TEN Ltd (NYSE: TNP), one of the largest publicly traded owners of tanker tonnage, posted increased quarterly profits as its time-charter strategy allowed it to outearn the spot market and its profit-sharing arrangements kicked in.

On June 6, TEN reported net income of $11.2 million for the first quarter of 2019, compared to a loss of $11.9 million in the same period last year.

The company – led by chief executive officer Nikolas Tsakos of the Tsakos shipping family of Greece – owns a diversified fleet of 68 tankers with an aggregate capacity of 7.5 million deadweight tons (48 crude tankers, 15 product tankers, three shuttle tankers, and two liquefied natural gas carriers).

During the latest quarter, 73 percent of TEN’s fleet was on long-term charter, including both fixed-rate and index-linked charters. Its ships earned $21,054 per day in the first quarter of this year, up 18.5 percent from the first quarter of 2018.

TEN’s fixed-rate contracts provide for profit splits above certain rates. According to the company, “As market conditions improved, profit-share arrangements were activated and generated a further $4.3 million in revenue.”

In general, its strategy of minimizing spot exposure has served it well during a multi-year slump for the crude and product tanker markets.

TEN noted that in full-year 2018, its strategy generated vessel-employment revenues that exceeded the spot market by 40 percent. It said it outperformed the spot market by 5 percent in the first quarter of this year.

Back in 2016, TEN pivoted to a long-term-charter-centric approach at a time when storm clouds were just beginning to gather and most of its public counterparts remained heavily focused on the spot market.

Tsakos explained the strategy shift in a conference call with analysts in September 2016. “We are in the process of turning the company into a much more ‘industrial’ company. We will become a much more long-term [charter] player, rather than a spot player,” he announced.

He explained that TEN preferred to lock in returns in the high single or low double digits and split any upside via profit sharing. The idea was to abstain from aiming for a “huge return” and instead guarantee a “comfortable minimum rate” that allowed TEN to be assured that “all its obligations will be paid.”

To put in context how unusual this strategy was at that time, TEN already had 60 percent of its fleet on long-term contracts in September 2016, whereas contract coverage for Nordic American Tankers (NYSE: NAT) in September 2016 was 3 percent, for Scorpio Tankers (NYSE: STNG) 6 percent, Frontline (NYSE: FRO) 12 percent, Euronav (NYSE: EURN) 24 percent and DHT (NYSE: DHT) 36 percent.

Some market-watchers believed TEN was being unduly conservative when it made the switch, but in retrospect, its decision proved highly prescient. Tanker companies that stayed in the spot market have been clobbered over the past two and a half years.

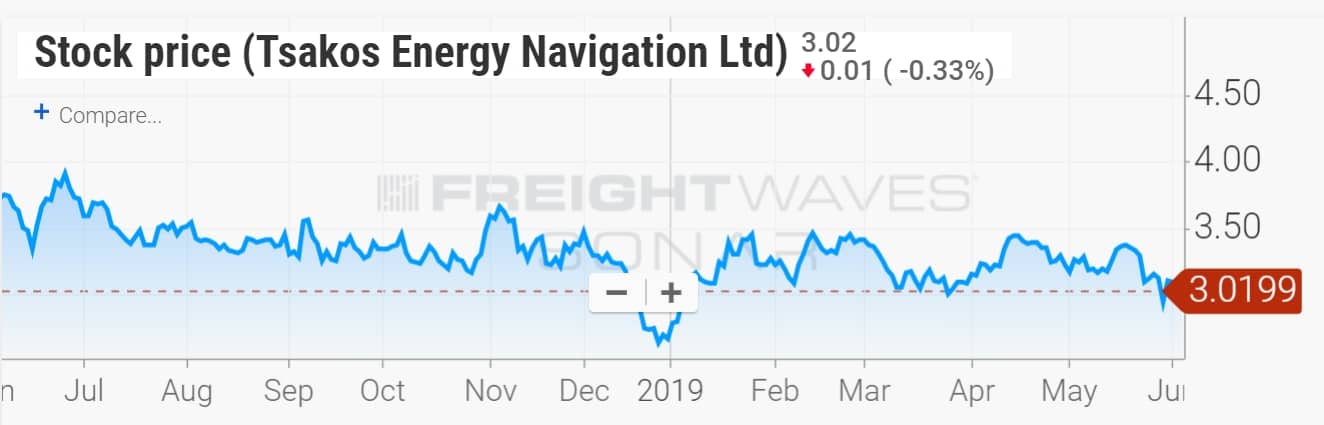

That said, conservative strategies that limit both downside and upside are not necessarily enticing to stock investors. As of June 6, TEN’s share pricing was still down year-on-year.