Last month McKinsey Global Institute released an impressive, comprehensive research report entitled “Making it in America: Revitalizing American Manufacturing” that quantifies the current state of American manufacturing and makes recommendations that McKinsey says could boost the beleaguered sector 20% above current trends by 2025. McKinsey calls for increased capital investment, a more robust network of small- and medium-sized suppliers, and a transformative embrace of technologies like digital manufacturing, analytics, and IoT to help create value at different points in the production chain.

In 2010, China displaced the United States as the world’s leading manufacturing country, but the US still ranks second as measured by the dollar value of its annual output and by its global market share. In 2015, US value added in manufacturing reached $2.2T, more than 2.5 times higher than Japan and 3 times higher than Germany. But the American manufacturing sector has contracted both in relative and absolute terms, shedding 1/3 of its jobs from 2000-2010.

Growth in manufacturing has really been concentrated in only a few high tech, R&D-intensive sectors like pharmaceuticals, medical devices, computers, and aviation—and much of that value added has come in the form of research, patents, design, and branding rather than the production of final goods. Segments posting real declines over the past 15-20 years include locally processed goods, basic consumer goods, and resource-intensive commodities. Still, there are 500 counties in the United States where manufacturing remains the primary economic driver.

The United States is the leading destination for foreign direct investment because of the desire for proximity to the lucrative American consumer market, which accounted for more than a quarter of global household consumption in 2015. Just this fall, Adidas has started returning footwear manufacturing capacity to the United States with the opening of its robotic Atlanta “Speedfactory” specializing in customized, small-batch running shoes. The Speedfactory suggests how Adidas intends to address changing US consumer demand, which is increasingly tech-savvy, culturally diverse, and expects high quality, low prices, and a wider range of options.

McKinsey points out that while in American political discourse, emerging economies are characterized purely as sources of low-cost labor, US manufacturers should also realize that they’re the fastest-growing sources of consumer demand. McKinsey estimates that consumption in emerging markets will grow from $12T in 2010 to $30T by 2025, and American manufacturers can reap the benefits if they can expand their product portfolios, whether they introduce new varieties and brands or tweak their core products to suit local tastes. Nestlé, for example, opened up its first new Kit Kat factory in more than 25 years in Japan after discovering a huge local demand for new flavors like wasabi, azuki bean, and green tea. The key to making those kinds of expansions profitably is to successfully manage supply chain complexity—otherwise bloated inventories and bogged down operations will erode profit.

In many industries and counties, manufacturing plants and equipment are outdated, the workforce is aging, and companies are foregoing investment to maintain positive cash flows. In 1980, the average US factory was 16 years old; now the average plant is 25 years old. In 1980, the average piece of manufacturing equipment was 7 years old; today the average piece of equipment is 9 years old. “Industry 4.0 technologies can reinvent production processes and pave the way to new products and services, but it is unrealistic to expect a return to 1960s-style mass employment on assembly lines. The jobs at stake will be fewer in number but may be higher- paying positions that require higher skills. Some may be design, service, digital, or analytical roles—all of which means that workforce training will be crucial,” McKinsey wrote.

