Investment bank JP Morgan has issued its 2018 outlook for transportation and logistics, picking winners and losers for the upcoming year in sectors like parcels, railroads, truckload carriers, logistics companies, and intermodal. JP Morgan set December 2018 price targets for a number of stocks and offered commentary on the cyclical and secular forces acting on US freight markets.

Positive macro trends include elevated valuations, stocks trading well on tax reform momentum, and high expectations for rising truckload rates through next year. Risk factors include anticipated rising interest rates as the business cycle matures which will reduce margins, and the expectation that geopolitical uncertainty and tight labor markets will persist through 2018. JP Morgan prefers asset-light brokers based on their flexibility navigating a truckload rate cycle initially led by a cost-push from driver pay, combined with an expected tilt toward more spot capacity vs. contracts—rising rates and more action on the spot market should keep brokers’ balance sheets healthy in 2018 despite the longer term threat of disintermediation from emerging digital technologies.

The ‘Amazon effect’ is expensive

For parcel carriers, JP Morgan likes FedEx more than UPS. The bank set FedEx’s December 2018 price target at $272 with an implied return of 13.6%; for UPS, JP Morgan calls for a return of -1.8% at a price target of $116. Calling FedEx “one of the best multi-faceted growth stories over the next several years”, JP Morgan pointed to the company’s consolidation of its ground network, its successful TNT integration, and its play in industrial markets through less-than-truckload operations. Amazon’s market share of e-commerce sales will continue to grow in 2018 and is predicted to reach 56%, up from 49% in 2017, but the rate of overall growth will slow as the expansion of e-commerce pushes more retailers (Walmart, Target, etc) into digital sales.

FedEx has made huge investments in their ground operations, with capital expenditures ~$5.8B over the past five years. JP Morgan expects Ground capex to stabilize at current levels for 2018-9. UPS has begun leaning into e-commerce growth and will add tens of millions of square feet in facility space over the next 3-5 years, with about 7 million sq ft opening next year. Amazon and the USPS have tightened their partnership; as USPS volumes have soared since Q1 2012, Amazon shipping costs have risen in tandem. Amazon’s shipping costs are forecasted to rise to ~$30B in 2018; the company is adding robotics for inventory handling and sortation, and smaller warehouses closer to population centers to increase the efficiency of their supply chain. While total warehouse square footage will continue to rise, average warehouse size will start to fall in 2018.

Railroad outlook: high quality growth is hard to find in 2018

JP Morgan favors Canada Pacific’s differentiated volume growth upside associated with new infrastructure; CP lost traffic in 2017 but should enjoy margin upside as capacity is backfilled at high incrementals. JP Morgan’s analysts write that until CP’s recovery proves itself, the stock will be available at a discount valuation. The only other railroad that looks cheap when compared to historical P/E levels is Kansas City Southern. Positive Train Control will continue to be an expense with no clear benefit until the systems are fully installed in 2020 and can then be leveraged to cut costs.

U.S. coal production is expected to decline at 2% CAGR from 2017-2020, with reductions concentrated in the Appalachian basins. Natural gas, at near record low prices, is coal’s biggest competitor for share of power generation. A strong US dollar in 2018 could hurt coal and steel exports. JP Morgan’s analysts wrote, “Coal production declines modestly in 2018 as softer exports weigh on Appalachian basin production.” Thermal coal should hold steady; metallurgical coal remains under pressure in the export market. Natural gas prices will probably go up in 2018, which may relieve some competitive pressure on coal.

