Trucking rates gain, but continue to face headwinds

Data on producer prices shows that wholesale inflation pressure remained subdued in June. Industry detail showed a second consecutive gain in trucking rates during the month, though much of this gain was driven by seasonal strengthening

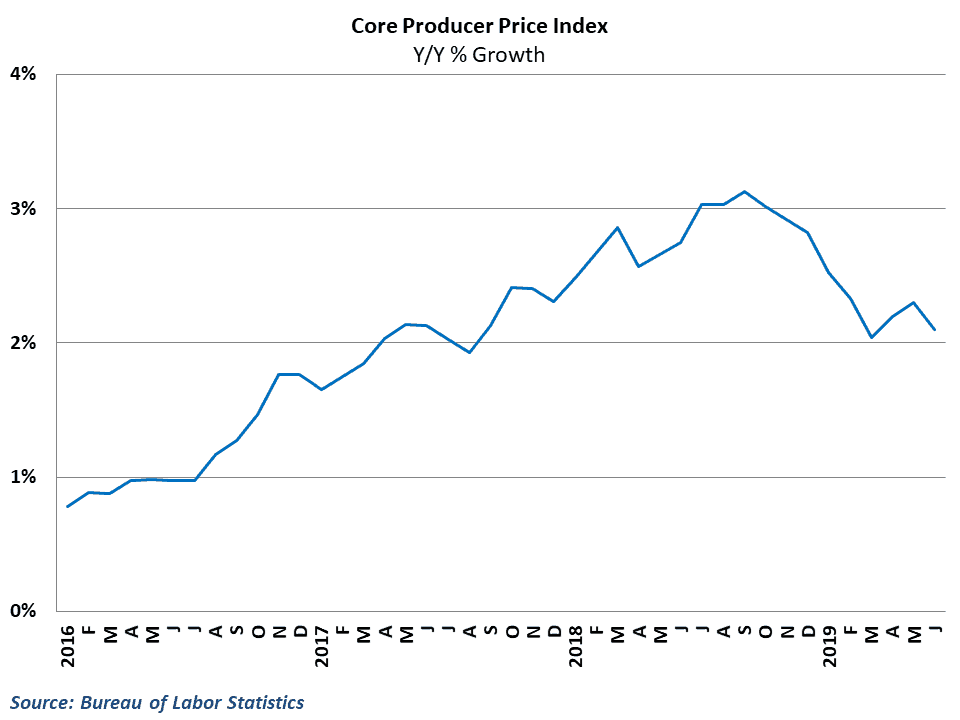

The Bureau of Labor Statistics reported that the producer price index (PPI) rose 0.1 percent in June from May’s levels. This exceeded consensus estimates of a 0.1 percent decline and follows a similar 0.1 percent gain the previous month. Overall results during the month were weighed down by a decline in goods prices, as a 3.1 percent drop in energy prices led to the largest monthly decline in the goods sector since January. This was partially offset by a 1.3 percent increase in the prices for trade services, which measure the margins that retailers and wholesalers receive. The core PPI, which excludes food, energy, and trade services, was unchanged in June as year-over-year growth fell to 2.1 percent.

Market watchers and policymakers typically use the PPI to gain some insight into what the underlying pressures of inflation are in the economy. Recently, various measures of inflation have come under additional scrutiny, as Federal Reserve officials have been signaling that concerns over low inflation could lead them to cut interest rates soon. While the PPI is not the Fed’s preferred measure of overall price levels in the economy, this morning’s core PPI results would suggest that inflation pressures remain generally subdued in the middle of the year.

