It wasn’t one of his Steve Job-like, hype-filled announcements, like the Semi/Roadster one, or the colonization one. It should have been exciting news: Elon Musk’s recent announcement that they plan to build an all-electric pick up truck.

This one came from a tweet—a tweet asking for feedback. Someone suggested an all- electric truck, and Musk responded that he’s been “dying to build one,” and “thinking about it for the past five years.” Musk said the Tesla truck would be “similar in size” to Ford’s bestselling F-150, but “maybe slightly bigger” due to a “really gamechanging feature” he would like to add.

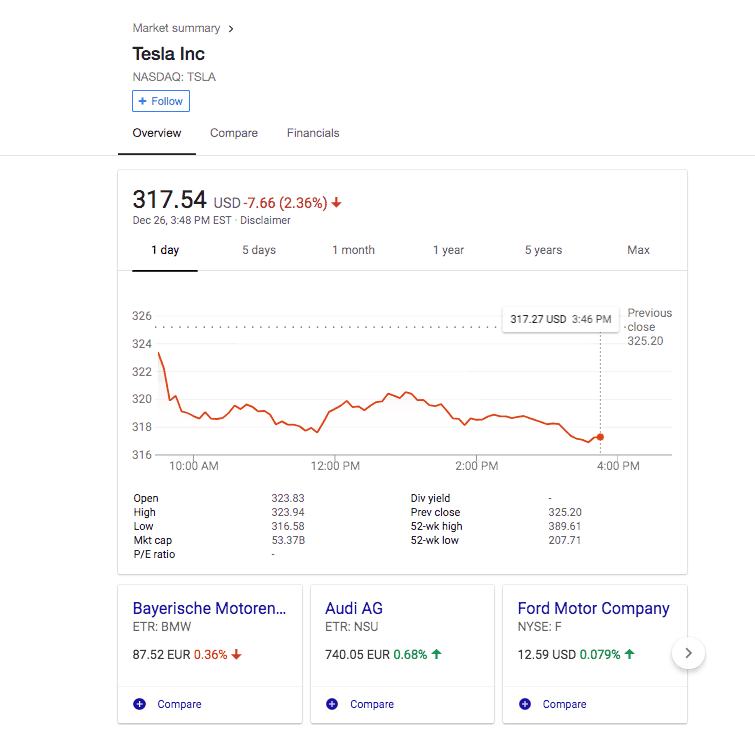

But in a strange twist, Tesla’s stock took a hit yesterday in spite of this apparent good news. Why? Well, for starters, Musk also added that they won’t actually begin work on the e-truck until after they finish delivering on the Model Y. That makes it likely that it’s still another two or, more likely, three years from now.

Surely, the problem wasn’t the platform he used for the announcement: Musk has plenty of capability to stir up interest and engagement via Twitter, as with the relatively infamous mistake of saying he’s had “verbal agreements” at the top levels of government for tunneling permissions for the hyperloop. Some may argue these are just gaffs.

It could be just coincidence. Maybe Tesla’s stock is just overvalued, as he’s said himself on prior occasions.

“I’ve gone on the record several times that the stock price is higher than we have the right to deserve and that’s for sure true based on where we are today,” Musk told Nevada Gov. Brian Sandoval at the National Governors Association summer meeting six months ago.

After that announcement, similar to yesterday, shares went down 3 percent by midday.

Call it what you will—Musk’s candor reveals a truth, not only about himself, but his company. The expectations for Tesla to succeed are very high, and the stock market price indicates an optimism—a hope—that the “rebellion will succeed,” to put it in Star Wars terms. The stock is only as real as everyone believes it will be based upon predicting the not-so-super-short-term future. And that’s the key, the time-lapse differentiator, if you will.

Just how far away is this future? Aye, there’s the rub. The announcement seems to have stirred up one long-standing issue for how investors currently wrangle with their feelings toward the company. Their production efficiency–or lack thereof.

Analyst Brad Erickson of Wall Street firm KeyBanc Capital Markets wrote his clients yesterday, “While it is likely to be a few quarters before the Company’s true Model 3 gross margin judgment day arrives … we think the Model 3 margin ramp will disappoint and investors will have to acknowledge no [Model] S/X growth at some point, which is not reflected in the shares.”

In the third quarter of 2017, Tesla manufactured only 260 Model 3 vehicles, while it had estimated it would produce more than 1,500. Musk described the situation as “manufacturing hell,” as Tesla works to ramp up assembly line production of the car.

One wonders how persistent the issues will become, and how just how patient–and hopeful–will investors remain for the short-and-not-so-distant future.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.