The trucking apocalypse is upon us, and it has taken its latest victim. This time, it’s a 40-year-old carrier out of California. Timmerman Starlite Trucking Inc. of Ceres, California, announced it would be shutting down, placing 30 employees in the unemployment line effective immediately. Ceres is a suburb of Modesto, California, a mid-sized city 100 miles east of San Francisco. Starlite had a fleet of 30 trucks, 150 trailers and 28 drivers, according to Federal Motor Carrier Safety Administration data.

Owner Colby Bell cited a tough freight market and environmental regulations as the primary factors in the company’s failure, according to the Ceres Courier, which broke the story. Starlite also announced its closure on its Facebook page.

“We tried to provide a healthy work environment for our employees and give them the best wages and benefits we could,” Bell said. “But in the end, the rates that were available did not support the cost structure needed to compensate our employees appropriately.”

The company served clients through an 11-state region stretching from the Rocky Mountains to the Pacific Coast.

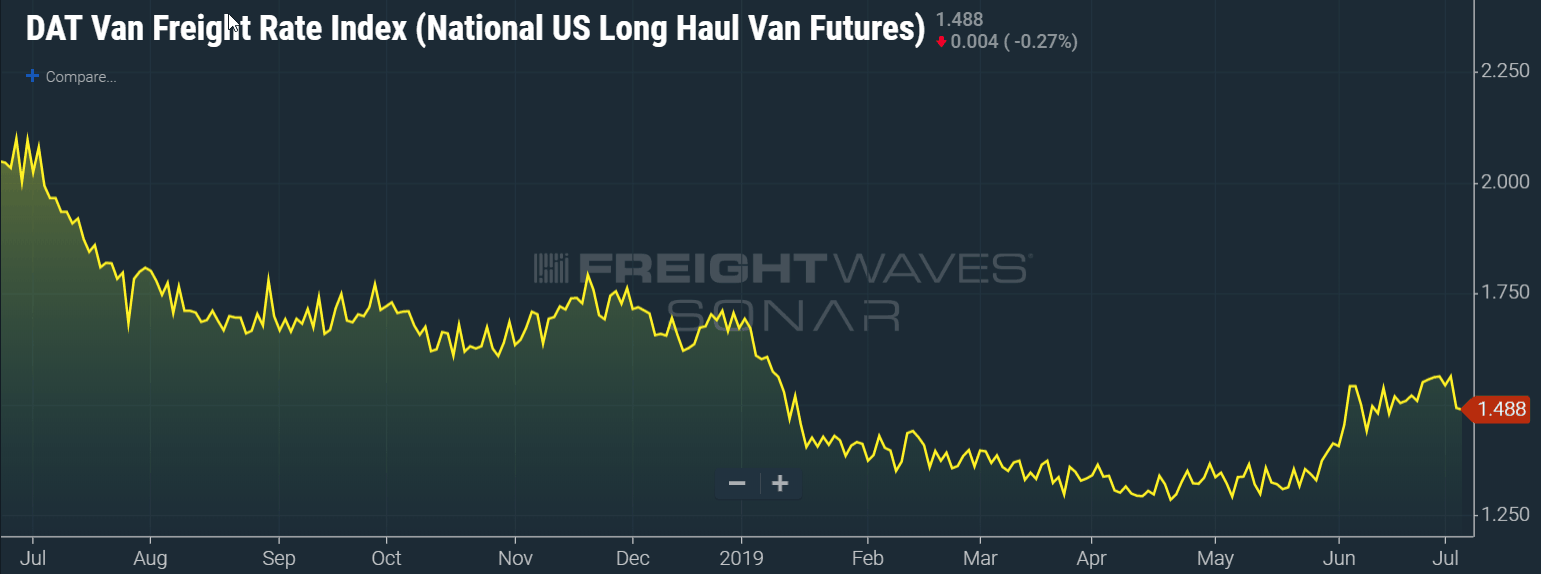

Long-haul trucking spot rates are at their lowest levels in the past few years, off by over 30 percent since last year’s peak.