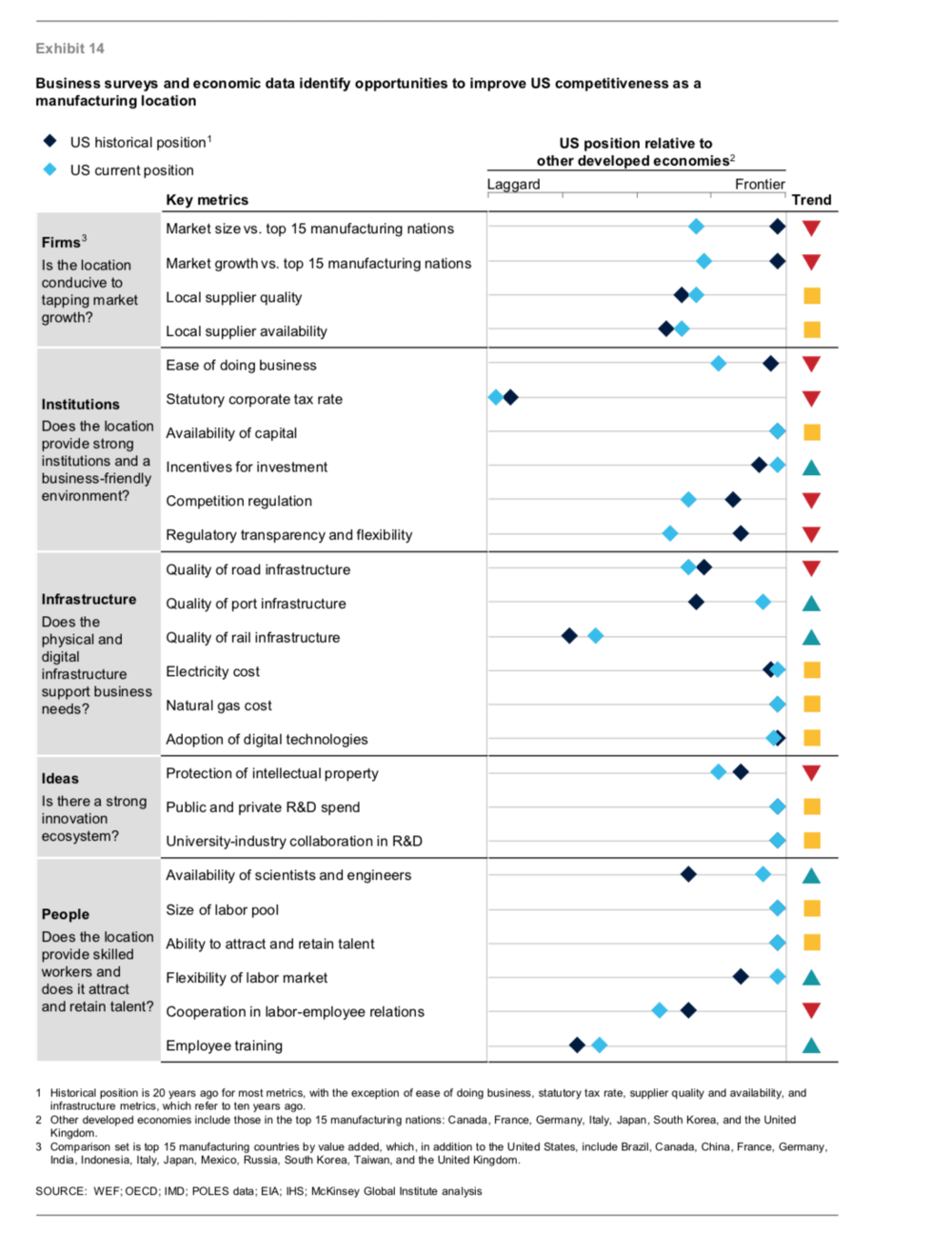

This infographic by McKinsey identified key opportunities to improve US competitiveness as a manufacturing area, showing where the US falls along the spectrum of other developed economies historically and currently. Longstanding strengths of the American economy like labor pool size, ability to retain talent, public and private R&D spend, and availability of capital are still without parallel among other advanced nations, but there are some worrying downward trends, too. The ‘ease of doing business’ in America has fallen relative other developed economies over time, road infrastructure continues to deteriorate, statutory corporate tax rates remain uncompetitive, and various measures of the American regulatory scheme—transparency, flexibility, and whether it encourages competition—have fallen over time. Workforce training is a perennial pain point for American manufacturing firms. The protection of intellectual property has weakened slightly but should still be considered above-average among developed nations. Rail infrastructure is weak but improving, and port infrastructure has made considerable gains in the past ten years, jumping to near the front of the pack.

Finally, McKinsey thinks that there is a role for policy in strengthening America’s network of small- and medium-sized manufacturers. Government agencies that provide financing for small manufacturers should be placed on surer budgetary footing—McKinsey finds that small firms’ inability to invest in equipment and plant upgrades contributes to a stark 40% productivity gap with large firms. Participation in America’s export economy should be encouraged and streamlined for small- and medium-sized manufacturers (currently less than 1% of US manufacturing firms export their products, a far lower share than in other large advanced economies). Part of the problem with growing America’s exports has been a historically over-valued dollar, but McKinsey has ideas for how currency issues can be overcome.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.