Trucks and brokers outlook: stay selective as the TL cycle shifts gears

JP Morgan likes Schneider and Echo Logistics for 2018—Schneider made a series of proactive moves in mid-2017 to increase its net count of drivers, which gives the carrier an advantage in an extremely tight labor market with rising unseated tractor counts, rising wages, and new ELD and synthetic opioid regulations. Regarding Echo, JP Morgan’s analysts wrote, “Echo is re-engaged for growth with a favorable tilt toward spot market volumes, potential bolt-on M&A, and recovering productivity after the Command integration. Consistent execution should lead to positive earnings revisions in a stronger truckload market.” The majority of carriers instituted wage hikes and sign-on bonuses, but Werner and Schneider are ahead of the curve. JP Morgan forecasts industry-wide realized rates excluding fuel at +5.5% in 2018 and an additional +3.5% in 2019.

Broker disintermediation risk is diminished in an up-cycle, but note that accelerating orders could shorten the normal Class 8 cycle (under normal conditions we could expect at least one more full year of growth in truck sales). Truck sales are back above the estimated replacement demand, and the strong order books JP Morgan saw appear to be weighted toward smaller carriers.

Still, the leading indicators for truckload demand remain strong, including a declining consumer savings rate through 2017, growing retail sales, and a moderating inventory to sales ratio. Like other industry analysts, JP Morgan thinks that rebuilding projects in Texas, Florida, and California and re-establishing those supply chains will provide a positive lift for truckload demand after the holiday peak.

“While truckers generally pass-through roughly 30-40% of their rate increases to raise driver wages, the current pass-through rate has risen significantly to 50-60%, and increases the possibility that truckload carriers will see muted margin expansion in the near term,” JP Morgan’s analysts wrote.

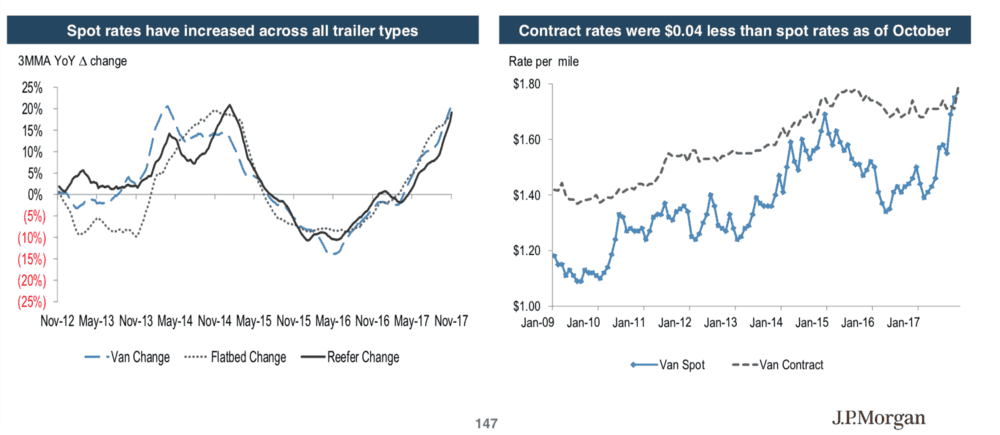

A strong spot market will eventually pull contract rates up, with the potential for high-single digit gains off a low base; shippers will try to react by being more effective ‘consumers’ of truckloads and switching to intermodal, but intermodal will be a smaller release valve than in previous cycles. Reefer rates and lanes with HOS cutoff points will likely experience the most pressure from ELD enforcement in 2018, but spot rates for all three trailer types have tracked very closely since summer 2015.

JP Morgan picks winners and losers

Winners: JP Morgan calls for returns of 18.7% at a $272 Dec. 2018 price target for Canada Pacific and 17.9% returns from Kansas City Southern at a price target of $130. Schneider’s price target was set at $30, representing 12.5% returns, while J.B. Hunt investors could see returns of 7.9% if the stock hits its price target of $120.

Losers: JP Morgan thinks UPS stock will drop to $116 with a return of -.18% and sets a price target of $112 for Union Pacific, representing a -14.3% return. Knight-Swift investors will lose 7% if the company’s stock drops to the $40 target, and shares of C. H. Robinson are expected to drop to $75, for a loss of 14.8%.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.