Reading the annual Third-Party Logistics Study for 2019, a project owned by a Penn State professor and Infosys, what jumps out from the extensive report are a few statistical points.

One is that while the use of 3PL firms is increasing, not everybody buys into the need for them, though maybe that number is dropping. The data that shows an increase in the use of 3PLs reports that 63% of shippers said they would outsource more of their logistics operations in 2018, compared to a figure of 61% for the same question in 2017. And among the 3PL companies that responded to the survey, 86% said they had more use of their services from their customers, which was up from 83% the prior year.

But at the same time as that, even as the supply chain demands get more complex, 28% of the shippers said they were bringing some of their activities back in-house. That is unchanged from last year, but the figure was 35% just two years ago, an indication that fewer shippers are going it alone when getting their products to market. The response from the 3PLs were that 36% of their customers were returning to some insourcing, though that was down from 42% a year earlier.

There are some shippers who choose not to the use the services of 3PLs at all. The survey didn’t reveal how many companies they questioned fit that description, but did note some of the reasons for them making that choice: 27% said they thought control over the logistics functions they outsourced “would diminish”; 22% thought they had more experience than the 3PLs; 18% had concerns about IT integration; and 15% concluded there wouldn’t be sufficient cost reductions.

The occasional small number of “no” answers to certain questions can leave one’s head scratching: “93% of shippers agree that IT capabilities are a necessary element of #PL experience,” meaning 7% don’t believe that for a field in which technology investments are never-ending; and 89% of shippers and 98% of 3PL providers “agree that the use of 3PLs has contributed to improving services to the ultimate customers,” which means that 2% of the 3PLs surveyed had some negative feelings about the value of their own company.

But overall, the report shows positive trends for the industry. Among some of the key findings:

-

More than 90% of shippers agreed that “IT capabilities are a necessary element of 3PL expertise.” But satisfaction with what’s out there is far from overwhelming; only 55% of shippers said they were satisfied with the IT capabilities of the 3PL sector. “While we have commented in earlier reports about the fact that the percentage of shippers indicating satisfaction with 3PL IT capabilities exhibited overall increases from 2002 to 2011, this analytic has remained relatively consistent in more recent years,” the report said.

-

The ground is fertile for changes. A full 42% of shippers surveyed in the report said they have not made changes “to increase their inherent agility over the past five years.” That doesn’t mean they aren’t aware of the danger of that. The survey also reported that just over half of shippers said, “Nothing is off of the table and they are willing to evaluate all pieces of the supply chain.”

-

The shippers also showed tremendous self-awareness in recognizing shortcomings in some of their other capabilities or lack thereof. In the discussion over “omni-channel retailing,” a description for the ability of a retailer to be able to sell in a bricks-and-mortar store, online and any other channel that might develop, “just 4% of shippers rated themselves as high-performing in that area.” The number describing themselves as “competent” was 18%, and 36% said they had no capabilities. The numbers coming out of the 3PLs were almost as weak, with 31% saying they had no capabilities in omni-channel retailing.

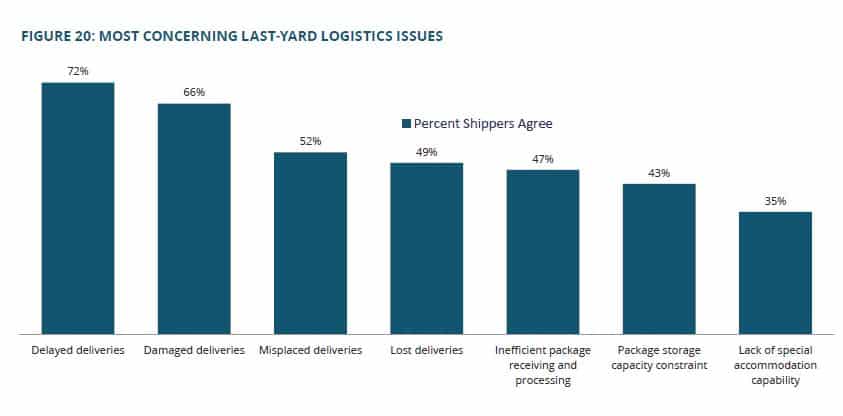

The numbers on what most people call last-mile logistics but which the report referred to as “last yard” also had some puzzling numbers. A little more than 70% of both shippers and 3PLs said both sides of the transaction “recognize the need for capable, last-yard logistics services,” raising the question of the worldview of the more than 25% who don’t. But there is also a big gap between the recognition and the reality of what’s going on out there. A little more than half the shippers responded yes when asked if “they effectively manage(d) last-yard logistics needs.” The numbers out of the 3PLs were a lot lower; only 34% of the 3PL respondents thought their customers managed those needs “effectively.”

The numbers on the financial spend showed some gains and some losses for the 3PL sector. In the category of total logistics expenditures as a percentage of sales revenues, that held at 11% from the prior year, and is up just one percentage point from the study of two years ago. The percentage of logistics expenditures dedicated to outsourcing took a jump to 53% from 50%. But the percentage of transportation spend managed by third parties dropped to 50% from 55% and the percent of warehouse operations spend managed by third parties dropped to 34% from 39%.

But the more significant overall number in the report comes from a report by 3PL consultancy Armstrong & Armstrong, and it was cited by the in showing an overall positive trend for the industry. In North America, 3PL revenues rose 9.8% from 2016 to 2017, and was up in every region of the world, ranging from 2.4% in Africa to 17.5% in CIS/Russia. The total for the world: up 8.1% from 2016 to 2017.

One other notable statistic: in the question about workforce issues, “attracting talent” received the highest percentage of votes as a key issue. But the figure was only 59% and it’s hard to imagine many OTR trucking companies citing a number that low. Retaining high performers got 40%.

The survey–which besides owners Infosys and C. John Langley, PhD, the Penn State professor–is also sponsored by Korn Ferry, the Penn State Smeal College of Business and Penske Logistics. The split among the respondents was 38%, 3PL/4PLs; 46% users of 3PL services; and 16% non-users of those services. Among the top three industries of shippers who responded 22% were in manufacturing, 17% were in retail & consumer products and 11% in food & beverage.