Long-distance truckload rates rates improve in June

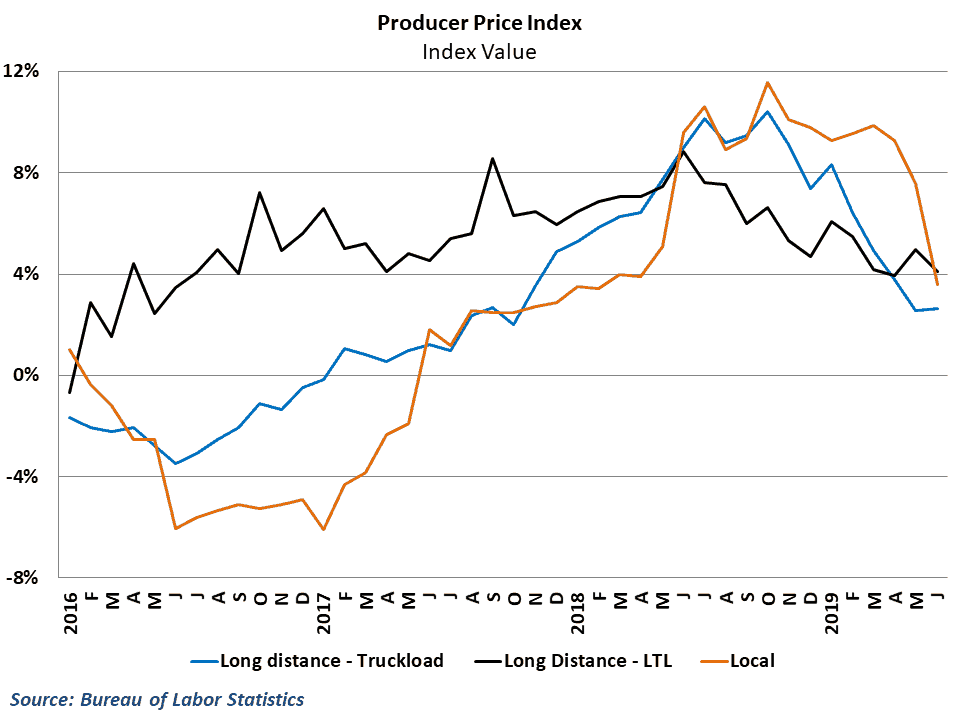

Headline PPI data has offered little in the way of news over the last several months, with core wholesale inflation settling just above 2 percent. However, the monthly PPI release offers a tremendous amount of detail each month, allowing for insight into pricing trends for commodity, product, and industry groups. Industry detail in the June PPI data showed that rates in the trucking industry climbed at a respectable pace during the month. Producer prices for the General Freight Trucking industry rose 1.0 percent in June from May’s levels, marking the second consecutive solid gain for trucking rates. Despite the monthly gain, year-over-year growth in overall trucking rates slipped further to 3.2 percent from 4.1 percent in May, which is the slowest pace of yearly rate inflation since the third quarter of 2017.

While rate gains in May in the trucking industry were solely driven by the long-distance less-than-truckload (LTL), June gains were more evenly distributed across the industry. Long-distance truckload rates surged 1.5 percent during the month, ending a streak of four consecutive monthly declines. Long-distance LTL and local trucking rates experienced more modest gains during the month, with each rising 0.4% from May’s levels.

While this appears to be good news for rates in the industry, it is worth noting that the industry detail in the PPI data is not adjusted for seasonality. As a result, much of the gains experienced during the month are simply the result of seasonal patterns that typically occur at this time of year. As a result, year-over-year growth fell across most trucking metrics, with only long-distance truckload making a slight improvement to 2.7 percent from 2.5 percent in the previous month.

Behind the Numbers

June’s headline results were slightly stronger than expected, but core price trends continue to signal little in the way of an inflation threat in the economy. This is notable only for the fact that the June data comes just days after Fed Chairman Jerome Powell signaled that the Fed could cut rates as soon as the July 30-31 meeting of the Federal Open Market Committee. Moreover, Fed officials specifically cited stubbornly low inflation as one of the chief reasons for a potential rate decrease. The Fed prefers the personal consumption expenditure deflator as a price metric for inflation, but the PPI data also suggests that there is not much inflation pressure in the pipeline.

On the trucking side, the increase in rates in the industry is a welcomed sign after consistent declines to start the year, but it is probably all seasonal. Our own SONAR tender volume data (SONAR: OTVI.USA) shows that volume had a seasonal surge in volume following Memorial Day. That is good news, but the surge was still several percentage points lower than the rise in volumes last June. As long as volume is flat or slightly negative year-over-year and capacity is still up, there will continue to be downward pressure on yearly rate inflation in the industry. The comparisons to last year are going to be tough throughout the remainder of the year, especially for long-distance truckload, and it appears likely that PPI data in the industry will turn negative before the year is out unless there some significant improvements in the freight economy.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.

Mark

I have a million in cargo, a lot of you brokers aren’t anything but leaches, you don’t stay up all times of day and night, kiss everybody’s butts to keep the shipper and receiver happy so you can keep your work, the money we get doesn’t come out of your pocket, you don’t even pay until you get your cut, you don’t buy one dime of diesel, or pay truck repairs, and are way over paid for what you do! With All do respect for those that are honest this remark doesn’t in no way apply to you! But to brag you pay 250k cargo give me a break!

A Broker

Diane, will all do respect, I have a few questions. How many trucks does your fleet contain? Do you have 24/7 availablity and capacity from coast to coast for the following: flatbed, dry van, reefer, box truck, sprinter van? Do you carry $250k in cargo insurance? What sort of data mining, transparency, and cost reduction programs are available to your clientele? How about LTL or Air Freight? How about some high-level data analytics with SQL reporting capabilities?

He man

Its very interesting to see the industry and its customers and their growing interests to allow truckers a chance to make money

Diane Hidalgo

The rates and truck driving business is a joke respect 95 percent of owner operators they pay more fees to stay afloat with economy driving experience are loyal from long time drivers but all these companies need to cut out the middle man THE BROKERS !! TAKE THE BROKERS OUT SO drivers can get paid …excuse my French they f……….take too much of there paid load waiting around for commands sitting ducks are the drivers with anything COMMING there way as far as a break down accident fuel and violations for uncontrollable people who cut them out of the world on the highways is terrible without experienced drivers our people are at risk it’s not just a drop and pick up there’s different patterns to every load..drop the brokers to much greed and unexpierienced drivers have no yrs of training there’s more needed to pass a employee to put out there on the highway.

He man

How do i find the going charts in the trucking industry?