from previous industrial use. One of the few things that can sensibly be done with it is to cap it with thick concrete – which would be a necessary step in the creation of container terminal. And that has already actually been done in a A$110 million program of remediation works that ended in 2019.

The Port says it wants to build a terminal that can handle 13,500 TEU box-ships; if it could, it would be the only terminal of that size in the whole of Australia. The terminal would be fully automated, with 11 quay cranes and a potential capacity of up to two million TEU.

But no one will put the money up to build it while the financial compensation clauses are in place.

Craig Carmody, the CEO of the Port of Newcastle, told a state Parliamentary inquiry that global marine terminal operator, DP World Australia, “walked away because the port commitment deed made it economically unviable.”

Duelling economic consultants

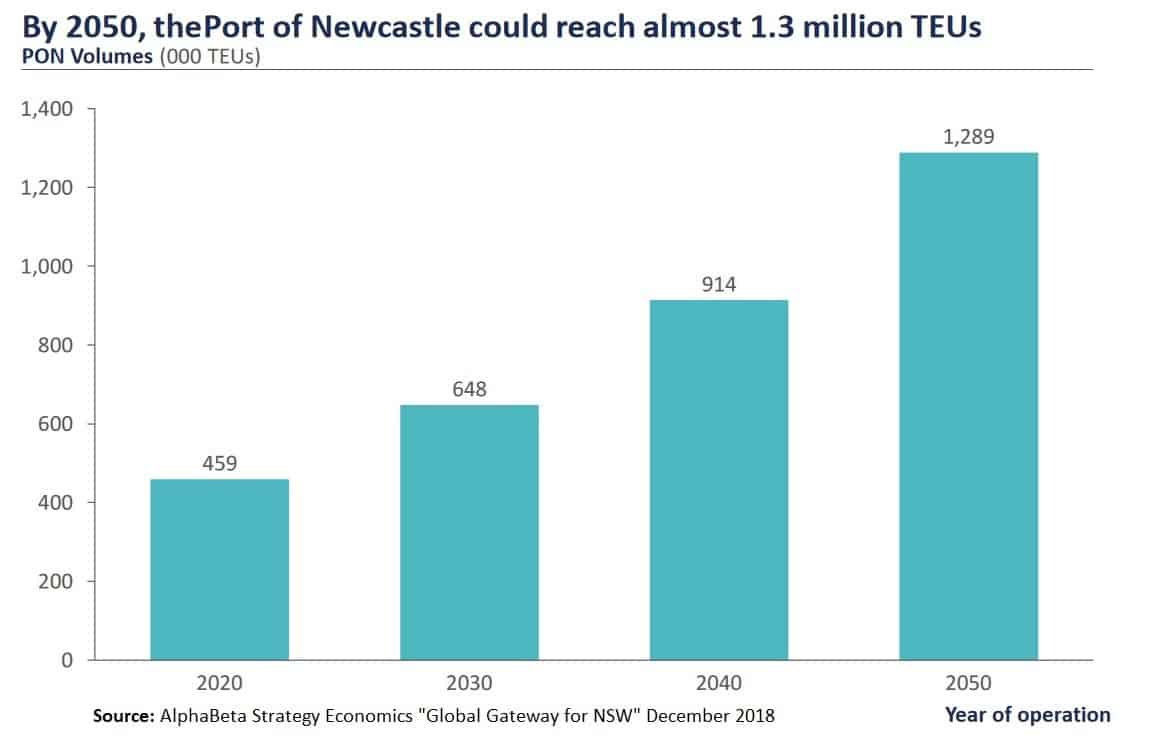

A report by economic consultancy AlphaBeta – commissioned by the Port of Newcastle – said that a box terminal at the Port of Newcastle could drive A$6 billion of economic value through lower land freight costs in northern New South Wales, competitive pressure on Port Botany, deferred or avoided infrastructure elsewhere, road freight traffic declining from Botany to northern New South Wales and other economic adjustments.

The consultants also argued that a box terminal would be a boon to the local regional economy and to the local export markets.

That said, the operator of Port Botany and Kembla responded with its own report from economic consultants KPMG. The KPMG report found that a new container terminal is not needed in New South Wales for “several decades at least” and that premature development of a new terminal would increase costs across the entire NSW supply chain.

The report’s penultimate conclusion was that Port Kembla makes the “most sense for containers, but only once Port Botany nears capacity.” Its final conclusion was that boxes at the Port of Newcastle “makes the least sense” as, it claims, the port’s road and rail links to Sydney are constrained.

Political change may be underway, although…

However, even though the state government has – firmly – stuck to its policies, the possibility of political change is in the air.

Firstly, the Nationals, the junior political party in the coalition with the Liberals, did an about-turn last weekend. The party’s state conference passed a motion calling the NSW Nationals to ensure the “removal of all obstacles facing the Newcastle Container Terminal Expansion Plans, including the cap on the number of containers and the State Government fee payable on container exports and the Port’s development of a high intensity container terminal.”

It’s a particularly interesting development as the Nationals had previously supported the policy of focusing on Botany and on Kembla.

… the courts might beat them to it

But in a development that may yield more immediate direct action, the competition watchdog, the Australian Competition and Consumer Commission (ACCC), is suing NSW Ports, which operates the ports of Botany and Kembla.

The ACCC has concluded that the likely effect of the compensation clauses is to render the development of a container terminal at the Port of Newcastle uneconomic for 50 years. It also concludes that the compensation clauses are a barrier to the expansion of the supply of containerized port services in the state.

But for the compensation clauses, the Port of Newcastle would likely try to build a container terminal to compete with Botany and Kembla, the ACCC believes.

The competition watchdog therefore alleges that the compensation clauses in favour of NSW Ports have the purpose, or have the likely effect, of substantially lessening competition in New South Wales. And that’s unlawful under section 45(2) of the Competition and Consumer Act 2010.

The ACCC is seeking an order from the Federal Court of Australia that NSW Ports be restrained from enforcing or otherwise giving effect to compensation clauses.

The litigation is ongoing.

Maritime news from around the world

Dry bulk owner boost scrubber order

Scorpio Bulkers looking to meet IMO 2020 rules with devices. (Maritime Executive)

Japanese ocean carrier tests autonomy

MOL studied autonomous vessel handling and berthing. (Marine Link)

Port of New Orleans preps for Barry

Tropical storm is expected to be a hurricane by the weekend. (Maritime Executive)