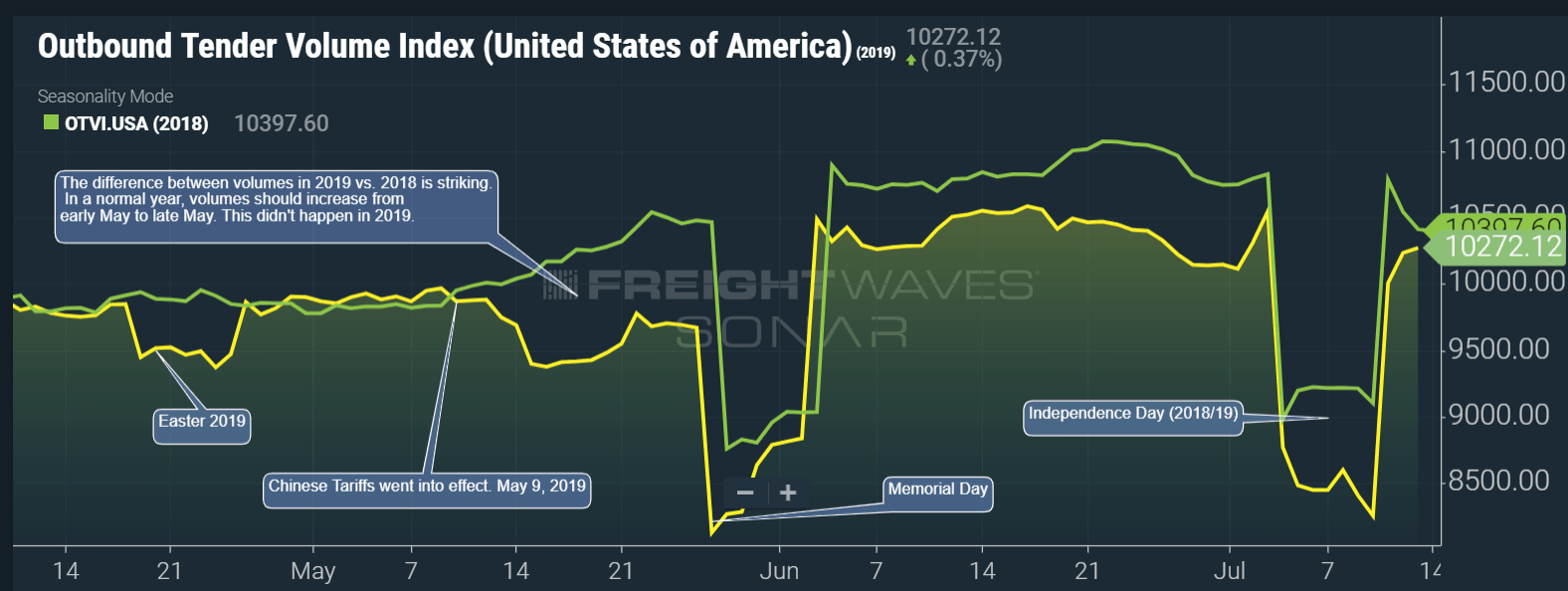

Even more challenging, trucking volumes have been running between 2 percent and 7 percent in equivalent days in 2018, starting with a large drop in mid-May.

While rates and load volumes reflect the demand side of the freight market and paint a picture of the revenue conditions for carriers, the profit story is much worse. In the past two years, carriers have seen significant cost inflation and operational pressure in almost every aspect of their businesses.

Wage increases for drivers have increased by double digits, insurance renewal rates have gone up and equipment is more expensive to maintain. Carriers have been forced to buy electronic logging devices, running their trucks with an inflexible clock.

