As the transportation and logistics industry moves into bid season, we’re starting to see the effect of lessons learned from 2018.

Both shippers and brokers are becoming more creative, with both sides trying to proactively manage risk and stay flexible enough to seize opportunities as they present themselves.

For shippers, that means “putting everyone back on an even playing field,” according to Asa Shirley, SVP of Sales at Arrive Logistics, who said that many shippers are re-evaluating even their long-term carrier relationships after being left high and dry last year. For brokerages, managing risk means rebalancing their mix of contract and spot freight according to historical volatility on a lane-by-lane basis.

Brokerages told FreightWaves that shippers are already making adjustments to their operations in the new year. Transportation managers under pressure to control freight costs and stay out of the spot market are experimenting with a mix of carrier rate decreases and contracts with third-party logistics providers to cover lanes where capacity became scarce last year.

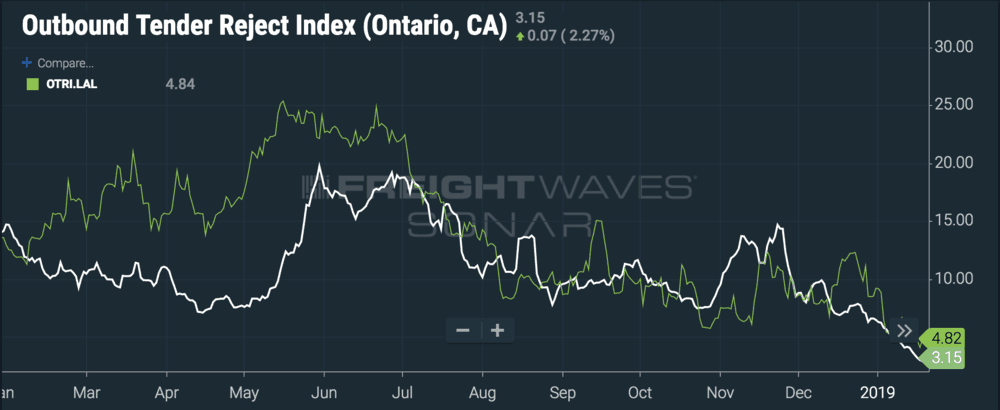

It’s a somewhat confusing time in the national freight market: flat volumes trending slightly downward and depressed rates feel like typical January doldrums, but brokers and shippers still have last year’s turbulence in the back of their mind. Capacity is much looser than last January, but the market does not appear confident that supply-side issues are over.

While many brokers are bidding aggressively for contract freight, they worry that spot market softness won’t hold up.

“In the negotiations I’ve been a part of this year, we’re seeing brokers get really aggressive in the third party market, more aggressive than we’ve seen in the past, because people are anticipating a contract-heavy year,” said William Kerr, president of Chicago-based Edge Logistics.

“We’re quoting our contract freight incredibly thin compared to what we used to,” said Sean Byrne, branch manager at ARI Logistics in Chattanooga. “The transactional side is pretty solid for us. These customers are trying to go direct with carriers or trying to use one carrier instead of a lot of different brokers, so we’re getting last minute truck fall-off loads. We’re doing pretty well on those margins, staying around 17-20%.”

Brokerages are managing their risk by being aggressive in stable markets and playing it safe on lanes that erupted last year.

“We try to look at markets that don’t flip as badly—we try to stay out of the sand traps,” Kerr said, referring to volatile produce lanes out of southern California and Florida. “We’ve had a number of shippers where we are kind of sitting out right now. Markets change, lanes change, and rates change fast. Sometimes the best trade is no trade.”

Shirley of Arrive Logistics said that his shop managed risk through a mixture of offensive and defensive plays.

“Shippers are trying to force the market to settle,” Shirley said. “But in Q1, we just want to make introductions. We don’t want to bite off more than we can chew—we want a ‘crawl, walk, run’ approach. If we can get in their network, we want just a few lanes so we can get an understanding of what they do and how they do it.”

Shippers also seem to have a hunch that volatility will eventually return to the spot market, which could make contract agreements fall apart. They’re trying to stay flexible and keep their options open, by balancing the need to save money on their freight budgets where they can against the need to lock in reliable capacity.

“Our high volume, mega-shipper customers are telling us, ‘let us know once the paper rates aren’t getting taken any more,’” Kerr said.

“We’ve been consulting with shippers, learning about their networks, and using our data to talk to them about how they’re exposed to the market,” Shirley said. “We’re pricing difficult lanes and showing them why it makes sense to invest in a 3PL to have us manage the lane for them. Everyone wants good service for a fair market price.”