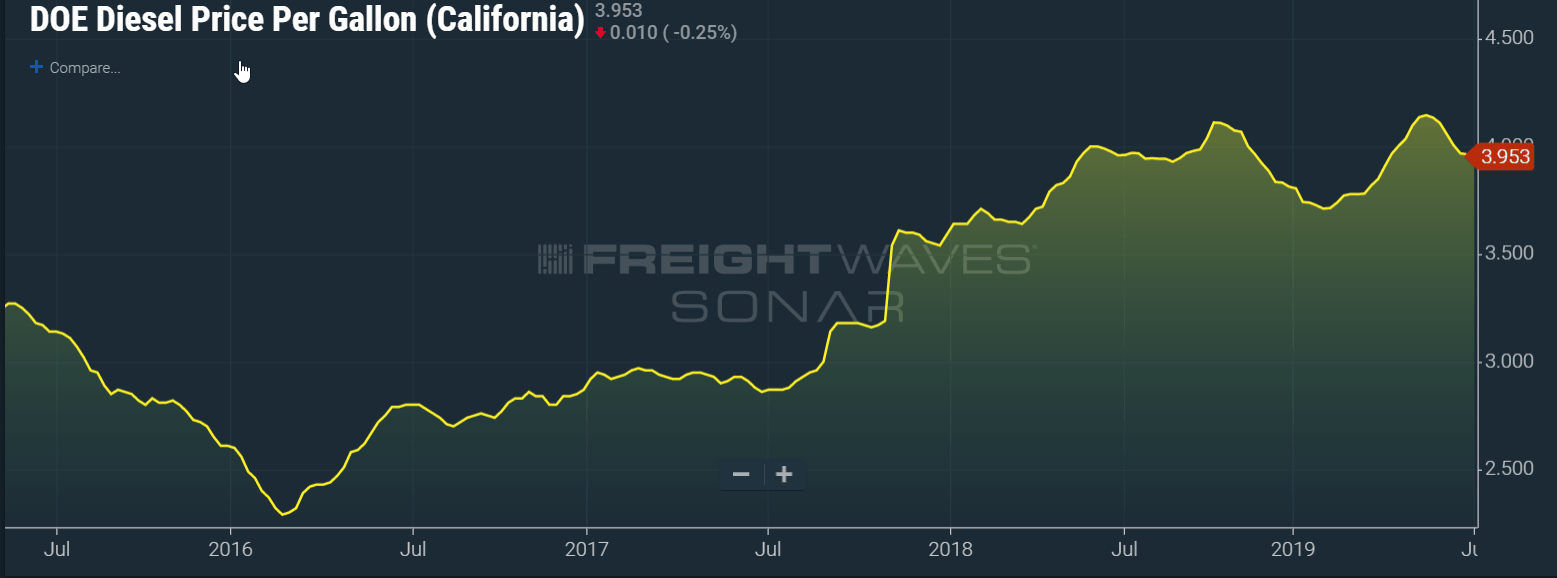

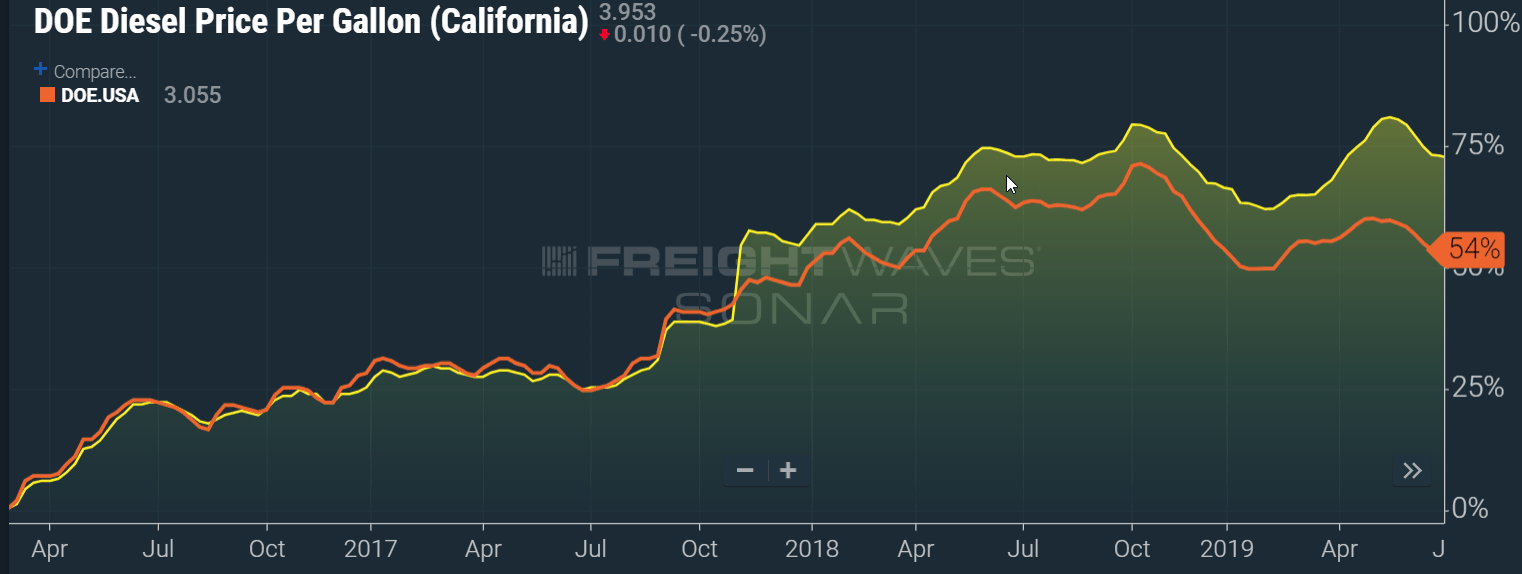

Fuel expenses, particularly in a tax- and regulation-heavy state like California, have also been way up in the past three years. Since February 2016, retail diesel prices in the state have increased from $2.29/gallon to $3.95/gallon, roughly equivalent to $.25 per mile. At $1.49 per mile, this will cost a carrier 17% of their operating profits if they aren’t on a fuel-surcharge program.

Larger carriers are able to recover most, if not all, of this in the form of a fuel surcharge. Unfortunately, Starlite was likely too small to have much leverage of their shipper relationships to do so.

Retail average diesel fuel prices in California have shot up 75 percent since February 2016, while only jumping 58 percent on a national basis during the same period.

California has added two fuel and excise taxes during the period, first with a 20-cent-per-gallon increase in 2017 and another 20-cent increase initiated this July.

If taxes weren’t enough of a burden for California’s operators, the environment czar, the California’s Air Resources Board (CARB), creates its own set of challenges.

For the past decade, CARB has required carriers to buy and operate trucks that operate under a more stringent set of emissions regulations.

In describing the plight of environmental and business regulations on Starlite, Bell was quoted in the Turlock Journal:

“The air’s a lot cleaner today because of the work the industry has done — and we’re proud of that — but the rate structure is [holding arm flat] and the cost structure is like this [arm at an incline]. The family was just in a position where we could not continue to operate without risking financial devastation.

“If you’re an interstate carrier that operates in 50 states and you can make money in 49, you can lose a little in California while the pressure’s on, and over time you know that things are going to equalize. But, yeah, the smaller carriers are stressed. Most of them are family companies. They’re not capital rich and it’s a heavy capital industry to be in. They’re pulling $200,000 worth of equipment and that’s a lot of money when you think about almost a 40 percent increase in costs over the last 10 years but no change in the revenue.”

Few would deny that California has benefited from cleaner air, but tax increases, inflexible labor laws and a litigious court system have all made the operating environment for California-based trucking companies extremely difficult.

Last year, we wrote a commentary: “California’s Hostile Environment for the Trucking Industry.”

California, perhaps more than any other large state, is incredibly dependent on the trucking industry to keep the economy humming. It has a large agriculture industry, a sizable industrial sector and the biggest port in North America, and a third of all jobs in the state are in logistics-dependent industries. Trucking is still the largest logistics mode by far.

While it is too late for Starlite and Bell, chief executive officer of the California Trucking Association Shawn Yardon issued a statement about the closure: “I am saddened to learn of Starlite’s closure and this is further proof that California must take a very hard look at its business environment.”

If you are keeping score, this is the sixth major trucking company failure of 2019. LME, a Midwest LTL carrier, also shut its doors last week.

Mr. Fox

My baby drives a Peterbilt. Her wheels are big and mean.

Chromestacks fill the sky with smoke. She’s proud of that machine.

Ormond Otvos

Save your pennies and buy a low maintenance, low operating cost Tesla, Nikola, or other electric semi!

Luke

Cathy. It’s simple. We (small fleets) are separated. Anybody can take an advantage of it. When we will unite we can protect our rights.

Cathy

It says in the bible we are made in his image and what we allow in heaven we also allow on earth. So to make heaven our earth change what we are allowing on earth. We are the change . it is up to us to change what we are allowing to happen here on our earth. Do we want what we are now allowing to happen?

Cathy

Well cant the truckers boycott california to get their attention? Heres a question: how many sanctuary. Cities soon to be whole sanctuary states like california are there now? Seems their are operators /united states from within? Arizona has people organizing now to get it on the ballet to turn arizona into a sancuary state!.

Multinational conglomerates are not just taking over trucking.

John

So according to this article it has nothing to do with environmental regulations. According to this article the downturn in the industry is primarily due to tariffs imposed by the trump admin, on Chinese import goods. Sounds like a recipe to disaster. Sorry but Trump’s economic advisers are living in the 19th and 20th centuries instead of the Twentyfirst century. Tariffs are attacks on people who buy goods and USE services in this country. It affects manufacturers Importers and export hers in the United States. It effects the shippers and us truck drivers.

Luke

John. Wait a minute. Now it’s a Trump’s fault. I spoke with other business. They are doing well while China Tarrifs. How is this happened that tricking industry is a weakest link?

Marc Rettus

Perhaps the most liberal state in the US is making laws favoring big business over the “little guy.”

Who would have guessed that?

Rotund Rider

That’s always the way it works, regardless of party. The only way to fix it is to get money out of politics. Start by getting rid of Citizens United. Corporations are not people, and money is not speech.

Rotund Rider

Small companies can’t make the big political contributions that large corporations can, to buy politicians.

Actually, the liberals are the only ones who care about fairness. Which party supports unions, and which party is always trying to kill them off?

Rotund Rider

Go ahead and leave California, or don’t deliver there. Other businesses will take the market share you give up. There are > 30,000,000 people in the state; it’s a huge market- if it were a country, it would be the world’s seventh largest economy.

Eventually costs to consumers will include the higher operating costs. Don’t want to play? You don’t have to. No one is forcing you to operate in California.

Andrey

Fu ck California

Luke

Rotund Rider. Even in California jungle Capitalism somebody wants to protect small businesses.